People of the UAE are no longer standing in the long queue of the traditional bank branches. So where are they?

They all turn towards the smart and innovative digital banking apps. With the rise of smart fintech solutions, customers are more inclined towards seamless, secure, and quick banking solutions.

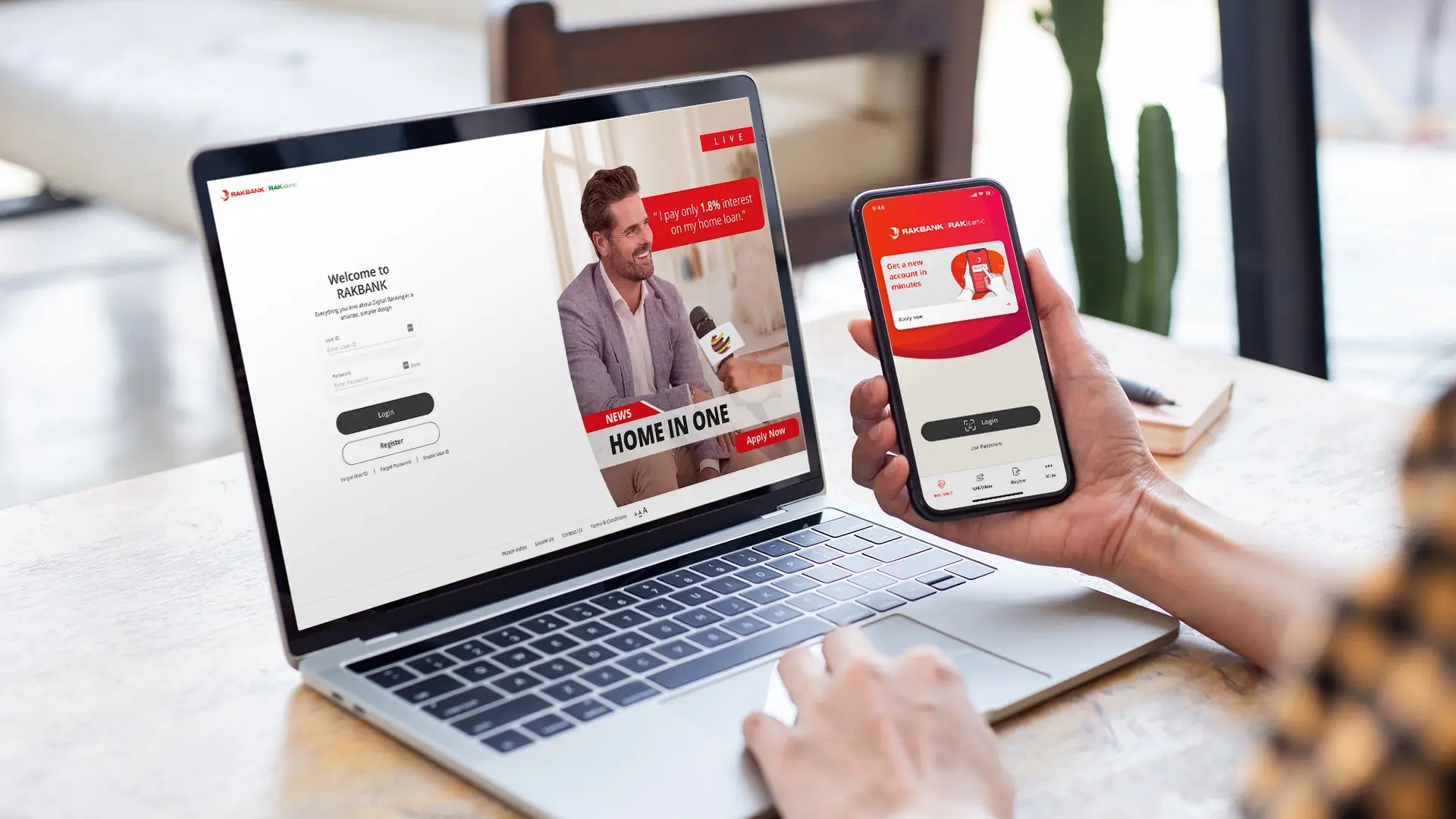

This has encouraged the leading financial institution of the UAE, RAKBANK, to introduce its digital banking app.

The RAKBANK app has set a benchmark among the digital banking apps of the UAE with its innovative features, security, and convenience. It has encouraged many to invest in creating such mobile apps.

If you also wish to develop an app like RAKBANK, you have made a great decision. But to establish the same level of success, you need to take the right approach.

Don’t worry, we have got you in this; that is why we are presenting you with this blog, which tells everything about creating a next-gen digital banking app like RAKBANK.

Explore this blog till the end to gather complete knowledge.

What is RAKBANK?

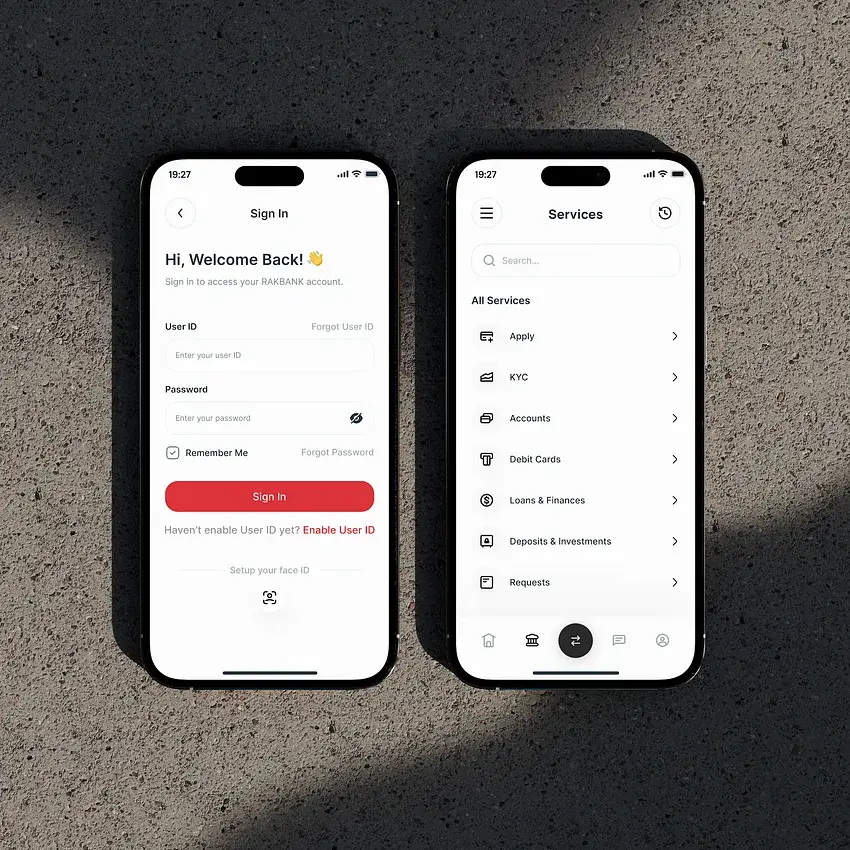

RAKBANK app is a leading and one of the best fintech apps in the UAE that was officially launched on behalf of the National Bank of Ras Al Khaimah PJSC, the leading retail and business bank. The app offers a diverse range of features that minimize users’ hassle of visiting physical banks for any small requirement.

The app caters to a wide range of audiences with its service offerings, which include personal banking, business banking, and wholesale banking.

This is a features-rich digital banking app that aims to make life easier for the people of the UAE. The features are customer-focused, which makes it one of the favorite choices.

The RAKBANK app offers financial services like a credit card, loan application, insurance, savings account, wealth management, and Islamic banking.

The features this app offers include fund transfer, pay bills, manage credit cards, mobile deposits, and SME banking services.

An Overview of the UAE Digital Banking Industry

UAE is a digitally forward country, with the government’s aim of running a complete cashless economy by the year 2031.

This idea has encouraged many traditional banks in the UAE to strengthen their services with innovative technologies. Due to this, the digital banking industry of the UAE has witnessed an excellent boom.

The reports gathered by us also say in favor of the above statement. The statistics of our report are explained below.

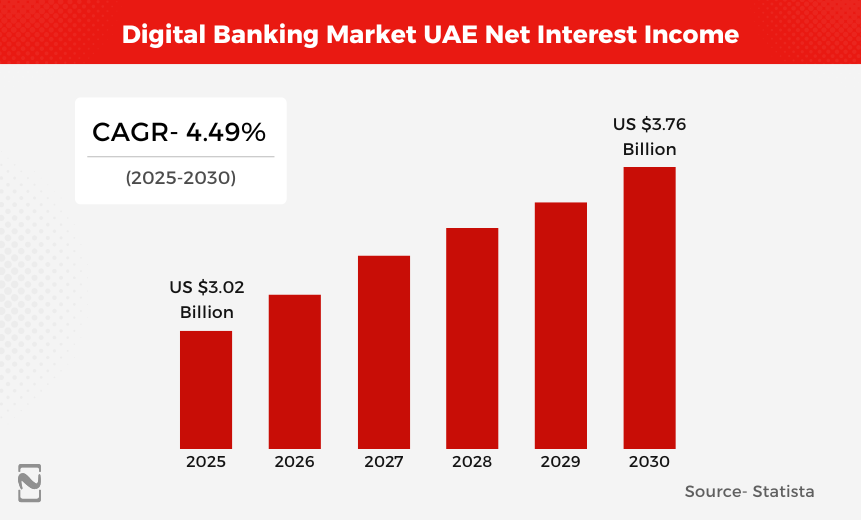

- The digital banking market of the UAE is expected to increase in Net Interest Income in the year 2025, reaching the value of $3.02 billion.

- Further, it is expected that by the year 2030, the Net Interest Income of the digital banking app in the UAE will reach $3.76 billion.

- So, during the forecast period, i.e., between the years 2025 to 2030, the Net Interest Income of the digital banking app market in the UAE will witness an annual growth rate of 4.49%.

- Also, today, in the UAE, 83% of the customers prefer to use the banking apps to manage accounts, transfer funds, and make investments.

Thus, these statistics are saying it loud to turn your digital banking mobile app ideas into reality.

The Must-Have Features of the RAKBANK App

We now know about the RAKBANK app and some market reports that support the idea of creating similar apps. Now, before you learn the steps to develop an app like RAKBANK, you should know the features that made the app a popular choice in the UAE.

We have mentioned the key features of the RAKBANK app that you should know. Let’s get to know them one by one.

1] Manage Account

There must be a feature that makes it easy for users to manage their accounts on the app. Users must be able to enjoy a seamless onboarding process that allows them to sign up to the app via different media, like email, contact number, etc.

After the account creation, users can track their accounts, savings, and investments within the app. Also, the account must show users their details, transaction history, and account balances.

2] Fund Transfer

When you develop an app like RakBank in the UAE, ensure you have added the feature of fund transfer. This feature of a digital banking app ensures that users can seamlessly and instantly transfer funds from one account to another.

Funds must be transferred internationally and also to the local banks. Also, like the RAKBANK app, your app must support a fee-free fund transfer facility that makes things quick and easy.

3] Pay Bills

Ensure that the users of your digital banking app can help users pay their bills. The RAKBANK app is capable of allowing its users to pay different kinds of bills.

The users of the RAKBANK app can pay utility bills and other expenses. Thus, make it easy for your users to pay bills from anywhere and at any time. This feature allows the user to plan their future payment, i.e., automate the bill payments and make on-time settlements.

4] Mobile Deposit

Since you will develop a digital banking app, it must offer the features that meet the requirements of visiting a physical bank. So, users of an app like RAKBANK must be offered a feature that allows them to deposit checks directly from their smartphone to their bank account.

This makes banking more convenient for the users and allows them to access the feature 24/7. This digital method is a faster option than the traditional way of depositing a check.

5] Apply for Loans

If you need money urgently and are thinking of taking a loan, then users can apply for a loan from the ease of their couch through the digital banking app. Whether users require a home loan, an auto loan, or a personal loan, it can be available in just a few clicks.

Thus, users can apply for customized loans as per their needs and progress with the application work in real time. Also, users can track the application progress right from the app.

6] Manage Credit Cards

The RAKBANK app offers a feature that helps users manage their credit cards right from their smartphones. First, users can link their credit cards to the app seamlessly. After successfully linking, users can check all the details of the credit card right in the app.

Track the credit card expenses, manage autopays, and verify due dates. Also, users can get exciting rewards and cashback when using the credit card through the app to make payments.

Steps to Build a Digital Banking App Like RAKBANK

Now that you know the features of the digital banking app RAKBANK, it’s time to learn how to develop an app like RAKBANK. A stepwise approach will be best to teach you the development process.

If it is hard to create a digital banking app all by yourself, then it is best to hire a mobile app development company in Dubai.

Let’s explore the development process for creating a dynamic digital banking app tailored to the UAE population.

Step 1: Market Analysis

Start the process with a thorough market analysis of the RAKBANK app in the UAE. Don’t forget the competitors in the market; count them in your market analysis or research process.

By analyzing the competitor’s app, you can learn about the features that make them different. Also, this will help you to find loopholes in those apps that your app can fulfill.

Next are the potential audience of your app, study about them as well, so that you understand the demand and work towards meeting them.

Step 2: Plan the Process

Now move to the next step of making an app similar to the RAKBANK online banking app, where you have to create a development plan. Without a clear development plan, it can be difficult to achieve the desired result. First, understand the objective you want to achieve with your digital banking app.

As per your objective, select the required features, create a budget for your app, and set an aim. Ensure your digital banking app is secure, has an intuitive user interface, and offers the required service to the users.

Step 3: Define Features

Next comes one of the important steps of the app development process, which is deciding upon the features for your digital banking app. Features are the main element of your app, as they will decide its success in the competition.

Define the core and advanced features that we will need to create a money transfer app as successful as RAKBANK. We have already told you the key features of the RAKBANK in the above section. If you follow the above features, choosing the right features for your app will be easy.

Step 4: Choose the Tech Stack

Moving forward, you need to choose the right tech stack, the secret to building a dynamic digital bank app that surpasses the competition. Every category of app development requires its respective technologies.

The tech stack used to develop the frontend of the app cannot build the backend of the app. Additionally, you must choose the right tech stack for security and the cloud. The required tech stacks are listed below in tabular form for your understanding.

| Categories | Tech Stack |

| Frontend development | Native- Swift or Kotlin

Cross-platform- Flutter or React Native |

| Backend development | Microservices with Java, .NET, or Node.js |

| Database | PostgreSQL, MongoDB, or Oracle |

| Security | TLS, AES-256, MFA, biometric APIs |

| Cloud | AWS, Azure, or GCP |

Step 5: UI/UX Design the App

Now, the UI/UX design of the app, without completing this step, you cannot jump to the development step of the app. For this, you should create a prototype of the app using the wireframe. Ensure the design of the app is simple, accessible, and don’t forget the security concerns of the app.

A visually attractive app with clear and easy-to-access features can bring users to the app for more. When you design an easy-to-navigate user interface UI of the app, it will offer a successful user experience UX.

Step 6: Begin Development

Now comes the core step of the process that teaches you to create a successful digital banking app, i.e., the development. It consists of multiple steps. First comes the frontend development, where you have to turn the UI/UX app design into an easy-to-navigate app interface for the app users.

It consists of creating the feature for the apps. The backend development where you have to ensure the features of the app are working in their optimum condition. All the integration work will be done, like APIs of the payment gateways, etc.

Step 7: Test & Launch

After completing the development process now it’s now time to test the app before its deployment. The step of app testing is another crucial step, without which the problems of the app cannot be identified, and launching without fixing problems brings downfall.

Testing, make sure you can present a bug-free and problem-free app to the valuable users. When you’re sure you have successfully tried and tested the app, then launch it to different app downloading platforms like Google Play and Apple Store for public use.

Step 8: Post Maintenance

Launching your app doesn’t mean your work is done. If you want to witness the long-term success of the app, this is a crucial step to be followed. Post-maintenance of the app has a similar importance to the development process. In this, developers have to ensure the app is working in its optimum condition even after its launch.

Developers keep their eyes on the app, analyze its performance, and if they find any issues, they fix them in real time. With the increase in security concerns, the security batch of the app keeps updating.

Cost to Develop an App Like RAKBANK

You have learned the process that will help you create a mobile app like RAKBANK, which is followed by experienced developers. Now, if you are in doubt about your ability to meet the requirements of digital banking app development, then you can hire mobile app developers for your project.

Before you progress, you should know about the mobile app development cost in the UAE, as this will help you in budgeting. The cost to develop a digital banking app like RAKBANK approximately ranges from $30,000 to $300,000 or even more, depending on the various factors.

The factors that affect the cost of app development include complexity, features, tech stack, developers’ location, and more. So, if you are developing a basic version of the app RAKBANK, then it will cost you up to $30,000 to $50,000.

However, if you are developing a full-stack digital banking app, then it can cost you approximately $150,000 to $300,000.

Start Developing Your Digital Banking App Like RAKBANK Today!

Get Exact Cost Quote!

Factors that Influence the Cost to Develop an App Like RAKBANK

We have told you that the cost of digital banking app development is influenced by several factors. You should have an idea of these factors that will affect your app development cost and ultimately help in budgeting.

So here is the list of a few of the factors that influence the cost to develop an app like RAKBANK. Let’s take a quick look at them.

● App Complexity

The first factor that decides the cost of a digital banking app development like RAKBANK is its complexity. The more complex the app, the more time it takes, and hence the cost of development increases.

The app development will become complex when the latest features are integrated into the app, like AI integration, biometric security, or real-time data.

● Developers Location

The location of developers decides the cost of app development. There are two types of developers available: offshore developers and onshore developers.

Offshore developers are the ones who are located outside the country, and onshore developers are the ones who exist within the country. Offshore developers are more talented and cost you less than onshore.

● Implementation of Technologies

To make a banking app just like the RAKBANK means you must implement the latest technologies for development. Implementation of the technologies has a huge impact on the cost of app development.

You have to use top-notch technologies if you desire to create a digital banking app that comes with the best results in the long run, which affects the cost.

● Choice of Platforms

The choice of platform for your digital banking app is also a crucial factor that affects the cost of its development. There are two types of platforms: one is native, i.e., either iOS or Android, and cross-platform for both iOS and Android.

If you are planning to create a cross-platform app that caters to both iOS and Android, then it will become costlier than compared to Native.

In native platforms, the iOS app development costs more than the Android app development costs.

How Does an App Like RAKBANK Make Money?

Do you know that your digital banking app, like RAKBANK, can help you make money? Yes, that’s right, various mobile app monetization strategies help your app make money.

Below, we have mentioned a few of the strategies that will help your digital banking app make money.

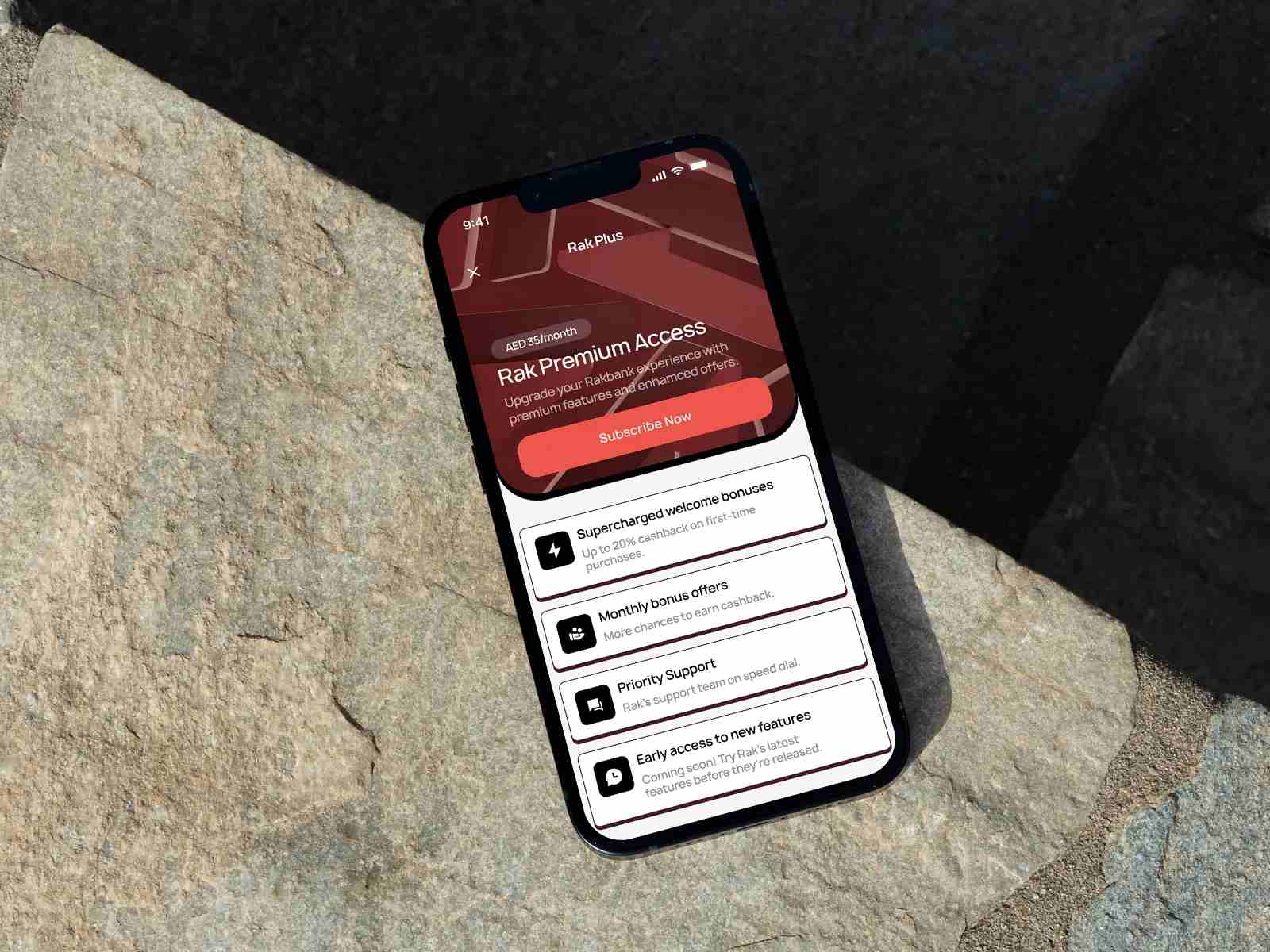

➢ Subscription Models

Subscription models are one of the best strategies to monetize the digital banking app that you have created. This not only helps the app make money but also allows the app to cater to more users.

The subscription models will allow different categories of users to pay for using the required features of the app on an annual and a monthly basis.

➢ In-App Advertisements

In-app advertisements are also a good idea to make money from your digital banking app. The third-party brands will use your app as their banner to run ad videos.

The ad videos can be shown in different formats. People don’t have to pay for these advertisements, but to unlock features of the app, they have to watch those ad videos that will generate revenue.

➢ Transaction Fees

As you have developed an app like RAKBANK, which is a digital banking app, transaction fees will work best to make money. You must consider utilizing the transaction fees as an app monetization strategy.

As per this strategy, the users have to pay nominal fees for using a few features like bill payments, fund transfers, and international transactions.

➢ Data Insights

Data insights is also one of the good strategies to make your digital banking app make money for you. In this, your app will provide anonymous user data and insights to third parties in exchange for fees.

These insights and data include the financial activity, market trends, and patterns of spending. Implementing this strategy requires following strict privacy policies.

Nimble AppGenie is a Helping Hand to Develop an App Like RAKBANK

Want to take the chance and build a money transfer app like RAKBANK that dominates the competitive landscape of digital banking apps?

You have taken a great initiative to take your business to a new dimension. In this journey, if you are looking for a trustworthy partner that makes this work easy, Nimble AppGenie is here for you.

We are popular as the best fintech app development company in Dubai that has helped many businesses achieve success with a dynamic app. Our team of skilled developers has years of experience in developing different types of fintech apps, which include lending apps, mobile banking apps, billing apps, eWallets, and many more.

As digital banking in the Middle East is reaching new heights, more businesses are turning to invest in digital banking app development. We are the first choice when it comes to access to trustworthy and experienced app development services in the UAE.

Conclusion

When you develop an app like RAKBANK, you should prioritize creating a secure and customer-centric ecosystem that allows users to manage their finances by visiting physical banks.

A mobile-first, personalized, and trustworthy digital banking app is the future of banking in the UAE.

While everyone is struggling to create such a banking app, it’s no longer a hassle for you to create one. The secret of digital banking app development is in your hands now.

So, it’s time for you to stay ahead of the competition by creating a robust and scalable banking app like RAKBANK. Set your expert team of developers and level up your standards in digital finance with a futuristic app.

FAQs

How to create a digital banking app like RAKBANK?

To create a successful and popular digital banking app, just like RAKBANK, you must follow a few simple steps. Additionally, if you can't create by yourself, you can hire an app developer. However, the steps include:

- Conduct research

- Choose features

- Know the required tech stack

- Build a prototype

- UI/UX design

- Develop the app

- Launch

- Post management

How much does it cost to develop a mobile banking app?

The cost to develop a digital banking app like RAKBANK in the UAE typically ranges from $30,000 to $300,000 or more.

The cost of development is totally dependent upon the various factors like complexity, features, tech stack, developers' location, and more. If you are planning to create the MVP version of the app, then it will cost less, but an advanced one will cost you more than $300,000.

How to make money through a digital banking app?

If you have developed a digital banking app like RAKBANK, then you must utilise the strategies that help your app make money for you. There are various ways that allow your digital banking app to create money for you. A few of the monetization strategies include:

- In-app purchase allows your app users to purchase features of the app.

- The Freemium model allows your users to try the basic app features for free and pay for the premium features.

- In-app advertisements allow your app to make money by showing ads from third-party brands.

- The subscription model allows users to purchase a paid plan on an annual, monthly, or daily basis, which allows them to access additional features.

What are the key features that a digital banking app like RAKBANK should include?

To develop a clone app like RAKBANK then you should have good knowledge of its features. The features of the RAKBANK app make it unique and popular in the landscape of digital banking applications. A few of the key features of the digital banking app RAKBANK that you must know are mentioned below:

- Secure user authentications like biometrics, OTP, multi-factor logins, and more.

- A feature that shows account balance and transaction history.

- Allow users to pay bills and recharge mobiles.

- Loan application & EMI tracking feature.

- Push notifications and other alerts.

- An AI-powered chatbot to provide the best customer service