Digital banking apps are changing how we handle money, which makes things convenient and faster. One popular app in the UAE, named FAB Mobile, has millions of users because it provides secure services and gives people control over their money through an app.

In fact, a report shows that 72% of mobile phone users in the UAE prefer mobile banking apps for daily transactions. The UAE’s mobile banking market is growing fast with an expected annual increase of 11%.

This shows how huge the opportunity is for businesses that are looking to develop an app like FAB Mobile. However, creating something similar to FAB Mobile takes more than just an idea. It is about finding the right features, design, and ensuring strong security.

Therefore, in this blog, we’ll discuss the steps you need to take to build a mobile banking app similar to FAB Mobile that people can trust and love using.

So, let’s begin!

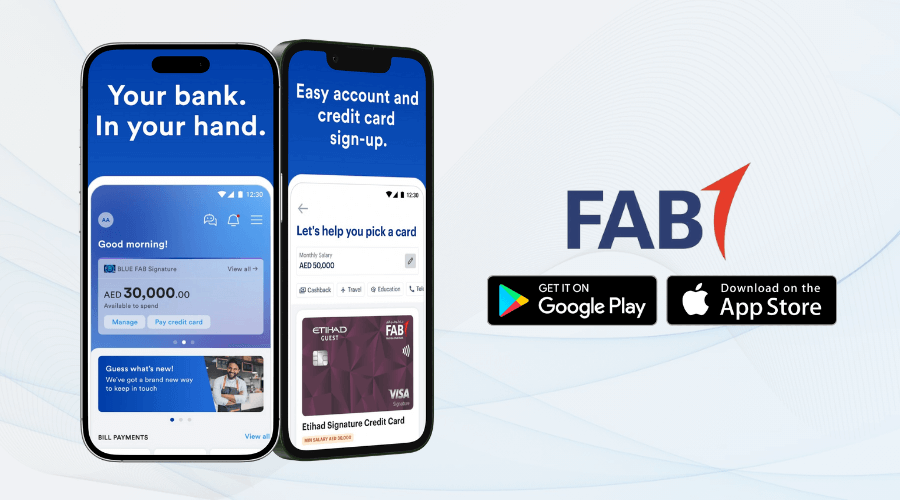

What is the FAB Mobile App?

The FAB Mobile app is the mobile banking application of First Abu Dhabi Bank, which is the largest bank in the UAE. This app is designed to help users manage their money right from their mobile phone.

Users can simply check their balance, pay bills, send money, or apply for new financial products. It is like a bank branch in your pocket. Additionally, users do not have to wait in line or visit a bank. Everything can be done directly through the FAB mobile app.

Let’s now have a look at the working mechanism of the FAB Mobile App.

- Users first download the FAB Mobile app from the respective app stores.

- Now they log in by using their customer ID, fingerprint, and passcode.

- After logging in, the app connects to the bank account.

- Now, users can check their account balance, recent transactions, and credit card details.

- Users can send money, pay utility bills, recharge their phone, etc, right from their app.

Market Statistics of the Mobile Banking Industry

Now, let’s take a quick look at UAE’s banking mobile app statistics. The numbers show just how popular mobile banking has become.

The online banking sector in UAE is on the rise, with its market size forecasted to increase from $12.5 billion in 2025 to $38.7 billion by 2031. That’s a strong growth rate of 20.5% each year. This surge is mainly driven by how fast people are moving towards digital platforms.

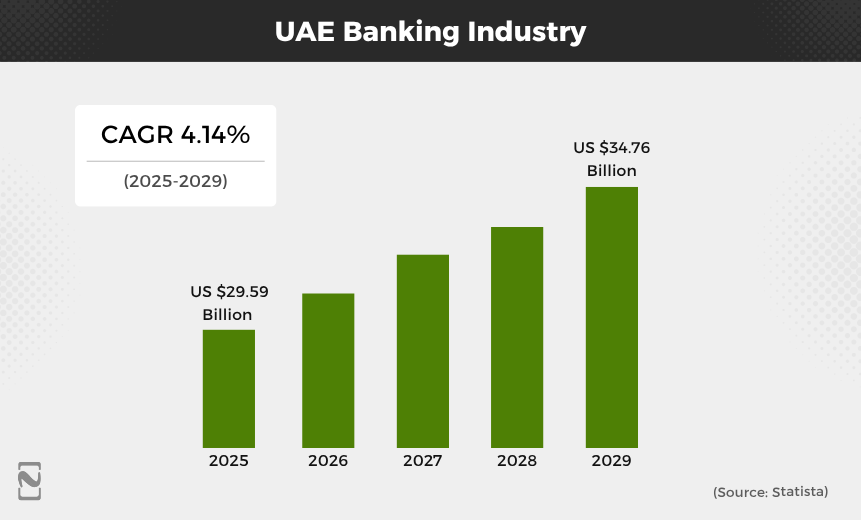

Meanwhile, traditional banks continue to lead when it comes to earning from interest. According to Statista, net interest income in the UAE banking market is expected to hit $29.56 billion in 2025.

Out of that, traditional banks are likely to bring in around $26.54 billion. By 2030, this figure is projected to grow at about 4.1% annually, reaching $36.13 billion.

Interestingly, a recent survey shared by Khaleej Times shows that 72% of people in the UAE prefer using mobile apps for their banking needs.

All of these statistics point to a huge demand and a great opportunity for businesses to build and launch mobile banking apps in the UAE.

Steps to Develop an App Like FAB Mobile

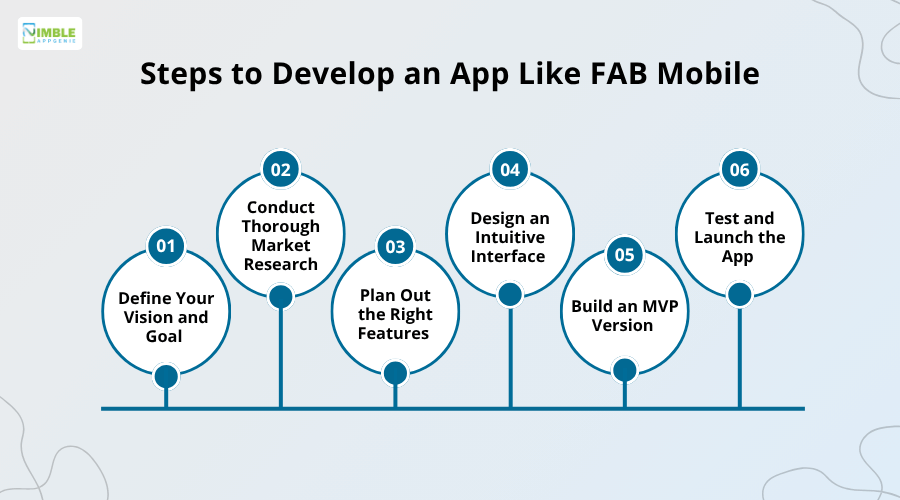

Building a good mobile app can bring a lot of benefits to banks and financial companies. But creating one takes careful planning and the right skills. Here’s a step-by-step process to build an app like FAB Mobile.

Step 1: Define Your Vision and Goal

Firstly, you should clearly define what your vision and objectives are. Do you want to provide basic banking features like checking balances and transferring money?

Are you planning to integrate more advanced features like financial planning tools or investment management? Understanding your goals will assist in shaping every decision you make.

Step 2: Conduct Thorough Market Research

Once you define your vision, it is time to thoroughly conduct the market research. You should study the existing banking apps in the UAE market, like FAB Mobile, Mashreq UAE, or the RAKBANK app, and understand what users like or dislike.

Additionally, you should pay close attention to industry trends and user reviews to identify gaps or areas for improvement. This insight will help you develop an app like FAB Mobile that addresses real user needs and offers something different from the competition.

Step 3: Plan Out the Right Features

Now you need to prioritise the features your mobile banking app will offer. You should integrate first only the must-have features. It means only those features that are necessary. It will help you test your idea with real users and align with your budget.

Later on, you can integrate advanced features and technology like AI in mobile apps when you think your app is getting enough engagement. It is vital to strike a balance between the advanced and core features that keep security as a top priority throughout.

Step 4: Design an Intuitive Interface

The mobile app design should be visually appealing and user-friendly. Also, it should be easy to navigate so that users can easily perform the task with minimal effort.

The mobile banking app’s interface should be intuitive, but functionality should always come first. Also, you should focus on elements like secure login options and clear access to main features.

Step 5: Build an MVP Version

Instead of going all-in with prioritising features at once to develop an app like FAB Mobile, you should go with the MVP version. This version helps you examine your dream app idea with real users.

In this version, you only add the must-have features and keep the design minimal. A minimal visible product allows you to gather user feedback early on, identify any bugs, and test usability, all without overwhelming your mobile app developers and budget.

Step 6: Test and Launch the App

Lastly, before your app like FAB Mobile, goes live, it is vital to thoroughly test the mobile app. You should test your mobile banking app on multiple devices, such as iOS and Android, to ensure smooth performance.

Conduct user testing to gather feedback and make any necessary adjustments. Once you’re confident in the app’s stability and usability, you can launch your dream app on the respective platforms, like the Google Play Store and App Store.

Must-have Features to Add in an App Like FAB Mobile

When you create an app like FAB Mobile, it is vital to integrate something unique that attracts users. The Digital banking app in the Middle East should work smoothly and help users manage their banking without any hassle. So, we have jotted down the must-have features that you should integrate when you develop an app like FAB Mobile.

► User Panel Features

| View account balances and recent transactions | Pay utility bills and credit card dues | Deposit cheques digitally and track status |

| Download account statements | Activate, block, and manage debit or credit cards | Secure login using biometric authentication |

| Transfer funds between accounts and to others | Send or receive instant payments | View and manage beneficiaries or payees |

► Admin Panel Features

| Monitor global cash positions across multiple banks | Enroll and manage devices for secure access |

| Initiate and authorize single and bulk payments | Access detailed transaction histories and statements |

| Manage payees and beneficiaries | Approve or reject transactions and payment requests |

| View cheque statuses, images, and return advices | Manage user roles and permissions |

Why Building a Digital Banking App in the UAE is a Smart Move?

The UAE is becoming one of the fastest-growing markets in the world. Developing a mobile banking app in UAE is one of the best mobile app ideas for businesses that want quick growth. So, let’s take a look at the reasons to build a digital banking app in UAE.

1] Growing Tech-Savvy Population

The UAE has a young and highly connected population. More than 96% of the population uses the internet, and the majority are under 40. As per Statista, smartphone penetration in UAE is more than 97%, one of the highest in the world.

This population is quick to adopt new technology that makes life really easier. A mobile banking app fits perfectly into their lifestyle, which gives them full control of their finances right from their mobile phones 24/7.

2] High Mobile Usage

In the UAE, mobile connectivity is extremely high, with over 21 million mobile subscriptions in a country of around 10 million people. Affordable mobile internet means users can access digital services on the go without interruptions.

Traditional banking feels slow by comparison. If you build a mobile app in Dubai, you can tap into this mobile-first behaviour. It offers users fast and simple banking from anywhere.

3] Cost-effective for Banks

Going totally digital is not just great for users. It makes business sense for banks, too. Between 2020 and 2024, UAE banks reduced their physical branches by over 23%. This reduces overhead costs like rent, utilities, and staffing.

This drastic shift has helped increase profitability, especially as more services move online. An online application minimizes the need for physical infrastructure while allowing banks to serve more customers more efficiently and at a lower cost.

Top Tier Examples of Mobile Banking Apps in UAE

In this section, we have jotted down the most popular mobile banking applications in UAE. So, let’s take a look at the table below.

| Best Mobile Banking Apps | Available Platform | Downloads | Ratings |

| RAKBANK | Android & iOS | 1M+ | 4.5/5 |

| Mashreq UAE | Android & iOS | 1M+ | 4.7/5 |

| ADCB | Android & iOS | 1M+ | 4.4/5 |

| FAB Mobile | Android & iOS | 1M+ | 4.3/5 |

How Much Does it Cost to Build an App Like FAB Mobile?

The cost to develop a mobile app like FAB Mobile typically ranges from $25,000 to $180,000. This FAB Mobile app development cost can vary depending on the scope and scale of your dream project.

At the lower end of that range, you can develop a basic version with must-have banking features. On the higher end, the cost to develop an app like FAB Mobile includes more advanced features like branch and ATM locator, smart digital authentication, and payment gateways in UAE.

The final mobile banking app development cost will vary based on app complexity, platforms it supports, and whether you are developing it in-house or outsourcing. Let’s understand this with the following cost to develop an app like FAB Mobile table.

| App Complexity | Cost Estimation |

| Simple FAB Mobile-like App | $25,000-$60,000 |

| Medium FAB Mobile-like App | $60,000-$110,000 |

| Complex FAB Mobile-like App | $110,000-$180,000 |

Monetization Strategies for a Mobile Banking App like FAB Mobile

Developing a mobile banking app like FAB Mobile is just the first step. To make it a sustainable business, it is important to find smart and user-friendly ways to generate revenue. Below are the mobile app monetization models you can use to make money from your app without affecting user trust or experience.

➢ Premium Features for a Fee

You can offer basic banking services for free, but provide advanced tools as part of a premium package. For example, users can pay a small monthly fee to access features like financial planning, detailed spending insights, and priority customer support. This adds value and gives customers a reason to upgrade.

➢ Partner Offers and Referrals

Just like how an app like Mashreq UAE partners with big brands, you can collaborate with other businesses like insurance companies, travel services, or e-commerce platforms to show their offers in your app.

When your users sign up or buy through your app, you earn a referral fee. It is a win-win situation. You earn money, and users get useful deals.

➢ Loan and Credit Services

If your mobile banking app like FAB Mobile, provides short-term loans, credit cards, or BNPL services directly through the app, it can be a big revenue model.

You can charge interest on these services, just like traditional banks, but with more convenience and a better experience for users.

➢ Transaction-based Fees

While regular banking should remain mostly free, your mobile banking app like FAB Mobile, can charge small fees for certain actions.

For example, international transfers, instant payment, currency conversion, or exchange. Be transparent and keep fees reasonable or affordable so users do not feel overcharged.

How Nimble AppGenie Can Help You Develop an App like FAB Mobile?

Nimble AppGenie is the leading app development company in UAE that provides quick and reliable solutions. We can help you develop a visually appealing and secure mobile banking app like FAB Mobile that aligns with your project requirements.

Our experienced team understands what clients need and builds a cutting-edge solution that looks really intuitive and attracts users. From mobile banking apps to e-wallet apps, we are happily developing any kind of mobile app with smart technology like AI, ML, etc.

So, if you are planning to develop an app like FAB Mobile, we can assist you. Partner with Nimble AppGenie today and let’s turn your vision into a powerful, revenue-driving mobile app that stands out in the market.

Final Thoughts

Now that you have a clear picture of what it takes to develop an app like FAB Mobile, the next step is putting that knowledge into action. It is not just about copying the features. It is about understanding what users truly need and delivering it in a secure, seamless way.

No matter if you are starting from scratch or upgrading an existing mobile banking app, you need to focus on visually appealing design and real value. Also, do not forget to consult the right development team that can help you create a standout mobile banking app.

FAQs

How long will it take to create an app like FAB Mobile?

The average time to make an app like FAB Mobile can be somewhere between 2 and 6 months or more, depending on the app's intricacy, features, and functionalities you add, and customizations.

How to Build a Mobile Banking App?

To develop a mobile banking application, you need to follow the steps given below:

- Understand the market & target audience

- Plan out the core features

- Choose the right technology

- Create a UI/UX design

- Build an MVP version

- Test and launch the app

Can I launch an MVP version first?

Yes, you can launch a simple MVP version first with basic features like login, balance check, and money transfer to test the app. Later on, you can create a full-featured app.

What features should a banking app like FAB Mobile have?

You can integrate features like login, account balance, money transfer, bill payments, card control, alerts, and strong security to keep user data safe.