Managing money should not feel like a puzzle. However, for millions of people in the UAE, access to simple financial platforms has always been limited. That’s where apps like Pyypl come in, which provide secure and bank-free financial freedom.

Did you know that around 64% of adults in the MENA region remain unbanked, as per the World Bank? That’s a huge opportunity for fintech entrepreneurs. Pyypl taps into the market by combining mobile payments, virtual cards, and remittance features into one app.

Therefore, if you are wondering how to develop an app like Pyypl or better, this guide will help you. It will cover must-have features, development cost, monetization models, and other aspects that can help you create a fintech app like Pyypl.

So, let’s begin!

What is the Pyypl App?

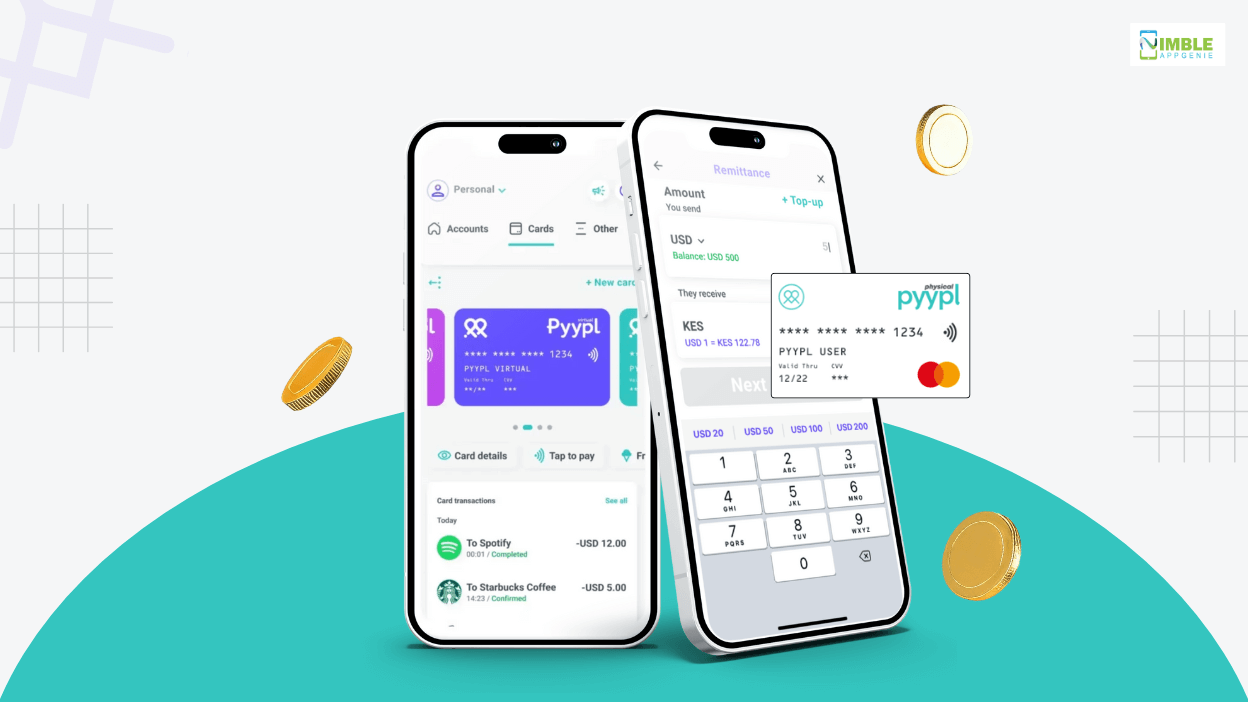

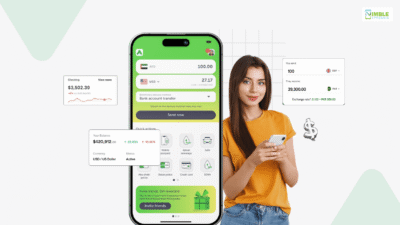

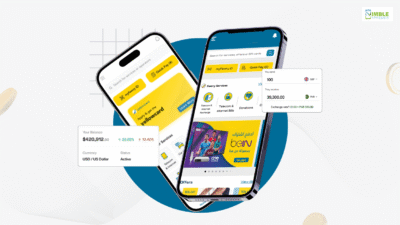

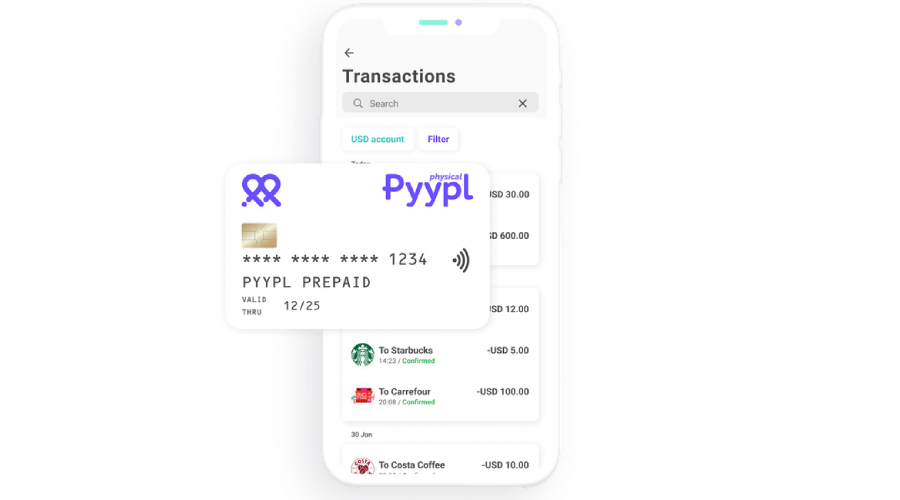

Pyypl is a UAE-based financial service app that enables users to make cross-border money transfers, purchase goods online, and create visually appealing cards.

Founded in 2017, Pyypl is one of the top fintech apps in UAE. It essentially provides users with banking-like features but without the need for traditional bank accounts. It mainly targets underserved populations who lack access to conventional banking services.

Simply, Pyypl provides users with a virtual prepaid card to shop online or make safe payments. Users can send money to other countries at low fees and hold money in different currencies.

Who Uses Pyypl?

- People without bank accounts

- Workers sending money home

- Online shoppers

- Small business owners

- Young adults and digital natives

- Residents in emerging markets

What Makes Pyypl Unique?

- No bank account needed.

- Low fees for international transfers.

- Safe virtual card for online shopping.

- Works with many currencies.

- Made for people without traditional banks.

How Does Pyypl Work?

- Users can download the app and sign up quickly with their phone.

- Then they can add money to their Pyypl account using different ways.

- Pyypl gives them a virtual prepaid card they can use to buy things online or pay safely.

- Users can send money to friends, family, or other people, even if they live in another country.

- Users can hold money in different currencies and use it wherever Mastercard is accepted.

The Future of Digital Financial Services in 2025

Fintech apps are booming in the UAE market faster than ever. Many people now use their mobile phones to manage their finances. Let’s justify this statement with the following mobile app statistics.

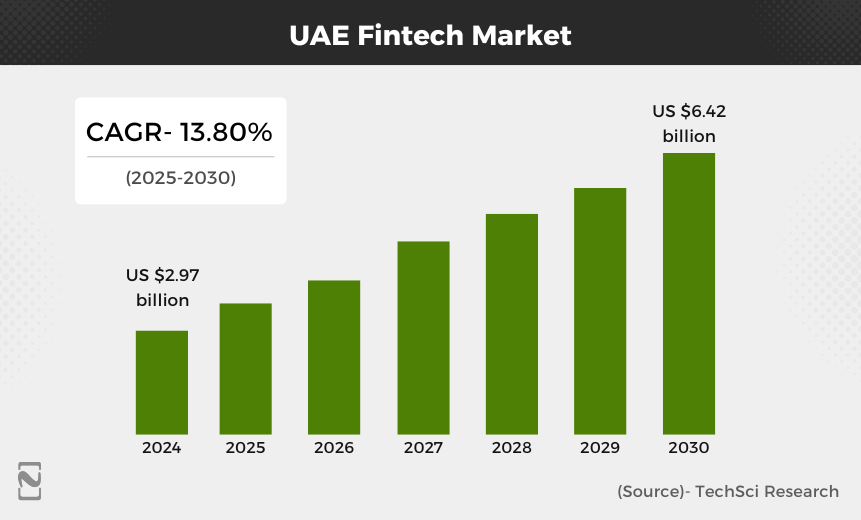

Market Growth

- The market size of the fintech market in the UAE was worth $2.97 billion in 2024. However, it is forecasted to hit $6.42 billion by 2030 at a growing rate of 13.80%.

- By 2031, people in the UAE are expected to spend around $18.7 billion just on payments.

- In 2024, 42% of people in the UAE used mobile apps to manage their money.

- Digital payments made up 56% of the market, mostly because people love fast transfers and sending money back home.

- 89% of UAE users now have online-only bank accounts.

- AI in mobile apps is helping the fintech industry to get smarter. It gives users more helpful platforms and makes sure everything follows the rules.

Major Fintech App Trends in 2025

- Cross-border payments are a big deal.

- Full financial apps are replacing basic e-wallets

- Blockchain and AI are making things smarter and safer

- Financial inclusion is driving everything

This huge growth is happening because more people have mobile phones. Internet access, and they want really fast and easy ways to handle their money.

It is especially in places where banks are hard to reach. So, this can be a great opportunity for businesses to develop an app like Pyypl to reach new heights.

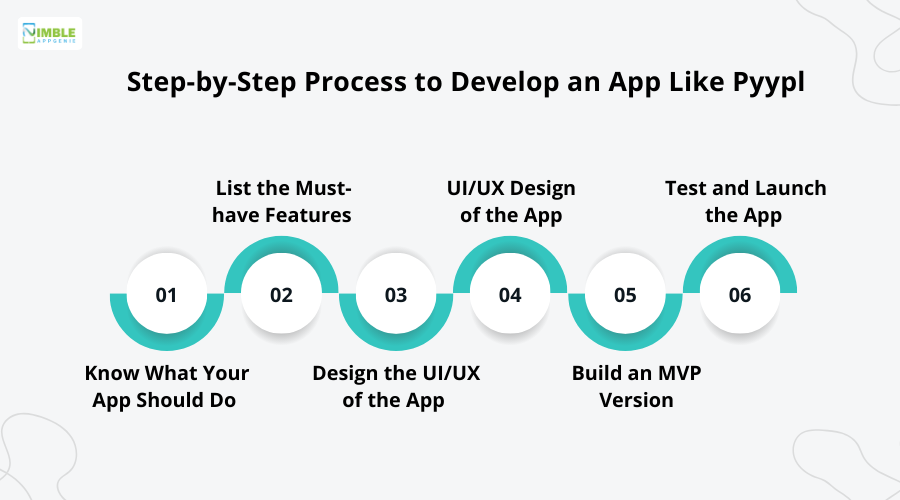

Step-by-Step Process to Develop an App Like Pyypl

It seems quite complex to create a fintech app like Pyypl, but if you take help from an expert development team, you will build your dream fintech app. Here is the process to develop a fintech app like Pyypl to help you understand the process.

Step 1: Know What Your App Should Do

Firstly, you should start by understanding the main objective of your fintech application, like Pyypl. Is it for sending money? Virtual cards? Helping people without banks?

You need to be clear about what problem your app is going to solve and to whom you are developing your dream fintech app. Besides, you can validate your fintech mobile app ideas with experts. A strong and unique app idea is the base of everything.

Step 2: List the Must-have Features

Now, this is the most important step to create an app like Pyypl, in which you have to jot down only the must-have features of your fintech app that you need to work on. Do not add unnecessary extra features that can only add to your budget.

Some of the must-have features you can integrate into your fintech app like Pyypl, are account setup, sending money, creating a card, and checking balance. These are the core features that can help users do what they came for.

Step 3: Design the UI/UX of the App

Make sure your fintech application, like Pyypl, is easy to use and visually appealing. The app design should guide users from one step to the next without any confusion. So, it is vital to design a simple, clear, intuitive, and user-friendly app.

If your user feels any type of confusion or gets lost or stuck in the app, they will not come back, even if the app works well. So, keep this important thing in mind while designing your app.

Step 4: Add Security and Follow Regulations

Since your fintech application handles money, security is really very important. So, with the help of an app development company in Dubai, add features like two-step login, biometric authentication, and data protection.

In addition to this, you should follow rules like KYC, AML, and other UAE-based security regulations to remain legal. It is vital to know that people would not trust your app if it is not safe or does not follow financial laws.

Step 5: Build an MVP Version

Now comes the main stage to develop an app like Pyypl, which is creating its MVP version. When you build a mobile app in Dubai, it is best to start by developing a simple version of the app with only the must-have features.

It helps you launch faster and test your dream app idea with real-life users, with their honest feedback. It saves your development time and the cost of investing in fully-functional app development.

Step 6: Test and Launch the App

Last but not least, test your fintech app like Pyypl by using different testing methods. You can look for bugs, ask for feedback, and see what is wrong or not.

Once the testing is done and your app is thoroughly tested, you can finally launch your app on the desired platforms. Also, do not forget to timely modify your dream app based on what users need. The best mobile app is always getting better over time.

Must-Have Features to Add in Pyypl-Like App

Pyypl is not just a money transfer app; it is a platform for people who do not use traditional banks but still need modern financial services.

So, if you are looking to make an app like Pyypl, you can not just copy-paste it. You need the right mix of features for users and admins to keep everything running smoothly. Let’s check out the features below for both panels.

1] User Panel

| Sign Up or Sign In | International Transfers | Mobile Recharge or Bill Payments |

| Mobile Number & Email Verification | Receive Money | Push Notifications |

| KYC Document Upload | Virtual Prepaid Card | Support Chat or Help Center |

| Dashboard | Card Management | Profile Settings |

| Add Money | Currency Exchange | Language Selection |

| Send Money to Contacts | Transaction History | Referral Program |

2] Admin Panel

| Admin Login | Virtual Card Management | Role-Based Access for Staff |

| User Management | Currency Rates Management | Manual Credit or Debit Adjustments |

| KYC Approval or Reject System | Fee & Commission Settings | Suspicious Activity Alerts |

| Transaction Monitoring | Top-Up & Payment Provider Integration | Feedback & Complaint Handling |

How Much Does it Cost to Build an App Like Pyypl?

If you are developing a basic version of an app like Pyypl, then usually Pyypl app development costs between $25,000-$70,000. This version will have the core features and is good enough to test with real users.

However, if you are building a fully-functional version with all features, then the cost to develop an app like Pyypl will be around $70,000-$180,000 or more. So, basically, the cost to develop a mobile app is highly dependent on how complex your app will be or the level of customization.

As for time, a basic version usually takes around 2-5 months. A full version can take anywhere from 6-9 months or even more if you keep adding more features after launch.

Key Challenges in Developing and Launching an App Like Pyypl

Creating a payment app is not just about coding features; it is about handling money, trust, and rules–all at once. So, while developing a fintech app, you might face some challenges that we are going to discuss below.

-

Launching Without Real-world Testing

Many teams develop a money transfer app in UAE, test it in-house, and push it live. But real users behave differently. They make mistakes, skip steps, or get stuck. If you skip live user testing, you will only find out what’s broken when your support inbox explodes.

-

Rules Change From Country to Country

There is no one-size-fits-all. What’s legal in one country might be blocked in another. Some regions need full licensing, some do not.

If you do not plan for this early, you could spend months rebuilding things just to meet one country’s rules.

-

Security is Not a Feature; It’s a Foundation

This is not about adding a password and calling it secure. The payment app like CashNow or Pyypl, must protect users, data, and every single transaction.

One weak spot, and you are open to fraud, chargebacks, or worse, financial penalties.

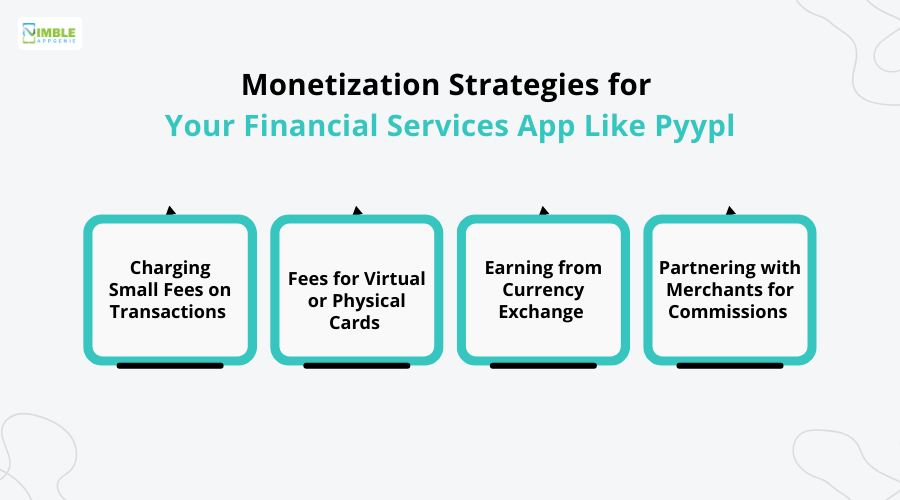

Monetization Strategies for Your Financial Services App Like Pyypl

A fintech app like Pyypl makes money by turning key user actions into revenue. It is about charging for services people actually use. So, you really want to monetize your financial services app like Pyypl, just check out the mobile app monetization models below.

► Charging Small Fees on Transactions

Every time someone sends money or pays a bill using your fintech app, you can charge a small fee. Most users would not mind a small cost if the service is really easy and fast.

These small fees add up fast as more people use your application.

► Fees for Virtual or Physical Cards

The next way you can make money from your fintech application like Pyypl, is by charging users a small fee to get a prepaid card.

Either virtual online shopping or physical cards for stores and ATMs. Some applications charge when users withdraw cash. This is a fixed source of income from card users.

► Earning from Currency Exchange

If your mobile fintech application allows users to convert money between different currencies, you can make money by adding a small margin to the exchange rate.

This means you earn a small bit on every currency sap. This grows as more users trade money internationally.

► Partnering with Merchants for Commissions

The last way to monetize your fintech application is by collaborating with stores or services. You can earn great commissions when your users shop or pay there using your app.

This helps merchants get more customers or a huge user base, and you get paid for bringing in business. This is a smart way to grow revenue.

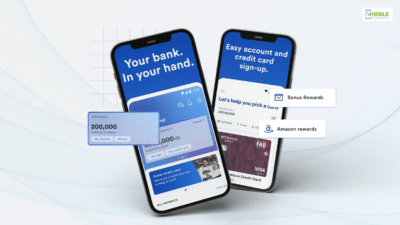

Why Choose Nimble AppGenie to Develop an App Like Pyypl?

Nimble AppGenie stands out because we understand the challenges of creating a fintech app. As a trusted fintech app development company in Dubai, our main focus is on developing a secure virtual card app solution that aligns with your budget.

Our expert team balances smooth design with high-tech security that ensures your app works well and stays secure. We do not just build mobile apps; we also help you launch a product that fits your market.

With Nimble AppGenie, you can get clear communication, on-time project delivery, and support that lasts beyond launch. If you want to develop an app like Pyypl that feels easy and safe, Nimble AppGenie is the perfect choice.

Building a Pyypl-Like App-Is It Worth It?

When you develop an app like Pyypl, which offers virtual cards instead of traditional banking, it takes so much effort. But the opportunity in 2025 is big.

Many people need secure ways to shop online without a bank account. If you’re ready to start, choose a mobile app development company in UAE that understands fintech rules and user needs.

The cost may seem high, but the long-term growth is worth it. So, you should start small, test early, and build something people actually need because now is the right time to begin!

FAQs

How much time does it take to build fintech apps like Pyypl?

The time to create an app like Pyypl may be between 2 to 7 months or more. This can vary based on your project requirements. If it is a simple version, it can take 2-5 months. But if you want a full-featured app, it can go beyond 9 months.

How much does it cost to develop an app like Pyypl?

The cost to develop an app like Pyypl can range from $25,000 to $180,000. This can fluctuate depending on factors such as features and functionality, app complexity, design, and size.

What compliance regulations must fintech apps like Pyypl follow?

Fintech apps like Pyypl must follow rules to protect user data, prevent fraud, stop money laundering, and follow local financial laws in each country.

How do financial apps make money from cross-border transactions?

Financial apps make money from cross-border transactions by charging small fees, using exchange rate margins, and earning from faster or special transfer services.