The Middle East is the global hotspot for Fintech innovation by transforming the landscape of traditional banking, payments, and investment.

The tech-savvy population, favorable regulations, and the government’s aim to strengthen digital banking solutions made a strong base for fintech app development in the Middle East. The Fintech enterprises of the UAE are making the best use of this situation to reimagine financial services.

Want to dig deep into the information about Fintech app development for the enterprises of the UAE?

Explore this blog till the end to access the complete guide.

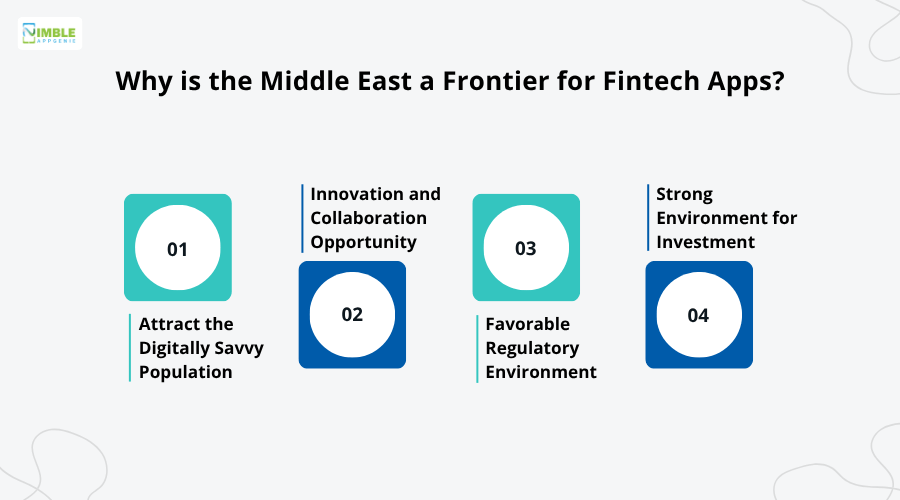

Why is the Middle East a Frontier for Fintech Apps?

The answer to the question with which we will start this blog is why the UAE has become a leading edge for Fintech apps. The market statistics about the Fintech sector of the UAE have the perfect answer.

- The Fintech market of the UAE was valued at $3.16 billion in the year 2024, which is projected to grow and reach the value of $5.71 billion by the year 2029.

- In the year 2024, the Fintech startups of the UAE raised $265 million 2024, which is one-third of the national startup funding.

- The UAE has witnessed that 89% of its customers use digital-first bank accounts.

- Behind this transformation in the financial services, Artificial Intelligence, or AI, is playing an important role, which enhances personalization, compliance, and risk management.

We will now tell you the benefits that are brought by Fintech app development in the Middle East. Here is a list of a few benefits below. Let’s check them out.

1] Attract the Digitally Savvy Population

UAE tops the list of smartphone users and internet access due to its huge digitally-savvy population. This creates a favorable environment for the enterprises to invest in mobile app development for fintech and attract the huge digitally-savvy population of the UAE.

The Fintech apps will make it easier for them to manage banking, payments, and investments all in one place.

2] Innovation and Collaboration Opportunity

The UAE market creates an excellent opportunity for financial enterprises to collaborate because of events like DIFC Fintech Hive and ADGM RegLab.

This will allow enterprises or startups to provide advanced, customer-oriented services at the lowest operational cost and regulation through Fintech apps.

3] Favorable Regulatory Environment

UAE is a nation that has a clear and progressive regulatory regime, such as the Central Bank, DIFC, and ADGM.

Additionally, regulatory sandboxes, licensing options, and similar initiatives allow enterprises and startups to build high-quality Fintech solutions without the need for unnecessary bureaucracy. This framework is favorable for earning trust.

4] Strong Environment for Investment

In the UAE, Fintech enterprises can get a lot of venture capital and institutional investment. Both private and government sectors of the UAE are in favor of supporting Fintech innovation, leveraging the funding programs, incubators, and accelerator programs. This works in favor of both Fintech startups and enterprises to create a great Fintech app solution.

Thus, the above information clearly states that if you have mobile app ideas that can redefine the Fintech solution in the Middle East, you must invest in them.

Emerging Trends Transforming Fintech App Development in the UAE

The UAE is slowly emerging towards becoming a cashless and innovation-led economy due to the visionary initiatives of the government. This is the core reason for the market of digital banking in the Middle East getting stronger, and a rise in fintech app development.

If you want to redefine the user’s experience and transform Fintech app development, you need to be familiar with the emerging trends. Here we have created a table for the trends below for better understanding.

| Trends | Explanation |

| Cashless Payments & Digital Wallets | ● The aim of the nation to become cashless needs to consider the cashless payment solution & eWallets.

● They ensure instant, secure transactions. |

| Blockchain and Crypto | ● UAE aims to become a crypto and blockchain nation.

● More Fintech app developers are incorporating them to ensure secure payments, smart contracts, etc. |

| AI-powered Personalisation | ● The AI trend has now become a must-have technology for Fintech apps.

● Incorporating these fintech firms is detecting fraud, managing risks, creating dynamic loans & credit offers, and more. |

| Cybersecurity & Digital ID | ● With rising risks of cyberattacks, cybersecurity and digital ID solutions have become a crucial trend.

● Integrating biometric authentication, multifactor authentication, and other measures to keep the Fintech apps secure. |

| International Payment & Remittance | ● International payment & remittance have become a vital trend to adopt by the Fintech apps in the UAE.

● With a large foreign population, this will make sending money abroad faster, easier, and cheaper. |

| Integrating Emerging Tech | ● Integrating emerging techs like IoT, voice assistance, and augmented reality is reshaping the user interaction with the Fintech apps.

● These technologies are making Fintech apps more intuitive, personalized, and accessible. |

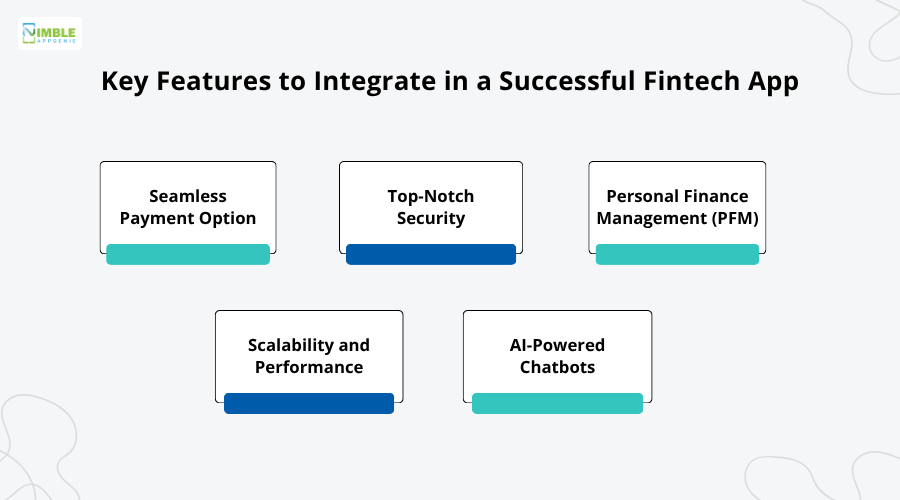

Key Features to Integrate in a Successful Fintech App

The success of a Fintech app depends on the features it offers to its users. The app, which has unique and advanced features, will attract more users. Thus, be careful while choosing the features for your fintech app.

You can partner with an app development company in Dubai, as they have good knowledge about the features and will also make the development process easier.

Though we have mentioned a few core features of a Fintech app that you must consider.

-

Seamless Payment Option

A Fintech app must have a feature that allows users to make seamless payments, which is the whole purpose of creating such an app.

So, integrate a payment gateway into the fintech apps, make sure the app supports local cards, and third-party payment apps like Google Pay or Apple Pay. All these will make the contactless payment journey more convenient.

-

Top-Notch Security

If you are creating a Fintech app whose main purpose is to make financial transactions, then you must protect it from potential cyber attacks.

So, your Fintech app must have top-notch security features. You can use bank-grade encryption in transit and a rest. Integrate biometric login, SMS OTP system, app authentication, and others for stronger security.

-

Personal Finance Management (PFM)

The younger spenders of the UAE are looking for a financial app that helps them manage their finances. While creating a fintech app must integrate the PFM or Personal Finance Management tools.

So, you must add features like bill reminders, categorized spending, and saving goals. Your app must show all accounts or cards and net worth in one dashboard.

-

Scalability and Performance

Scalability and performance must be the core of your Fintech app. In the UAE, most transactions are small but high, so make sure it does not cause glitches or load during the peak hours.

Build a Fintech app that scales on the UAE region cloud, with autoscaling, caching, queues, and a CDN. build resilience with load or soak tests, chaos drill, and real-time monitoring.

-

AI-Powered Chatbots

Fintech apps witness 24/7 activeness since money never sleeps, and it may come with several queries or issues from the users. So, make sure the support feature of your Fintech app can offer solutions to users anytime.

It is best to integrate AI-powered chatbots to make the Fintech app’s support more functional. The support must have a bilingual base for more helpful responses.

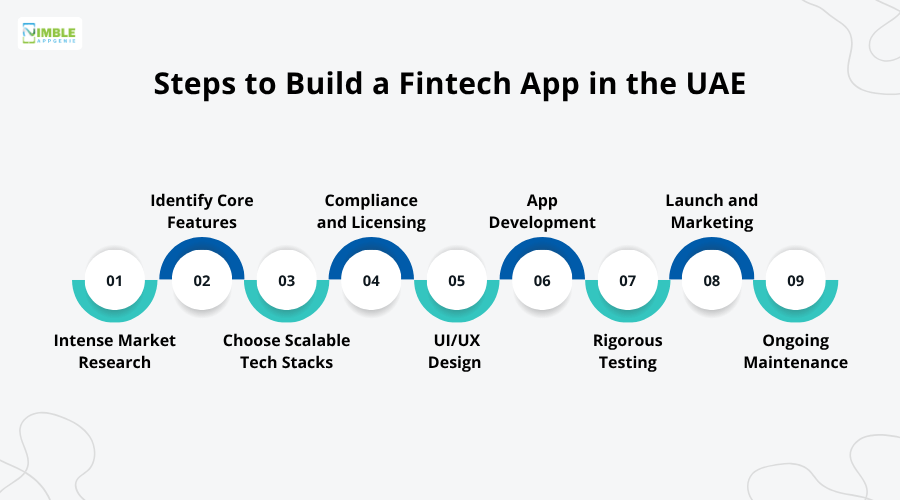

Steps to Build a Fintech App in the UAE

Since the Middle East has the fastest-growing base for Fintech apps globally, investing in fintech app development can be an excellent growth hack for enterprises. To build a thriving fintech app in the UAE, the secret lies in following its dynamic steps.

If you are someone who doesn’t have much knowledge, we have made it easier by creating a step-by-step Fintech app development guide. Follow the steps mentioned below, or just hire app developers for an easier way out.

Let’s proceed with the steps now to learn it.

Step 1: Intense Market Research

Start to develop a money transfer app in the UAE for your Fintech business by performing intense market research. This step will help you plan the Fintech app better so that it can thrive in the competition.

Research about the competitor fintech app in the UAE to understand how they perform and know about their features. You must also learn about audience demands.

Step 2: Identify Core Features

After the market research, proceed to identify the core features for your Fintech app. Features are a crucial element of the app that give it uniqueness and strong reasons to thrive in the highly competitive fintech app market of the UAE.

Must choose the features that will define your business, add trending and advanced AI-powered features that give your business a competitive edge.

Step 3: Choose Scalable Tech Stacks

Then comes tech stacks that define the quality of your fintech app functionality. You have to be very careful while choosing the technologies, because they will support the faster growth of your Fintech app and advanced financial operations.

If you are creating the app for an area with high penetration, then cross-platform frameworks like Flutter or React Native for both iOS and Android platforms are best.

Step 4: Compliance and Licensing

Next, make sure you comply with the government guidelines to create a successful Fintech app in the UAE. Get a license from the government, such as SAMA in Saudi Arabia or the Capital Market Authority (CMA), and Counter Terrorism Financing (CFT) controls.

You have to make sure that the user data is secure as per the local data protection regulations and audit trails.

Step 5: UI/UX Design

Now, start creating the UI/UX design of the Fintech app, which must be appealing and attract a diverse range of users. Create the prototype of the app and let the potential customers test it, which will help you identify changes.

Designing clear features, icons, and colors that can match branding. Your app must support right-to-left text as per the Arabic language, visual hierarchy, and more.

Step 6: App Development

After completing the design of the fintech app, we now start its development process. The app development process is divided into two sections: frontend development and backend development. In frontend development, you have to turn the UI/UX design into an intuitive app interface that users can navigate easily.

Then comes backend development, where you have to build the backbone of the app that helps to run the app without any issues. Here you have to integrate APIs, payment gateways, databases, and more.

Step 7: Rigorous Testing

The next step after being done with app development is testing. This is one of the crucial steps in the app development process. You have to perform rigorous testing on the app so that there will be no potential issues or bugs.

Testing helps you prevent users from having a bad experience. There are several tests, which include performance testing, security testing, utility testing, and more.

Step 8: Launch and Marketing

Now that you are sure that your app is free from issues and bugs, it is the right time to launch the app. There are several app download platforms like Google Play, Apple Store, and third-party platforms where you can launch the app, which users can install.

Before the launch, it is a good idea to promote the app through several channels like social media, email, and others to create buzz & attract more users.

Step 9: Ongoing Maintenance

The app development steps don’t end at launch, but they continue with ongoing app maintenance. It is crucial to keep the app in its best state so that it doesn’t affect the user experience.

Keep the app under monitoring for the on-time detection and cure of the potential issues & bugs. Keep the app updated with trending and advanced features. Also, update the OS and security patch of the app regularly.

Develop and launch a powerful FinTech app that fuels growth opportunities for enterprises in the UAE!

Book a consultation now!

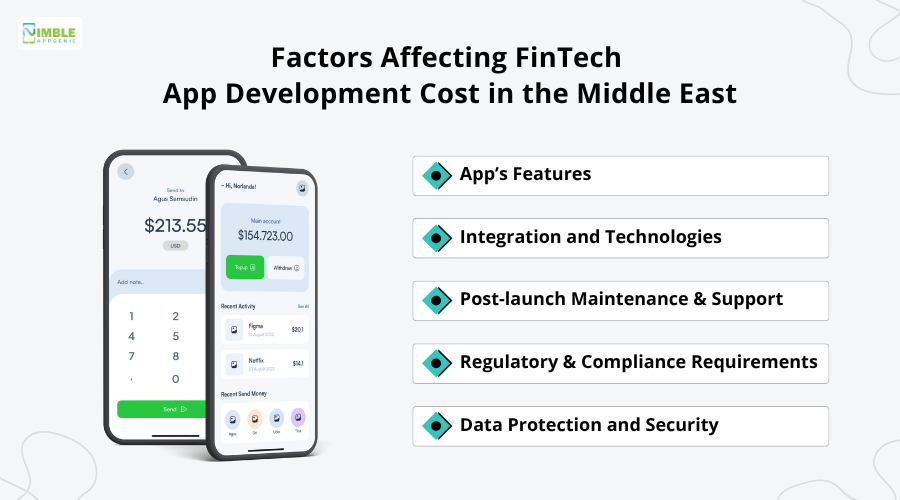

Cost to Develop a Fintech App in the Middle East

Are you planning to start fintech app development in the Middle East? Before proceeding, you should know how much it will cost you. This will help you plan the budget for the app development, as it allows you to choose the right tech stack and features for your fintech app.

The average cost to develop a mobile app for your Fintech enterprise ranges from $20,000 to $200,000 or more. For an MVP fintech app with basic features and technologies, it will cost you up to $20,000 or less. However, if you are planning to integrate AI in mobile apps and use the latest technologies, then it will cost more than $200,000.

Several factors decide the fintech app development cost; a few of them have been listed and explained below for your understanding.

➢ App’s Features

The type of features you will be choosing for your app decides the development cost of your fintech app.

If you want to integrate the complex features that include AI analytics, digital wallets, and blockchain, then it will take more time to develop, and hence increase the cost.

➢ Integration and Technologies

The choice of technologies that will be used by a fintech business in the UAE to create its app affects the development cost.

Along with that, the integration of legacy systems that often need APIs and middleware will increase the development expenses.

➢ Post-launch Maintenance and Support

Keeping the fintech app maintained, ensuring it offers users high-quality performance, can affect the development cost.

Also, continuous support to provide users with the best experience of the app by keeping features, OS, and security patches updated will increase the cost.

➢ Regulatory and Compliance Requirements

Complying with the required government guidelines to build a fintech app, as stipulated by the Central Bank, DFSA, and ADGM, affects the development cost.

Additionally, if you want to meet the requirements of AML, KYC, and data protection, that is also a solid investment.

➢ Data Protection and Security

Security is the most important aspect that you must consider while developing a fintech app.

You have to apply all kinds of security strategies like end-to-end encryption, fraud detection systems, biometric authentication, and constant security monitoring, which affects the cost.

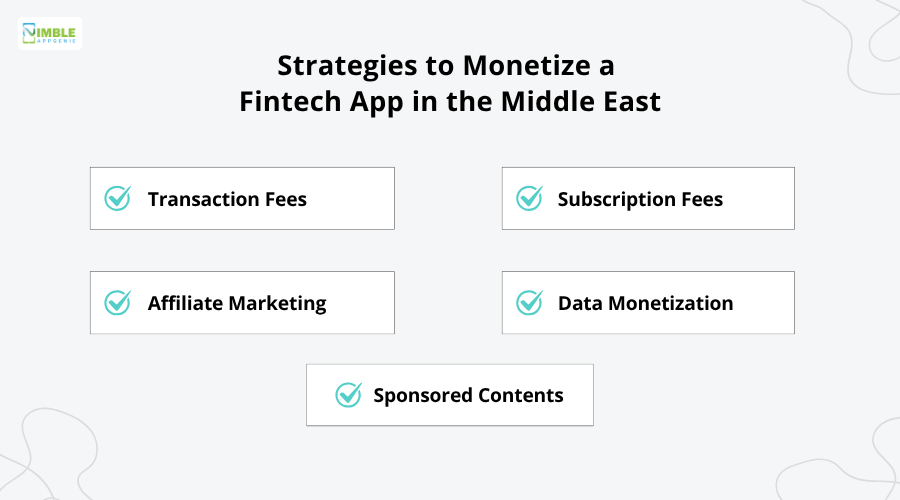

Strategies to Monetize a Fintech App in the Middle East

Here is excellent news about your fintech app, which can help your enterprise to enjoy good financial growth in the competitive market of the UAE. Yes, that’s right, you just have to apply a few strategies that will make it possible for your app to make money for your business.

We have shared some of the top mobile app monetization strategies below for you to consider.

● Transaction Fees

Apply transaction fees on your app so that the app can charge the users a flat fee for every transaction made through the app.

For every money transfer, bill payment, and other users, have to pay a charge that comes with the chance for your business to make money.

● Subscription Fees

You can create tiered pricing for the premium services available on your app. So, whenever users wish to use the value-added services, they have to buy them on a monthly or annual basis. This is a good way to monetize your app and earn business revenue.

● Affiliate Marketing

Affiliate marketing is a good monetization strategy for your fintech app. The app will recommend financial products from the partner institution, like credit cards, funds, and others that users may buy. For every purchase, the app earns commission for you.

● Data Monetization

Data monetization, in which you have to provide anonymous user data that includes insights into the trends, users, and others to financial institutions.

By offering the data, enterprises will get the chance to earn a good amount of revenue. In this, transparency plays a crucial role.

● Sponsored Contents

As per this, you can run sponsored content on your fintech app that shows several financial products from partners.

When products are purchased by the users of your app through the contents, you will get the chance to earn money. This is a good monetization strategy.

Develop a Robust Fintech app with Nimble AppGenie in the Middle East

Are you an enterprise that wishes to invest in fintech app development in Dubai? It will be an easy task with the right app development partner by your side. In this journey, there is no better partner than Nimble AppGenie.

We are the leading fintech app development company in the UAE, boasting over 7 years of experience. Our expert team of developers is the backbone of our success.

They have expertise in creating robust mobile apps for various industries, from scratch, and tailored to the client’s requirements.

Conclusion

The Fintech enterprises in the Middle East are using the favorable market as a launchpad for their innovative financial apps. By creating AI-driven and blockchain-powered Fintech apps, enterprises have redefined the way businesses and consumers interact with money in the UAE.

Thus, investing in fintech app development in the Middle East means reshaping the future of finance. You now know exactly how an enterprise can lead the charge in the rapidly evolving financial ecosystem of the UAE.

Thus, keep moving forward to become a pioneer in the financial technology market of the Middle East.

FAQs

Are there any compliance requirements that must be followed to build a Fintech app?

Yes, of course, to build a successful fintech app in the UAE, enterprises have to do it following several compliance measures.

They have to follow the guidelines of the UAE Central Bank, Dubai Financial Services Authority (DFSA), and Abu Dhabi Global Market. There are other significant requirements as well, which include AML, CFT, and KYC.

Do UAE enterprises have to integrate AI and blockchain into Fintech apps?

Yes, the enterprises of the UAE should integrate AI and blockchain while creating a Fintech app. Integrating AI technology is best for predictive analytics and offers a personalized user experience.

Whereas blockchain will allow enterprises to secure smart contracts, transparent transactions, and tokenized costs for their fintech apps in the UAE.

How to future-proof the Fintech apps as per the upcoming UAE regulations and open banking framework?

To future-proof their successful Fintech apps as per the upcoming regulations and open banking framework by the UAE Central Bank, DFSA, and ADGM, enterprises need to focus on a few things.

This includes modular architecture, API first development, and constant monitoring. Open-based construction will let the enterprise ensure rapid integration of new services in the apps, and following the agile approach for maintenance will enable them to manage the changing financial landscape in the UAE.

Can UAE Enterprises Monetize their Fintech Apps?

Yes, UAE enterprises can monetize their Fintech app, and it is one of the crucial approaches to create a stream of revenue that ensures their business's financial growth. However, enterprises have to follow a few of the strong monetization strategies.

We have listed some of the fintech app monetization strategies below for your knowledge. Let’s take a look.

- Access to premium financial tools through a subscription model

- Transaction fees for every payment and lending

- Accessing value-added services like analytics, advisory, or loyalty programs

- Partnership with Fintech platforms or banks to earn revenue

- Run sponsored content on the app