Banking in Middle East is no longer just about standing in lines. It is going digital. More people are using fintech apps and websites to ditch visiting conventional banks. This change is not just Middle East banking trends; it is becoming the new normal.

In the Middle East, more than 60% of the population is under 35, and most of them choose digital banking solutions for everyday transactions. That‘s why banks and mobile app startups are providing fast and smart digital banking in Middle East.

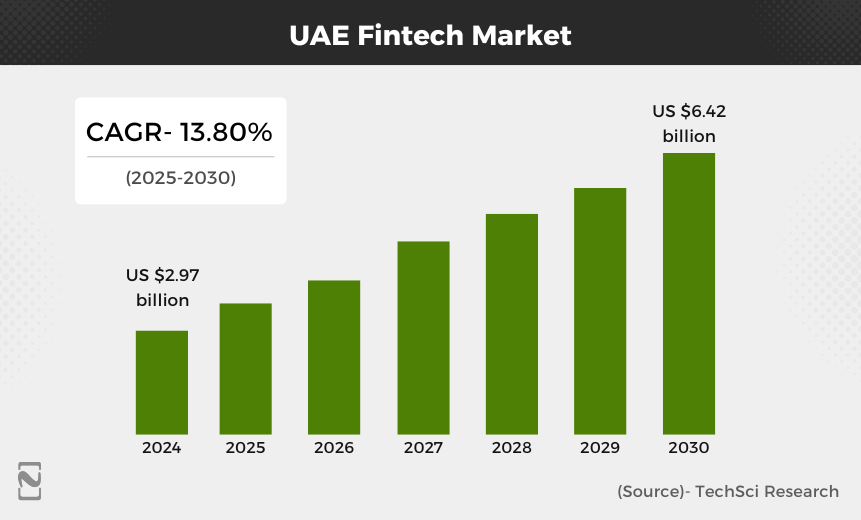

The Middle East’s fintech market is booming fast, with investment forecast to hit $6.42 billion by 2030. This indicates that people and businesses are prepared for digital transformation in banking.

In this blog, we will discuss how digital banking is changing the MENA region. From neo banks to mobile wallets, a lot is happening.

So, let’s take a closer look!

Market Overview of Digital Banking in Middle East

The digital banking sector is growing very fast in Middle East. In countries like Saudi Arabia and Qatar, many people are using apps and online services. It just changed the whole banking landscape. Let’s understand this with the market statistics of digital banking in Middle East.

- The Fintech in the Middle East is projected to grow 55% by 2033. This shows that total digital banking has a very strong future in this region.

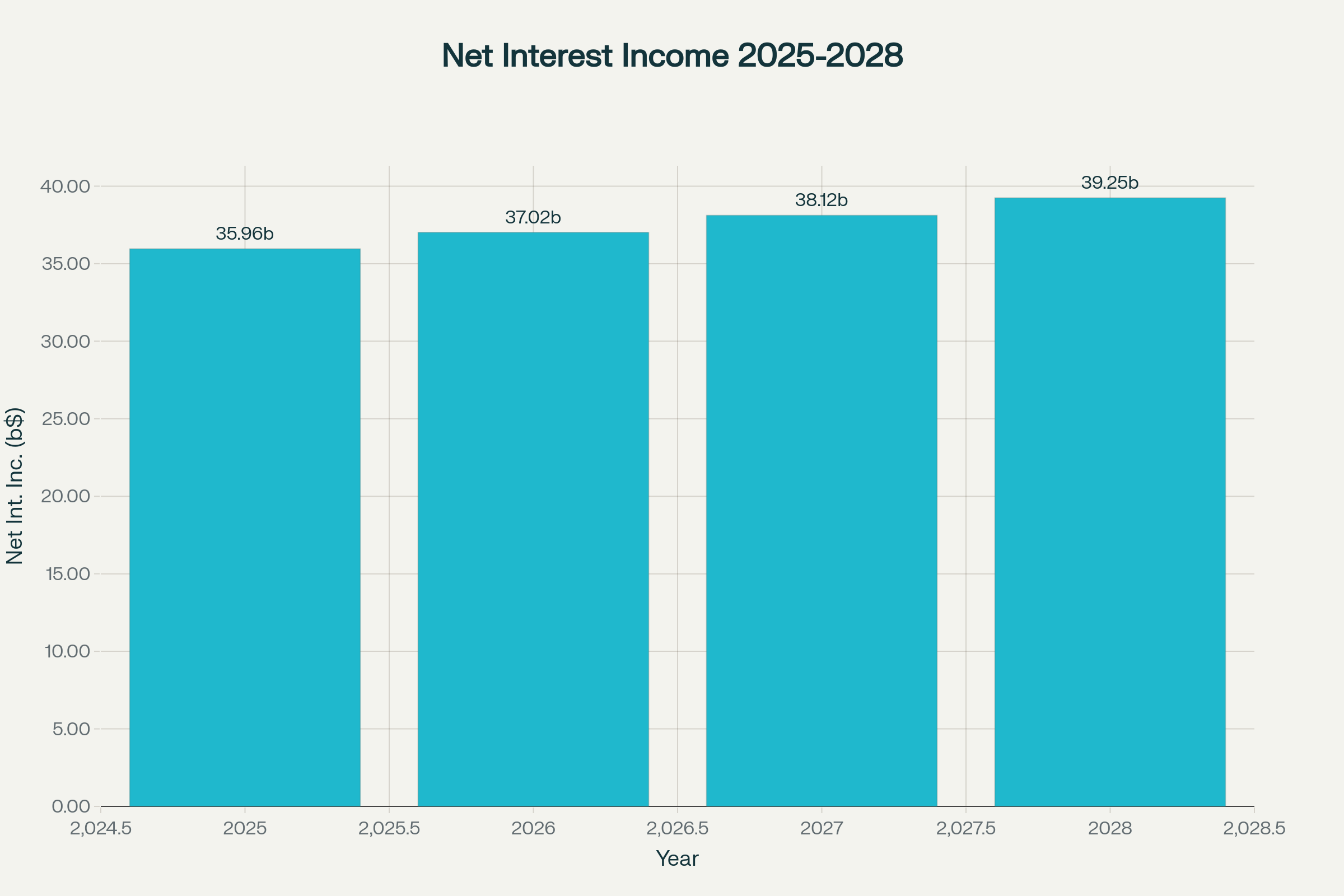

- In 2025, the net interest income from digital banks in the Middle East is forecasted to hit $35.96 billion. This is expected to increase by about 2.96% each year from 2025 to 2028 and reach $39.25 billion by 2028.

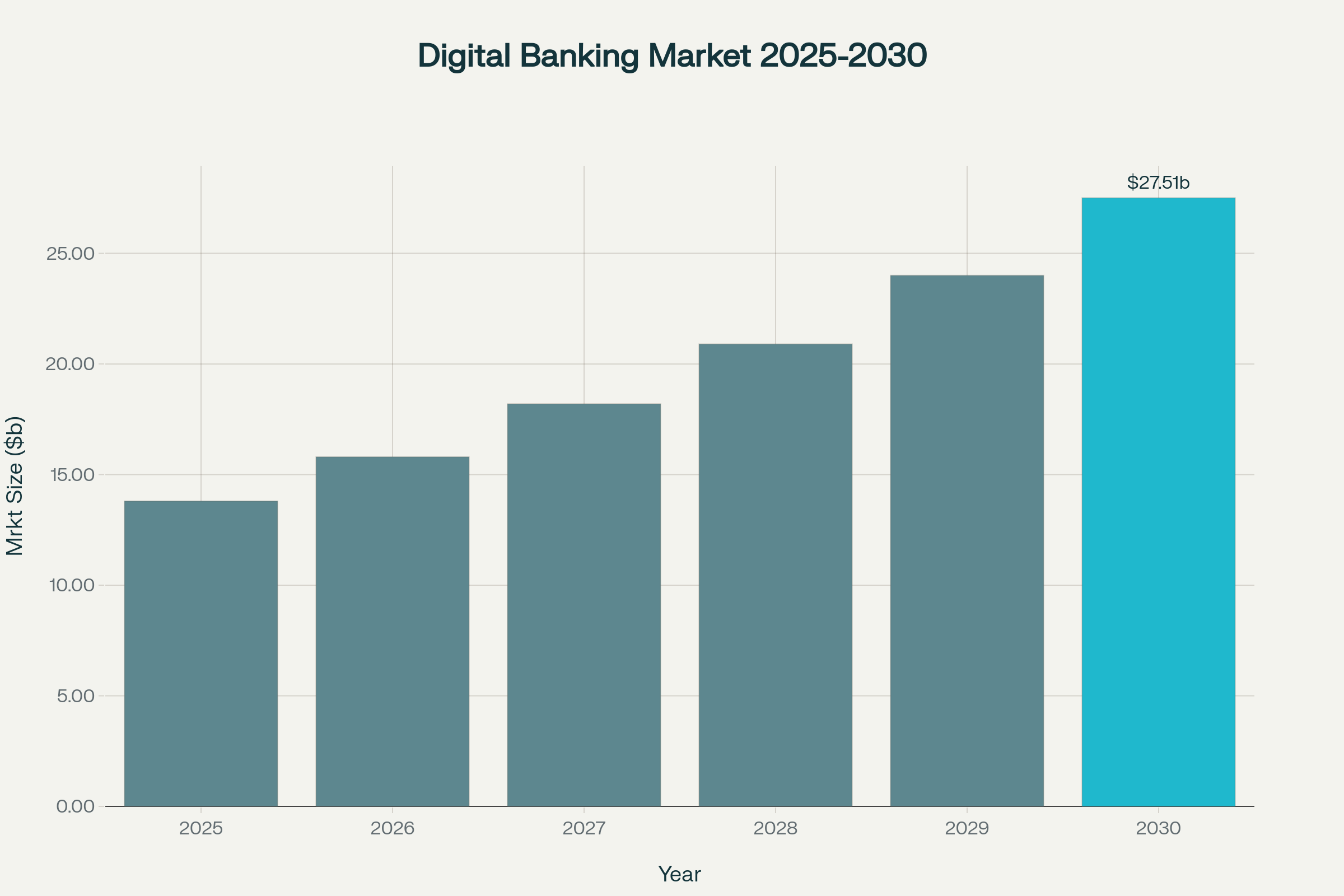

- As per Statista, the worldwide digital banking platform market is forecasted to reach $27.51 billion by 2030.

- If we compare it with other countries, China is forecasted to make the most net interest income from digital banks with $528 billion in 2025.

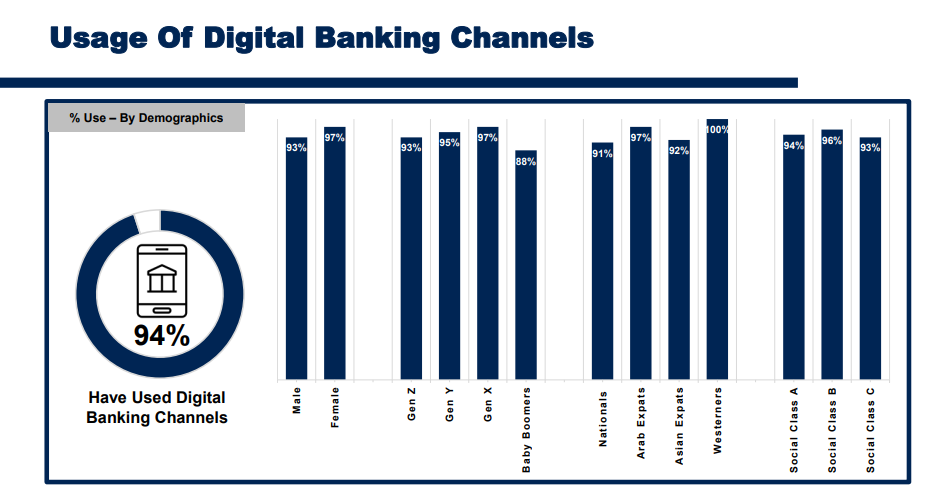

- In Qatar, a study by IPSOS found that more than 94% of bank customers have used some form of digital banking.

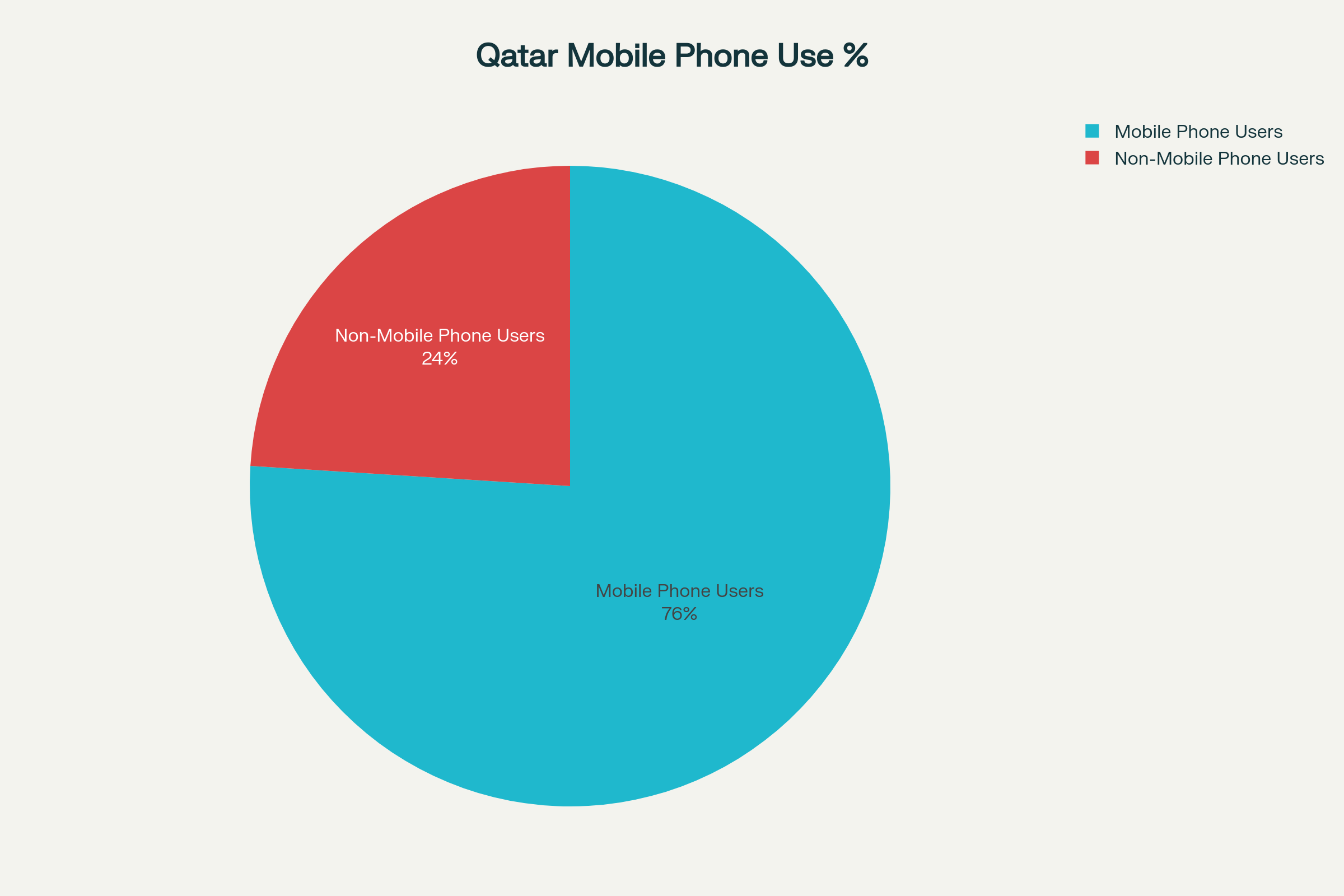

- Since more than 75% of people in Qatar use mobile phones, most banks are focusing on mobile banking to better serve their customers.

What is Digital Banking?

Digital banking means doing your banking through the internet using your phone and computer, or any other device. You do not need to visit a physical bank. You can simply check your balance and send or receive money, pay bills, or even open accounts with a simple app.

It is available 24/7 and is easy to use from anywhere. Digital banking saves time, and security is essential, so most banks use OTPs or biometric authentication to keep your money safe.

Types of Digital Banking in Middle East

Digital banking in the Middle East is transforming at a rapid pace. People in this region use only digital banking for most tasks. There are many different types of digital banking services available in the Middle East. So, let’s check out each of them.

1] Challenger Banks

Challenger Banks are created by regular banks, and they work mainly through applications and do not require you to visit a branch. It is made to compete with traditional banks.

They are known as challengers due to faster, simpler, and cheaper services than traditional banks. You can simply open an account within a minute and charge very low or no fees. For example, Wio Bank, Meem are some of the challenger banks.

2] Neo Banks or Digital-only Banks

Neo banks are 100% digital, and they do not have any physical offices. You can simply open a bank account in just a few minutes by using your fintech app development. These banks usually have low fees and instant services.

Some of the popular examples are Zand Bank in the UAE. Their main focus is on making banking simple and quick for users.

3] Standalone Financial Platforms

Standalone financial platforms are mobile applications or websites that provide financial services like a full bank. They do not take deposits like banks, but they assist people in handling money in different ways.

Standalone platforms can provide money transfers, budgeting tools, lending, and other services. In the Middle East, apps like Tabby or Sarwa are the best examples of standalone fintech platforms. People like them due to their fast and simple service on their phone.

Benefits of Digital Banking in Middle East

In the coming years, banking in Middle East has become more convenient. Thanks to growing internet usage, people can now do most of their baking through mobile apps.

It means they do not have to visit banks. Digital banking makes money transactions very easy. Let’s have a look at the benefits of using digital banking in UAE.

-

Easy Access to Banking Services

Digital banking in Middle East has made it very easy for people to manage money. You just do not have to go to the physical banks for easy tasks. This can be done with your mobile phone.

You can simply check your balance, transfer money with an app, pay bills, and also easily apply for loans. This saves a lot of time, and you do not have to stand in a long line at the bank. This is the most convenient method in cities like Dubai, Riyadh, etc.

-

24/7 Banking Availability

One of the best things about online banking is that it provides 24/7 services. Now no need to worry about bank opening hours. From Midnight to the Weekend, you can simply carry out banking work from anywhere.

This is very beneficial for working people or businesses who have to make urgent payments outside normal hours.

-

Promotes Cashless Lifestyle

Nowadays, you can purchase anything without needing physical cash. With digital wallets, contactless cards, and online transactions, people can pay for things easily and quickly without carrying physical money.

This is very beneficial in modern cities and shopping malls where card and app payments are very common. Also, it assists during emergencies where contactless payment reduces the risk of spreading illness.

-

Reduces Remote Areas

In many Middle Eastern countries, especially in small cities, bank branches are not always nearby. Digital banking bridges this gap. People can now open accounts, send or receive money, and handle their savings without traveling so far.

Middle East digital banking trends assist more people in getting easy access to formal banking services. Even if they reside very far from the cities.

-

Safe and Secure Technology

Banks in the Middle East use bespoke technology to protect users’ money and information. Some features like fingerprint login, face recognition, and one-time passwords assist in managing money online accounts safely.

People can utilize baking services hassle-free as long as they follow banking safety tips. Many banks also alert users to suspicious activity on their accounts, providing an extra layer of protection.

Launch Your Own Digital Banking App in Middle East with Nimble AppGenie.

Challenges of Digital Banking in Middle East

Now that you have come to know about the benefits of digital banking in Middle East, it is time to know about some challenges you might face. Here are a few challenges of digital banking in the MENA region.

► Not Everyone Can Use it Easily

One of the biggest challenges is that not everyone has access to digital banking. In some rural areas, many people are still not aware of mobile internet connections and mobile phones. Without these basic facilities, they can not use the online baking apps.

Besides, there are some elderly people who don’t know how to use banking applications. They can find it hard to handle money online. This creates a lot of problems where people in remote areas or with limited internet connections cannot use these digital banking services.

► Safety Issues Among People

Not everyone trusts online banking services. They hear stories about hacking, scams, or fraud. They think their personal details might get leaked. Although banks use high-tech security like OTPs and biometric authentication, people still do not trust these platforms.

If someone has even one bad experience, they might stop using digital banking apps. Trust is everything, and many people do not fully trust these platforms, which is challenging.

► Language Barrier and App Issues

You might be aware of some popular digital banking apps that are not easy to use. They may only be in English or may not have a good Arabic version. This makes it challenging for people who are more comfortable in their local language.

Also, the banking apps sometimes face lagging, errors, or do not work properly on every device. If users get stuck or the app crashes, they can not do their mobile banking. This creates a lot of frustration among users. A good mobile app should be simple and have language that people easily understand.

► Not All Services Are Fully Digital

There are many banking services that are not digitized. You have to visit a bank for those services. For example, opening a bank account, making a cash deposit, and getting big loans.

Also, you need to go to banks for identity verification, which requires physical documents and bank visits. This breaks the whole point of digital banking. People want everything online, but this is not always the case.

Future of Digital Banking in Middle East

The future of digital banking in the Middle East looks very promising and bright. There are now more than 465 fintech businesses. This huge growth is happening due to flexibility, and more money is invested in new mobile app ideas for the banking industry.

Around 70% of people use mobile internet service, and this helps them to access online banking in Middle East. Also, many people are now opening bank accounts and using mobile applications instead of going to banks.

Additionally, new mobile app trends, such as cryptocurrency and digital wallets, and AI integration, are growing. Gulf regions like UAE and Saudi Arabia want to stay strong in the global economy, so their main focus is on digital banking services. This will make digital banking modern and easy to use.

Conclusion

Banking in Middle East is quickly moving from conventional ways to modern digital methods. There are many people now using mobile phones and internet connections to manage their money and ditch physical bank visits.

MENA regions like UAE, Saudi Arabia, and Qatar are leading the digital banking with apps and new banking app ideas. While there are still some issues like lack of access, trust issues, or language barriers, all these are improving every year.

As more people accept online banking, it will become very simple for everyone. With better assistance and new tools, digital banking will become a normal and trusted way to manage money in the Middle East.

Frequently Asked Questions

Is digital banking safe in the Middle East?

Yes. Banks use strong security systems like Face ID, OTPs, and encryption. However, you should still be careful and avoid sharing your details.

Can expats use digital banking in the Middle East?

Absolutely! Multiple online banks in the Middle East enable expats to open and use accounts. There is no restriction unless they provide a valid ID, like an Emirates ID, and documents.

What digital wallets are popular in the Middle East?

There are many popular digital wallets in the Middle East. Some of them are STC Pay, Payit and Apple Pay, and BWallet.

Do all banks in the Middle East offer digital services?

Not all banks provide digital services. There are some banks that provide online or mobile banking. They are fully digital or online, while others provide both online and branch services.