The population of the UAE is increasing, and migrants are playing a huge part in this, who are shifting with a dream of building a thriving career.

These people heavily rely on remittance apps to send a part of their success in the form of money back home to their loved ones. Thus, it seems in the UAE, remittance apps have huge demand, and one of the top choices is the Taptap Send app, as it offers fast, affordable, and secure solutions.

As the demand for remittance apps increases in the UAE, entrepreneurs have a great opportunity to develop an app like the Taptap Send and secure a place in this thriving market.

But creating a successful remittance app like Taptap Send requires more than just coding. This may confuse you, but exploring this blog will help you get away with that

In this blog, we have explained everything you need to know about the remittance app development process.

Let’s get to this blog.

A Know-How of the Taptap Send App

Taptap Send is a popular choice of international remittance app that makes money transfer abroad affordable and a quick solution. The aim of creating this app is to make it easy for the migrants of the UAE to support their loved ones financially back at home.

Users of this app can select from many countries when transferring money. The app can seamlessly link with debit or credit cards and a bank account to send any amount of money quickly.

It also gives the receiver the option to accept funds almost instantly to their mobile wallets, directly to their bank account, or choose cash pickup, as per the country. The best thing about this remittance platform is that it offers competitive exchange rates and low fees.

This makes Taptap Send a cheaper alternative compared to traditional money transfer services. The Taptap Send app is a quicker, simpler, reliable, and affordable international money transfer solution.

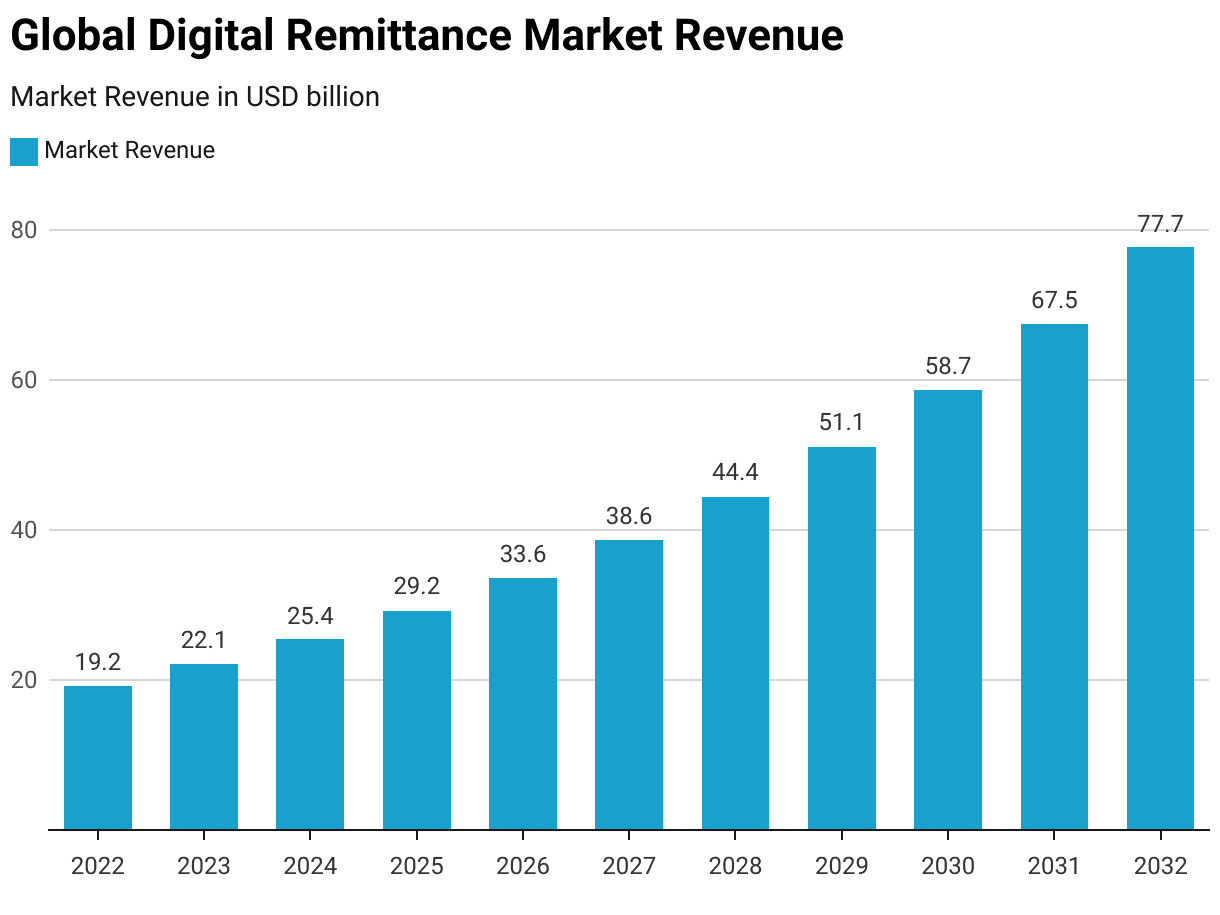

Global Money Transfer Market Insights

Digital banking in the Middle East has transformed the way international money transfers are done. It offers individuals a fast, affordable, and convenient way to manage finances around the world.

Even in the UAE, where people from all around the world are building their successful careers, it makes it seamless to send money to their family, friends, and businesses to any country. We are not only saying this, but the global report of the money transfer app is making our claim more evident.

Here are some interesting numbers for the global digital remittance market below that need your attention.

- Back in 2022, the market revenue of the global digital remittance market was valued at $19.22 billion. In the year 2023, the same market has witnessed visible growth, and the value rose to 22.1 billion, and it just keeps growing without any sign of slowing down.

- Moving forward to the year 2024, it was expected by experts that the global digital remittance market would be valued $25.4 billion.

- Later, it is expected that the market value of the global digital remittance would grow and reach the value of $29.2 billion. And in the year 2026, it is expected that the value will reach $33.6 billion.

- If the global digital remittance market keeps growing, then in the year it is expected to earn revenue of $67.5 billion in the year 2031 and in the year 2032, the revenue value will be $77.7 billion.

- Thus, over the decades, the global remittance market will grow at a CAGR of 15.0%.

The above statistics clearly indicate that if you have money transfer mobile app ideas like Taptap Send, then you should invest in app development. It will be the most important investment for the businesses of the UAE.

Steps to Develop an App Like Taptap Send

You are in this blog mainly because you want to know the process that the mobile app development company in Dubai follows to build the app Taptap Send. So, we will get straight to that now since you already know about the app and its features.

We have discussed the key development steps that help you build a mobile app like Taptap Send to compete in the money transfer app market of the UAE. Let’s get to them one by one.

Step 1: Research and Planning

The first step to developing a money transfer app like Taptap Send starts with planning app requirements and researching competitors, as well as the target audience. Do thorough research on the competitor apps, which include Taptap Send.

This will help you to know about their features and the gap they left. Then, understand the demand of the target audience, which the competitors have not covered. Plan your app accordingly so that it can fulfill audience demands and fill the gaps.

Step 2: Decide Features

Now, get to the next step, in which you have to define the features of the app, like Taptap Send. This is a crucial step because it is the features that will make your app stand out from the competitive crowd.

First, know about the features of the Taptap Send app, find the gap, and choose the features for your app to fulfill the gap. In the above section, we have already told you about the must-have features of the Taptap Send app.

For your knowledge and to make the right choice, we have listed the key features of the Taptap Send app.

-

User-Friendly Interface

The UAE money transfer app Taptap Send has the smoothest to navigate interface and is also intuitive. This allows the users, both the sender and the receiver, to have an excellent experience with sending and receiving money.

Even the new app user doesn’t feel many challenges in navigating through the app.

-

Low Fees and Exchange Rates

Using Taptap Send, an international money transfer online platform, is a cost-effective option for the people of the UAE for sending money globally.

This is because the app charges very low fees for the transactions made by the app. Not only does the Taptap app give the best exchange rates to its users through daily negotiations.

-

Multiple Payout Options

The users of the Taptap send app got multiple payment options within the app. Users can send money to various options provided to them, which include cash pickups, mobile wallets, or bank accounts, depending on the country locations.

Also, users can send money from their accounts, cards, mobile wallets, and others.

-

Security

The security offered by this money transfer app is one of the best things that makes it the first choice for the majority of people.

Taptap Send app offers state-of-the-art encryption and multifactor authentication services that help to protect the sensitive data of users. With the growing cyberattacks, the security features have improved.

-

Fast Transfer

The features that make Taptap Send a preferred choice of money transfer are its instant money transfer feature. Most of the money transfers can be done within minutes, which allows recipients to access funds quickly.

This app makes sure the monetary assistance can reach receivers whenever they want.

Step 3: Choose Tech Stack

Now, take your time to choose the right tech stack for your online money transfer app. Choosing the right tech stack is very important since the app’s performance and quality depend on it.

Each section of the app development process requires different types of technologies, without which a scalable app cannot be created that can beat the competition in the UAE market.

You must know the required tech stack so that you don’t face any problems during development. Check the table below.

| Categories | Required Tech Stack |

| Programming Languages | Swift (iOS), Kotlin (Android), Node.js (Backend) |

| Frameworks | React Native, Express.js |

| Databases | MongoDB, PostgreSQL |

| Integrating Payment Gateways | Stripe, PayPal, and others |

| Security | SSL/TLS encryption, two-factor authentication, compliance with policies like GDPR & PSD2 |

Step 4: UI/UX Design of the App

Now comes the design part of the app, which helps in the app development further. To create the UI/UX design of the app, first, you have to use the wireframe to create the prototypes of the app.

In this, you have to design different features of the app, the icon, the app’s format, and decide on the color. The interface of the app must be intuitive and user-friendly so that it can be navigated smoothly.

By creating an excellent user interface (UI) of the app, you can ensure a positive user experience (UX).

Step 5: App Development

Now comes the step where you can finally start development of a money transfer app like Taptap Send. In this part, you have to complete the development process to present your audience with a robust money transfer app with the best performance. It consists of frontend and backend development.

- In frontend development, you have to ensure the features that were designed formerly are giving optimal functioning, and the app interface can be smoothly navigated by users.

- Then, the backend development, in which you have to make sure to integrate stable APIs, payment gateways, and other elements that can handle the backend tasks of the app.

Step 6: QA and Testing

Now that you are done with the development process, you have to do the QA and testing of the app before launching it. This is also an important step in the development process because it will help you to maintain the quality of the app.

To present the best money transfer app, it must be free of bugs and other issues. So, you have to carry out various types of testing, which include performance testing, user testing, security testing, compatibility testing, usability testing, and regression testing.

Step 7: Launch & Marketing

Now that you have successfully tested the app and are sure about the quality of the app, it’s time to launch the app on different app download platforms.

You can launch the app on download platforms like Google Play, Apple Store, and others, from where users can install the app. Before launching the app, make sure to market the app via various platforms like social media, email, and others.

Promoting the app helps you to create a buzz in the market, which draws the attention of your targeted audience.

Step 8: Post Maintenance

No, after the launch, your app development process doesn’t end; post-maintenance also comes within the development sphere.

Keeping the app stable so that it can perform well even after the launch is crucial. So, keep your eye on the app’s performance, make sure your users don’t face any issues while using the app.

If you find any issues or bugs in the app, fix them as soon as possible. Also, keep the app updated from time to time with new features to keep users engaged and security patches to avoid potential cyberattacks.

Develop a Smart Remittance App Like Taptap Send with the Help of Nimble AppGenie!

Get Your Quote Now!

Cost to Develop an App Like Taptap Send

You have learned how to build a money transfer app that can thrive in the UAE market. But, before you start building, you need to plan the budget for the app, for which you must have an idea of the cost of app development in Dubai. That is why we have shared the cost breakdown of the money transfer app development.

The estimated costs to develop an app like Taptap Send typically fall between $30,000 and $250,000 or more. This cost will be finally decided by the various factors of development, like complexity, tech stack choice, platform choice, developers’ location, and much more.

Thus, if you have to develop an app like Taptap Send, integrating basic features and less complex technologies, then it will cost you less, within $30,000 to $40,000.

On the other hand, to create a full-stack app integrating the latest and unique features with the best technologies, it can cost you more than $250,000.

Here are a few key factors that affect the development cost of an app. Take a look.

➢ The Features Complexity

The features of the app that determine its success are the prime factor that decides the cost of its development. The features can be complex or basic.

If you have chosen complex features like AI in your mobile app, then it will increase the development cost since it will take more time to build them as compared to basic ones.

➢ Choice of Platforms

The next factor is your choice of platform where you want to launch the app. There are two platforms: native platforms and cross-platforms. The latter is for both iOS and Android; the former is for either iOS or Android.

If you are planning to create the app for native platforms, it will be a cheaper option for you than a cross-platform one. But if we compare native platforms, then the iOS app development cost will be higher than the Android app development cost.

➢ Choice of Tech Stacks

Then comes the choice of tech stack, yes, this is also one of the factors that drives the development cost of the international money transfer app.

The choice of technology for programming languages, frameworks, and cloud services decides the development time. When it takes more time to develop, it will automatically affect the cost.

➢ Security and Compliance

Since you are creating a money transfer app, you must be very careful about its security and compliance system.

You must meet strong financial regulations like PCI DSS, KYC, AML, and implement robust security measures, which means you must be ready to make significant investments. So, this is an important cost-driving factor.

➢ Location of the Development Team

The location of the development company or development team is another significant factor that decides the cost of app development.

There are onshore and offshore app developers you can hire; the latter belong to another country, and the former are situated in the same country. Hiring an offshore development team is a more budget-friendly option than a shore one.

How to Monetize a Money Transfer App Like Taptap Send?

Your money transfer app can make money that helps your business secure excellent revenue growth. So, don’t just create your app; make it capable of creating a long-term stream of revenue for your business, incorporating the right strategies. If you don’t know how it can be done, this section of the blog has brought the answer for you.

We have listed a few of the key money transfer mobile app monetization strategies for you to learn. Take a look at them.

● Transfer Rate Margin

The app will offer its users a competitive exchange for each transfer they make. The slightest margin between the rates will give you the chance to make money on a high volume of transfers made through the app.

● Transaction Fees

Transaction fees are also a good strategy to make money for the money transfer app. For every transaction or money transfer made through the app, the users will be charged nominal transaction fees.

● Value-Added Services

Offer additional premium features to your users for a fixed payment value. Offer a premium subscription through which users will buy premium features, and you will earn money. This also helps to retain different groups of customers.

● Data Monetization

Many finance companies are willing to get insights into market trends and customer behavior; they are even ready to pay for it. So, you can charge them well for providing such data through your app.

Develop Your Own Money Transfer App with the Expert Help of Nimble AppGenie

Planning to create a custom money transfer app similar to Taptap send and don’t know where to start? You can partner with the leading fintech app development company in Dubai, Nimble AppGenie, which offers an end-to-end app development solution.

We have a team of professional and skilled developers who take care of every step of the app development process from design to deployment. To make an app like Taptap Send, our team emphasized modern technologies and agile development practices.

Our main focus is to present you with an innovative, scalable, and user-friendly fintech product that thrives. So, seal the deal with us, as we can turn your dream app into a successful reality that offers the best remittance solution to customers.

Conclusion

Creating one of the best fintech apps like Taptap Send requires more than just solid coding. You need to take care of regulatory compliance, airtight security, seamless user experience, and a strong partnership with payment providers.

You already know all that you need to create a money transfer app that unlocks success by bridging distance and empowering communities worldwide. With that, you must invest in an excellent app development company to develop an app like Taptap Send that serves value.

Now, get to work and create an international remittance solution that serves real human needs.

FAQs

Why do I need to build an app like the Taptap Send app?

To build an app like Taptap Send your main aim should be to offer your customers a fast, affordable, and secure solution to send money to any country.

This app will help to fill the gap for those people who think traditional remittance services are too expensive, slow, or difficult to use. It offers a convenient and user-friendly experience.

How much does it cost to build an app like Taptap Send?

To build an app like Taptap Send that securely sends money globally, you need to invest approximately between $30,000 and $250,000 or more. However, the final price of the app development is based on different factors, which include feature complexity, tech stack, platform choice, developers' location, and more.

How long does it take to complete money transfer app development?

To complete the whole development process of the money transfer app takes anywhere between 6 to 12 months or more. The time is totally dependent upon the types of apps you are building.

If you are creating a basic app, there is a chance it will be completed in 3 to 6 months. On the other hand, for a full-stack app, it will take more than 12 months due to complexity.

Can my money transfer app earn revenue?

Yes, your money transfer app can earn a stream of revenue for the financial growth of your app. There are many monetisation strategies applying which your app can apply to make money for you seamlessly.

The strategies include in-app advertisements, charging transaction fees, commission fees, offering subscription plans, and others.