In the innovative and mobile-first landscape of the UAE, traditional banking is quickly getting replaced by digital solutions.

The majority of the population in the UAE depends upon various digital banking solutions. One of the leading names among them is Mashreq, which has set a benchmark with its feature-rich and innovative solutions.

The visible success of Mashreq UAE has encouraged many businesses in the finance sector to invest in similar apps. Thus, if you also want to build a money transfer app like Mashreq UAE to lead the banking landscape, then you are on the right track.

To make this journey easier, this blog has covered everything that you need to know about developing an app like Mashreq UAE.

Let’s uncover the information.

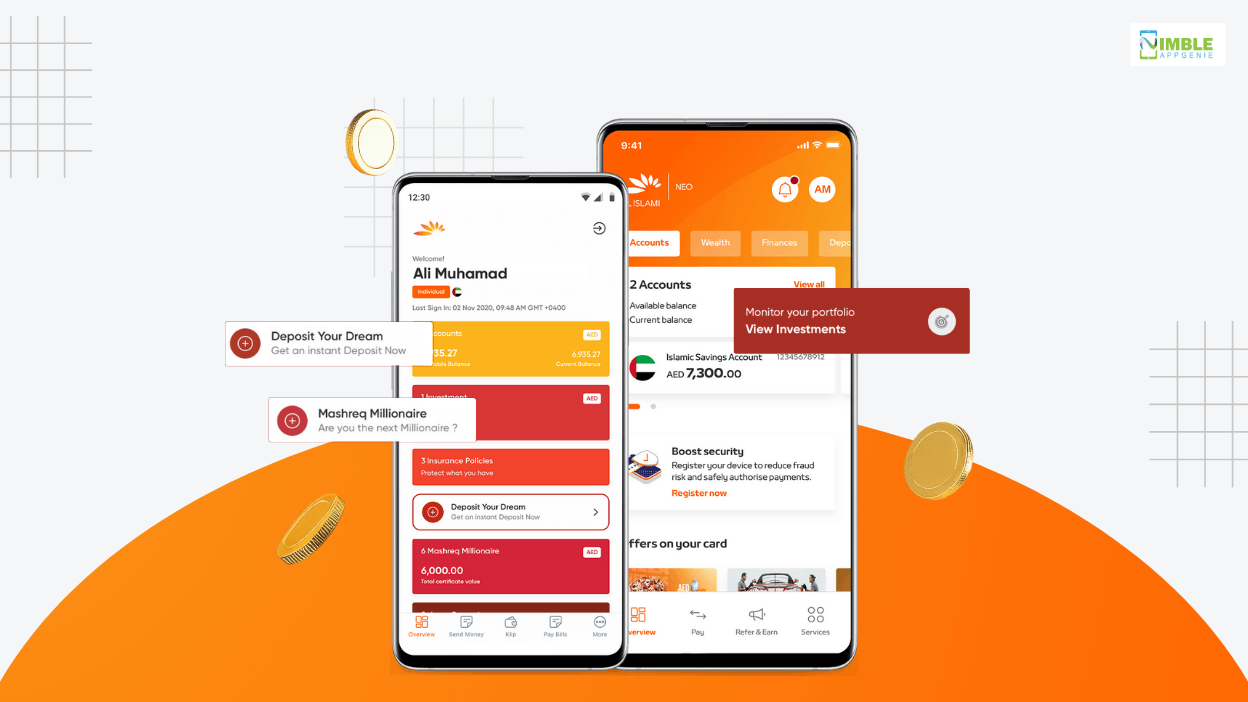

About the Mashreq UAE App

The Mashreq UAE app is the digital application launched by Mashreq Bank Dubai, which is one of the leading banks of the UAE. This digital banking app aims to make banking seamless and secure for the people of the UAE.

It reduces the hassle of visiting traditional banks and offers several attractive features to its customers. The feature of the Mashreq UAE app makes it the best fintech app in the UAE.

The users of this app can seamlessly open their new account in an instant, transfer money locally & internationally, pay all kinds of bills, apply for loans, track their spending history, and access other banking services right from their smartphones.

The Mashreq UAE app has secured the best place in the online banking industry because it focuses on convenience, innovation, and security. With the rising security concerns for online banking apps, integrating security features like biometric authentication has set them apart.

Other features like AI-powered insights and 24/7 accessibility to banking services represent their modern approach and their mindset for growth in the digital financial sector.

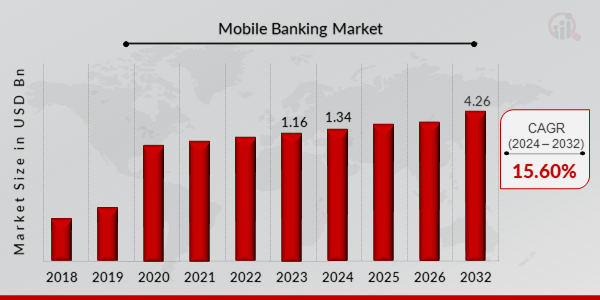

Evaluating the Numbers of the Global Mobile Banking Market

We have gathered the numbers of the mobile banking market, which clearly says that investing in the mobile app development of a mobile banking app is a profitable bet. Below are the numbers of the global mobile banking market and the UAE mobile banking market. Let’s take a look at them.

Global Reports:

- As per the reports in the year 2023, the global mobile banking market reached the value of $1.16 billion.

- It is now estimated that by the year 2032, the global banking market will reach the value of $4.26 billion.

- During the forecast period, i.e., between the years 2024 to 2032, the global banking market will grow at a CAGR of 15.6%.

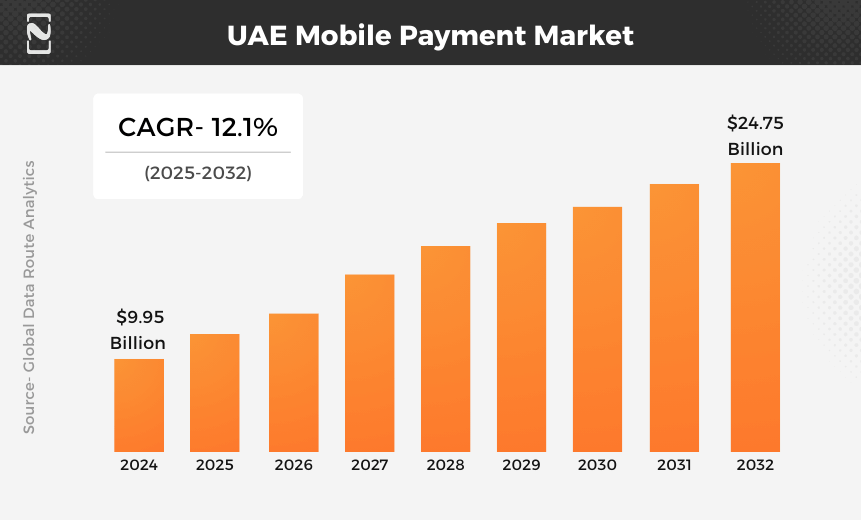

UAE Reports:

- The UAE mobile payment market in the year 2024 was valued at $9.95 billion.

- By the year 2032, it is expected that the UAE mobile payment market will reach the value of $24.75 billion.

- Thus, between the years 2025 to 2032, which is the forecast period, the UAE mobile payment market will grow at a CAGR of 12.1%.

If you have robust mobile app ideas for digital banking, you should turn them into reality. The above statistics make it clear that the banking apps have a thriving future ahead.

The Core Features to Integrate Into an App Like Mashreq UAE

As you want to develop an app like Mashreq UAE, you need to focus on the features that make the app a popular name in the UAE. So, before you learn the development process, you must be aware of the features so that you can choose the best option for your app.

We have created a list of core features of the app, Mashreq UAE, below for your knowledge. Let’s look at them one by one.

► Features for Users

1] Easy Onboarding

Make sure your app has a feature that allows users to register themselves in the app seamlessly. The users must be able to sign in to the app in various ways. like via contact number, social media, email address, and others. This will offer a convenient onboarding facility.

2] Account Management

There must be a feature in your app that allows users to manage their accounts. In this feature, users are able to check the details of their accounts, cards, and other personal details.

Moreover, this feature must allow users to check their transaction history and also their account balance.

3] Transfer Money

Since you will be developing an online banking app, you have to be sure that it can allow users to transfer money securely. For the Mashreq NEOBiz app, this is one of the core features without which it’s incomplete.

This feature allows users to transfer money from their bank to anyone instantly and can even make international transactions.

4] Bill Payments

Bill payment has never been easy, but the Mashreq UAE app has made it possible and has made it easy. The users of the app must be able to pay any type of bill in just a few taps directly from the app.

To pay bills, the app allows users to connect their cards to the app. Moreover, the users can even set a reminder for the recurring bill payments.

► Features for Admins

5] Manage Users

Admins must be able to manage the users of their app. So, your online banking app must have this feature for the advantage of the admins.

The admins must be able to approve and reject the users by verifying their documents, lock or suspend the accounts of suspicious users, and freeze/unfreeze the accounts when needed.

6] Monitor Transaction

Your app must allow the admins to track the transactions of their users. The main motive behind this is to keep the whole system safe.

The admin must be able to view the transactions happening in real time, flag suspicious transactions, and approve or decline the large transactions to be made by the users to prevent fraud.

7] Manage Money Transfers

The admins must also be able to track the bill transfers happening through the app. Admins are able to check whether the utility bills are paid by the users successfully or not.

They are even able to manage the recurring payments; if needed, they can change the automatic setting or set it for the users. Admin can help users fix the problem with bill payments.

8] Manage Push Notifications

The notifications of the online banking app can easily be handled by the app admins. It’s in the hands of the app admins to send notifications about important transactions to the users.

If admins notice any suspicious activity in the app, then they will send a notification about it to the users. Also, admins must be able to send notifications about any feature updates.

Steps to Develop an App Like Mashreq UAE

After knowing the core features, it will be much easier for you to decide on the features to be integrated into your digital banking app like Mashreq UAE. Just knowing the features will not be enough for you to build the mobile app; it requires strategic planning and following the vital development steps.

For the best results, you can partner with a mobile app development company in Dubai. We have mentioned the steps that a development company will follow to build your online banking app. Let’s have a look at them.

Step 1: Research and Planning

The first step of the development process is to do the research and the planning. As part of the research, you need to make a competitor analysis. Study the features of the competitor apps and include Mashre to know why they are thriving and if there is any loophole.

You should also learn about the target audience to know their demand. This analysis helps you to plan the app development, which will fulfill the audience demand and loopholes.

Step 2: Choose the Right Features

After you are done with the research and planning, move to choosing the right features of your app that make all the difference in the competitive market. Features of the app are the core element that makes the app different from others.

Ensure the features of your app are unique and define the app’s USP to earn a competitive edge. The must-have features of an online banking app have already been discussed with you in the above section.

Step 3: Choose the Right Tech Stack

In this step, you have to make sure you have chosen the right tech stack to develop an app like Mashreq UAE that leads the UAE market. It is crucial to choose the right tech stack because it will determine the quality and performance of your app.

To build a scalable and secure online banking app, you need to consider various technologies as per different development categories. Below is the table of the technological stack for your mobile banking app.

| Categories | Required Tech Stack |

| Frontend development | React Native or Flutter |

| Backend development | Node.js, Ruby on Rails, etc |

| Databases | MySQL, or MongoDB |

| App security | AES encryption and OAuth 2.0 |

Step 4: UI/UX Design

In this step, you have to design an interactive interface for the mobile banking app. You have to follow the best practices of the UI/UX design of the app. With the use of a wireframe, create a prototype of the app design, which has layouts and detailed models of the app.

Create an interactive user interface (UI) of the app with clear buttons, icons, and colors that match your brand. Create an intuitive interface to offer the best user experience (UX).

Step 5: App Development

Now that you have successfully created the UI/UX design of the app, let’s jump into the development work of your digital banking app. To develop an app like Mashreq UAE, it consists of frontend and backend development.

Start with the frontend development of the app, in which you have to convert the UI/UX design of the app into an interactive app interface, which consists of the app features and others.

Next, the backend development that manages behind the scenes of the app, i.e., the smooth functioning of the app, integration with payment gateways, data storage, and others.

Step 6: QA & Testing

After developing the app, here comes one of the crucial steps of the app development: QA and testing. Before launching the app, you have to make sure the app is working in its optimal situation without any issues, and it must be bug-free as well.

As part of QA and testing, you have to carry out the functional testing, usability testing, performance testing, and security testing. After all this, your app will be ready to take a step in the market.

Step 7: Launch & Marketing

Now, you can launch an online banking app in the market for the use of people. You have to launch the app on various app download platforms like Google Play, Apple Store, and others. After the launch, the app will be ready for download or installation.

Before the launch, make sure you promote the app through various channels like social media, email marketing, and others. This will create a buzz about your app and will encourage more people to install it.

Step 8: Post-Launch Maintenance

Wait, the development process doesn’t end after launching the app; it is crucial to make sure that the app is working properly after the launch. Thus, you have to carry out the post-launch criteria to maintain the stability of the app.

You must analyze the app performance, check for emerging bugs, and solve issues on time to offer the best user experience. Additionally, when looking into the factors of app security, keep the security patch of the app updated.

Build your Secure and Scalable Banking App Like Mashreq today!!

Talk to Our Expert Now!

The Development Cost of a Digital Banking App Like Mashreq UAE

You have mastered the steps to create an app like Mashreq UAE. Now, as part of planning, you must create a budget for your app development. In this process, you must have an idea of how much you have to invest in it, i.e., you must know the development cost.

Thus, the cost to develop a mobile banking app like Mashreq UAE typically ranges from $30,000 to $200,000 or even more. The cost is decided by the different factors of app development, which include features, tech stack, complexity, the developer’s location, and much more.

If you are planning to develop a basic version of the Mashreq UAE app, then it will cost you up to $50,000. However, if you are creating a full-stack app with trending features and advanced technologies like AI, ML, etc, then it will cross the budget of $200,000.

Factors Affecting the Cost to Develop an App Like Mashreq UAE

We have said above that the cost of developing an online banking app like Mashreq UAE depends on multiple factors. You must have the knowledge about those factors, so we will explain a few of them to you.

We have listed the real factors that decide the cost of app development below for your understanding.

-

Features Complexity

The complex features you have decided to integrate into the app play an important role in deciding the cost of app development.

If you have integrated the most advanced features like AI integration for your app to offer uniqueness, then the cost of app development will automatically increase, since it will take extra time to develop.

-

Choice of Platform

The choice of platform is another essential factor that decides the development cost of the banking app. There are two types of platforms: Native and Cross-platform.

The former consists of iOS and Android, and the latter consists of both. If you choose to create an app for cross-platform app, then it will be more expensive than a native app.

But in native apps, the cost to develop an iOS app will be more than Android app development cost.

-

Development Team’s Location

The location of the development team also affects the development cost of the app. There are two types of developers you can hire for your app development project: one is onshore and the other is offshore.

Onshore developers are those located within the country, and offshore developers are those outside the country. The former is costlier than the latter, and offshore developers are more talented.

-

Choice of Tech Stack

Your choice of tech stack to make an app like Mashreq UAE also affects the development cost. If you’re creating a basic app, then the tech stacks will be simple as well, which means lower development cost.

On the other hand, if you are building an advanced app, then you have to choose the latest technologies, and that will increase the development cost of your app.

Revenue Models of Mobile Banking App Like Mashreq UAE

As a business, you must be very mindful that your app, like the Mashreq UAE banking app, is helping you earn good revenue. This is because the motive to build the app is not only to offer convenience to customers but also to gain financial growth.

To help you out, we have come up with a list of a few mobile app monetization strategies below that help your app make money.

➢ Premium Subscription

A premium subscription is a good strategy to allow the fintech app to make money for the business. In this, premium features will be available to the users only when they buy the subscription plan on the basis of an annual or monthly payment.

➢ Transaction Fees

Since you have created an online banking app where people will make transactions, it’s a good idea for you to earn revenue from each transaction. The users of the app have to pay a nominal transaction fee annually or monthly, a good way to make money.

➢ Integrated Services

Offering integrated services to the app users is a good opportunity to earn revenue from the app. Offer services like stock trading or applying for loans via third-party companies. When users use these services for every order, your app will help you earn commission.

➢ In-App Advertisements

In-app advertisements also present a good opportunity for the app to generate revenue. As per this strategy, the app owner will offer their app as a banner for other brands to run advertisements. To run the advertisements, the brand has to pay a certain amount.

Nimble AppGenie is the Trusted App Development Expert to Build Your App Like Mashreq UAE

Want a trusted app development partner that helps you build a robust app for digital banking in the Middle East, just like Mashreq UAE? Nimble AppGenie will be your perfect app development partner in this journey.

We are the leading fintech app development company in Dubai, with a team of experienced and skilled app developers. The team supports our clients from the planning stage of the app development to the post-launch maintenance.

We have experience of more than 7 years in the app development landscape and have worked for different industries. The trust of our clients makes us the best.

Conclusion

If you aim to develop an app like Mashreq UAE, you must focus on the fact that it must offer a secure, seamless, and customer-first digital banking experience. Following the right strategy, you can easily achieve it.

You know about the Mashreq UAE app, what makes it the leading choice in the UAE, the development process, and much more. With the right development partner, you can make your digital banking app the best choice for your audience.

The future of banking is digital solutions; ensure your app leads the competition.

FAQs

What are the key features of the Mashreq UAE?

If you aim to create a mobile banking app similar to Mashreq UAE, then you should know its features. The element that makes the Mashreq UAE app unique is its features, so we have talked about the major ones below.

- User authentications

- Manage account

- Money transfer

- Strong security

- Pay bills

- Push notifications

- Monitor transactions.

What will be the average cost to develop an app like Mashreq UAE?

If you are planning to create a mobile banking app like Mashreq UAE, then you should also plan a budget for it. To plan the budget, knowing its development cost is crucial.

Thus, the average development cost to build an app like Mashreq UAE typically ranges from $30,000 to $200,000 or more. The development cost depends upon various factors, which include complexity, features, the developer's location, and more.

How much time will it take to develop a mobile banking app like Mashreq UAE?

To build a mobile banking app like Mashreq UAE, it takes you approximately 6 to 12 months, or in some cases, even more. The development time is based on the type of app.

If you are creating a basic mobile banking app, then it will take almost 4 to 5 months. Whereas if you are creating an advanced mobile banking app with unique features and advanced technologies, then it will take more than 12 months.

How can I ensure the security of my banking app?

If you are developing a mobile banking app, then you should prioritize its security aspects. Cyberattacks are at their peak, and you must take the required security measures that help you to keep the sensitive user data safe.

The best way to ensure the security of the banking app is by implementing strong encryption, two-factor authentication, biometric login, regular security audits, and compliance with standards like PCI DSS and GDPR.