Have you ever found yourself in a pinch, requiring instant cash but no easy way to get it? You are not alone. More than 75% of adults use some form of online payment, and apps like CashNow have stepped up to fill this growing need.

With just a few taps, users can borrow money, pay bills, or manage their finances, all from their mobile phones. No long bank lines, just fast access to money when it is needed the most.

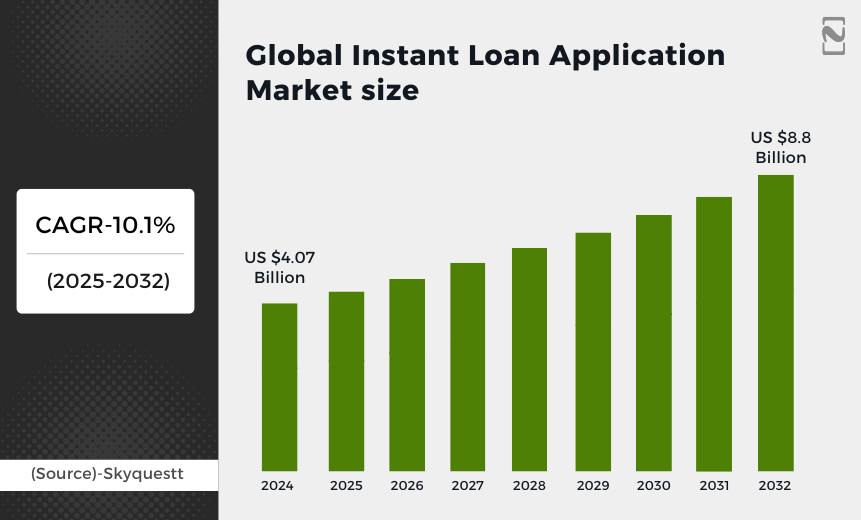

In fact, the worldwide market size of instant loan apps is projected to hit $8.8 billion by 2032. That’s a huge deal. And it explains why more and more businesses are planning to build their versions of these instant loan apps. If you want to be the next industry leader, then you should develop an app like CashNow.

In this blog, we will discuss the process of developing an instant loan app like CashNow, along with its key features, costs, and other aspects.

So, let’s begin!

What is the CashNow App?

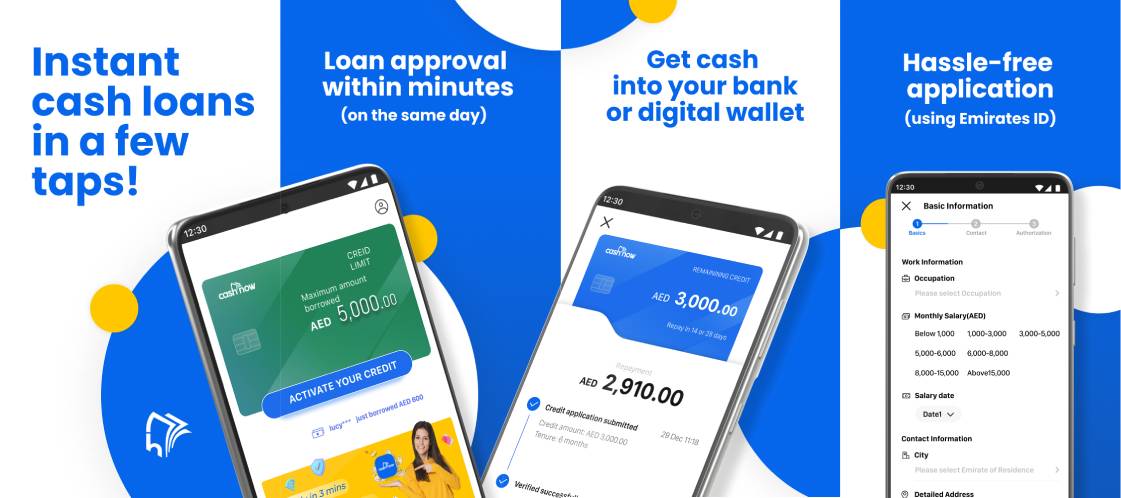

CashNow is an instant loan application that helps UAE residents with financial assistance. Users can get up to 5000 AED instant loan. Very little paperwork is required for an instant loan application. Users can receive loans directly into their bank accounts.

One of the best things about CashNow is that it uses AI for credit scoring and risk management. Individuals who do not have a credit card or a bank account can also apply for loans. But the interest rates are higher than traditional banks.

Additionally, any individual, regardless of their nationality, can use the CashNow app, but the drawback is that only those who have an Emirates ID can use it.

However, this cash advance app is available only in the UAE. Thus, this can be a golden opportunity for a mobile app startup in Dubai to develop a similar app for a global audience.

Market Overview of Instant Loan Apps in UAE

Before you create an app like CashNow, it is important first to understand the instant loan app market statistics. So, let’s have a look at them.

- As per Skyquestt, the worldwide market size of instant loan apps is projected to hit $8.8 billion by 2032.

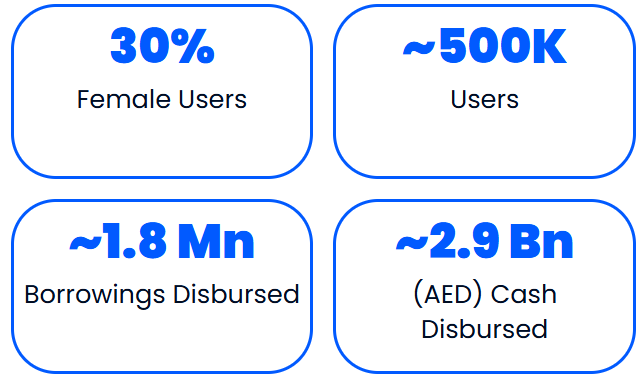

- The CashNow app has more than 500K+ users, according to CashNow. And the app has distributed more than AED 2.9 billion in loan amounts.

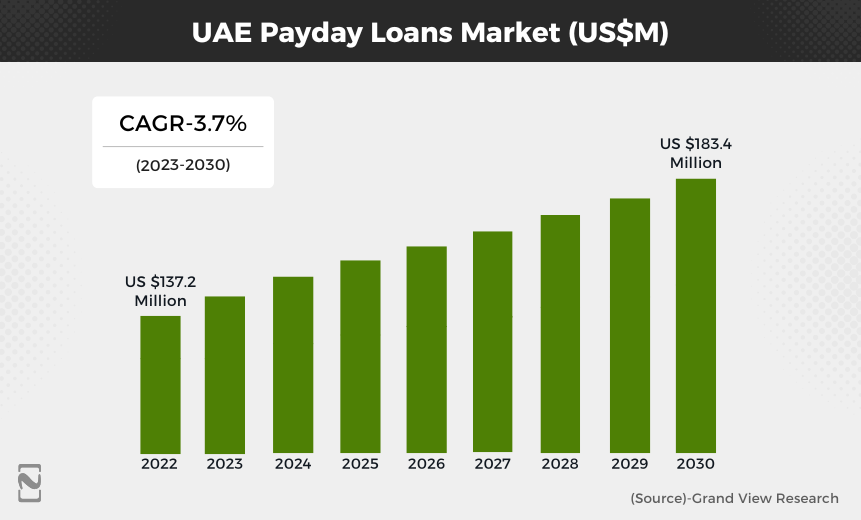

- The UAE payday loans revenue market is forecasted to increase to $183.4 million by 2030, as per Grand View Research.

- The number of instant loan app users in the UAE increased by 20%.

Why Develop an App Like CashNow?

If you are planning to make an app like CashNow, it can be a highly strategic move for quick financial solutions. Here are the major reasons for investing in mobile app development for instant loans in the UAE.

♦ High Demand for Quick Loans

The UAE market for instant loans is rising. If we look at the statistics, the market size of instant loan apps is expected to reach $8.8 billion by 2032. This shows that the demand for quick loans is going to increase.

Besides, many individuals require a small amount of money instantly for emergencies, bills, or unexpected expenses. Since digital baking in the Middle East is rising, Instant loan apps like CashNow provide quick loans within a minute. This type of service is highly in demand, especially for those who can’t apply for regular bank loans.

♦ Smartphone Usage is Very High

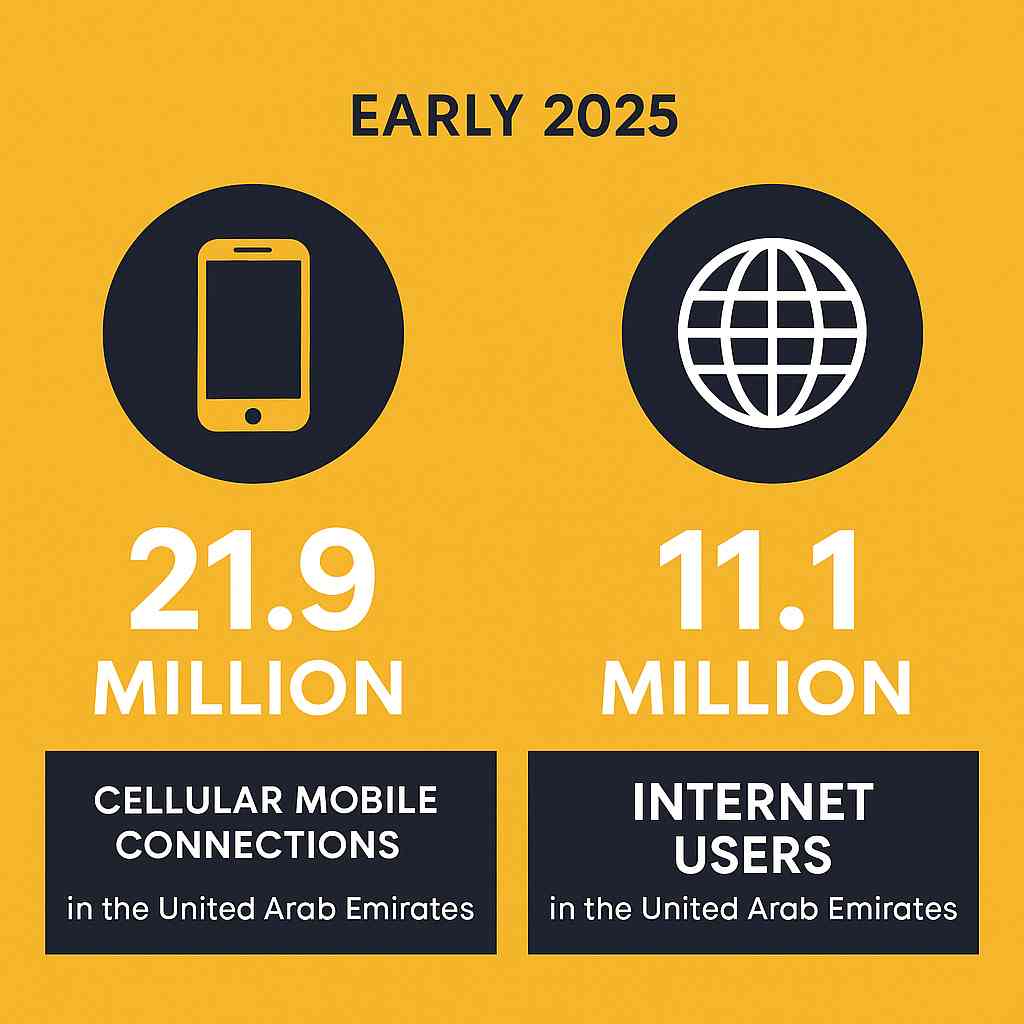

A report by Data Reportal says that the mobile phone users in the UAE account for 21.9 million in early 2025. This shows that the loan app fits perfectly into this mobile-first lifestyle.

With just a mobile phone, users can easily apply for an instant loan irrespective of their location. This is the biggest reason why instant loan apps are becoming popular, and you can grab this opportunity to develop an app like CashNow.

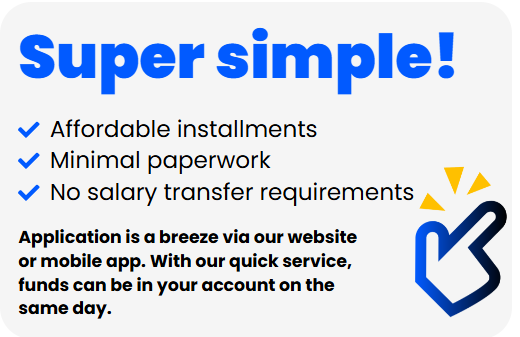

♦ Less Paperwork and Faster Approvals

Instant loan apps make the loan process a lot easier due to less paperwork and faster approvals. Users can simply apply directly through the app and get money within hours.

It means that users do not have to wait for days. This speed and ease make instant loan apps like CashNow very attractive to users. So, there is a great chance of success for new apps.

♦ Revenue from Interests & Fees

Instant loan applications can make huge money through higher interest rates and late fees. Unlike CashNow, interest rates should be fair and within legal limits.

This business model can be very profitable if you manage it carefully. As you know, there are many people who take small loans regularly. This can be your best bet to earn a huge income over time when you make an app like CashNow with unique features.

How Does the CashNow App Work?

Now that you know the benefits of creating an app like CashNow, it is time to know the workflow. So, here is the step-by-step working mechanism of CashNow that you must consider.

Step 1: Download and Sign Up

Firstly, users install the CashNow app and create an account with their phone number and email ID. Also, they can access credit bureau data for creditworthiness.

Step 2: Apply for a Loan

Now, users can fill out the application form and apply for a loan. It often includes answering a few questions and offering some documents.

Step 3: Loan Approval or Disbursement

Once users apply for the loan, the app uses its algorithm to check the loan application. It decides whether to approve the loan or disburse it. If the loan is approved, the loan amount is directly deposited into the user’s bank account.

Step 4: Repayment

Finally, users received the amount, and now they can track the loan details like repayment interest, loan balance, and so on. Users can also repay the amount early.

Key Features of a Loan App Like CashNow

Features make your instant loan app more attractive and successful. So, when you develop an app like CashNow, it is vital to choose the right core features that you can integrate into your app. Below are some of the key features that the CashNow app already has.

1] Instant Personal Loans

Users can apply for small personal loans quickly and without any hassle. They can get instant loans for emergencies, shopping, or bill payment up to AED 5000 directly into their bank account.

2] Use a Simple 5-Step Process

The instant loan application is short and easy. It only takes a few 5 steps to complete, so users can apply in just a few minutes.

3] Emirates ID Verification

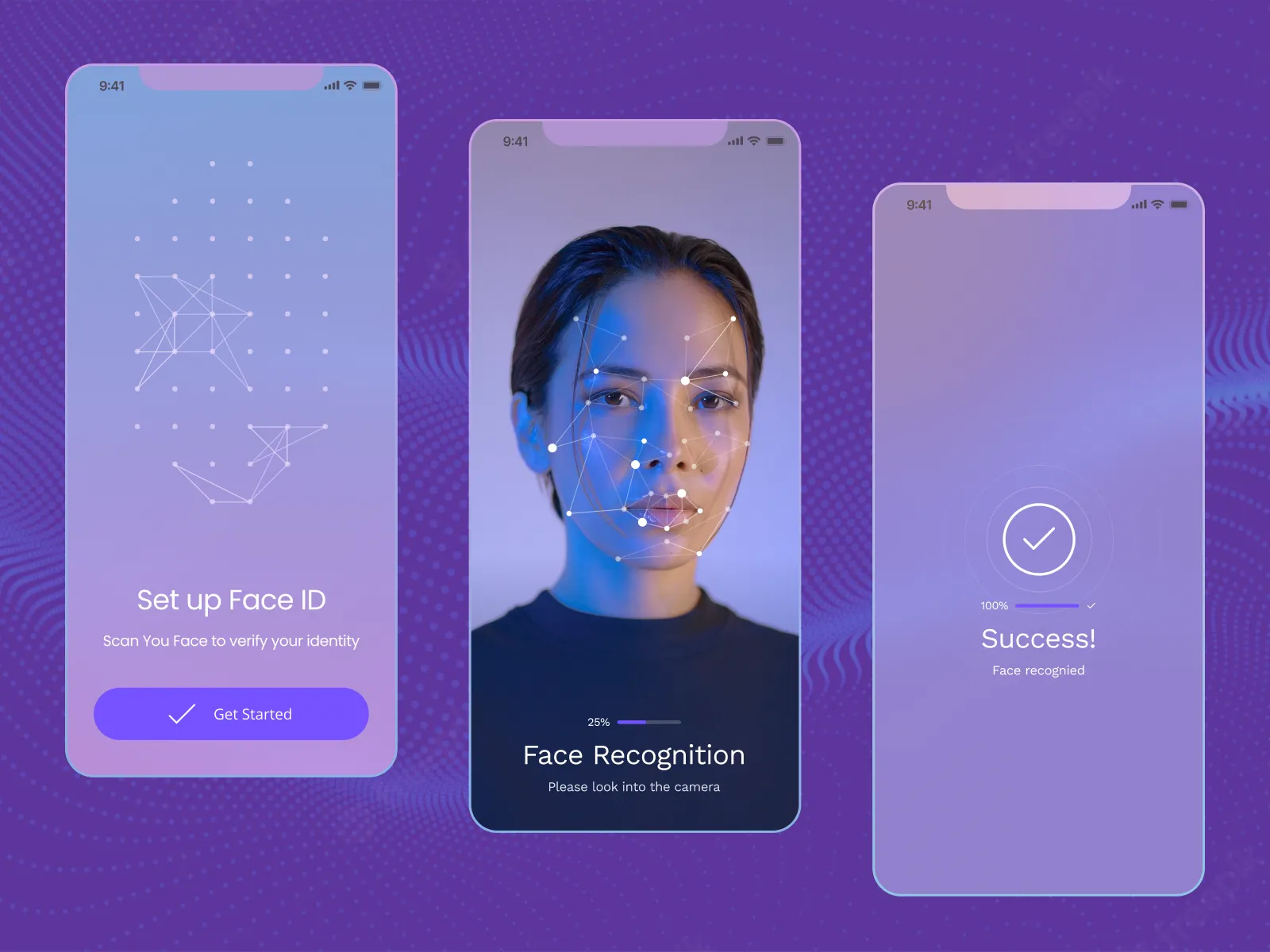

Users need to have an Emirates ID for verification. To confirm identity, they just need to scan their Emirates ID. The app checks it automatically and securely.

4] Selfie and Document Scan

Users can take a selfie and scan their ID by using their phone camera. The CashNow app reads the details of users by itself, and they do not need to type anything.

5] Smart AI Credit Scoring

The app uses a smart AI technology to check the loan eligibility of a user. If someone does not have a regular credit score, the app can approve the loan based on other data.

6] Log in with Face Recognition

Users can use the facial recognition feature to log in to the app. It keeps the user’s account protected by adding an extra layer of security.

7] Fast Disbursement

Once the user’s loan is approved, the money reaches their bank account or digital wallet within hours, sometimes even minutes.

8] Choose How to Receive and Repay

Users can pick whether they want to receive and repay their loan through a bank account or a digital wallet. The app gives them both options.

9] Select a Flexible Loan Term

Users can choose how long they want to repay the loan. For example, it can be as short as 14 days or as long as 180 days. It should have flexible loan terms.

10] See All Fees Clearly

Before taking the instant loan, users can check all the late fees and interest rates. In the app, nothing is hidden, and everything is clearly shown.

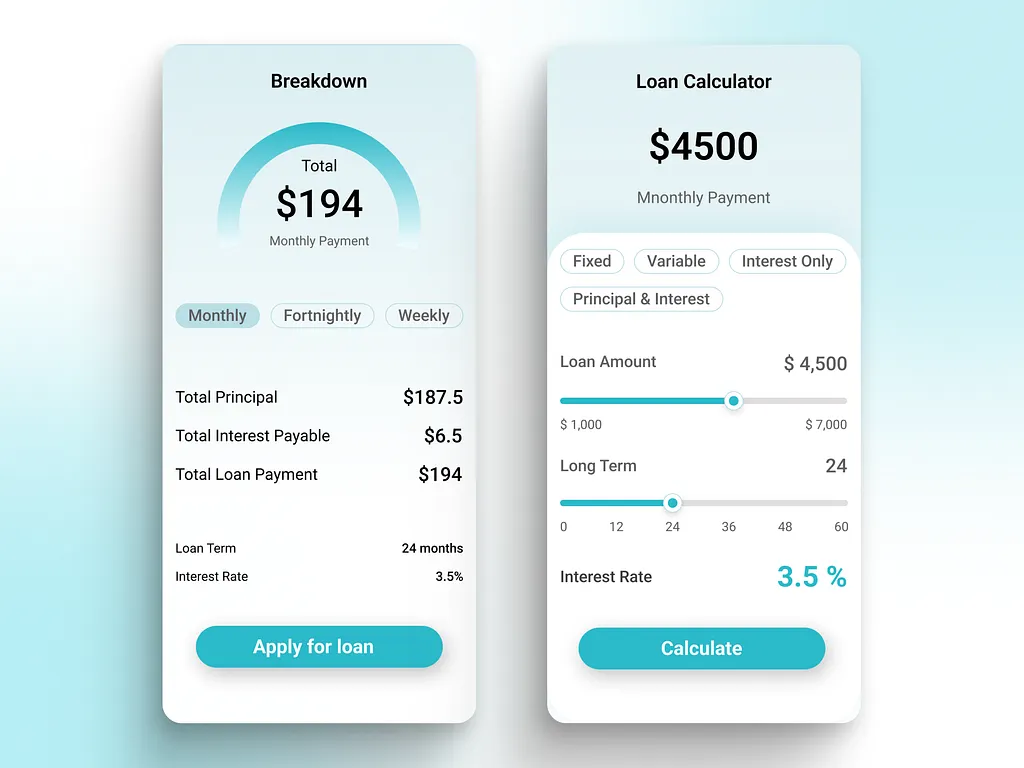

11] Use the Loan Calculator

Users can use the loan calculator to check the amount they will need to pay. Also, it updates the users to change the amount or period.

12] Track Loan Status in the Dashboard

Your app should provide a loan dashboard where users can see their loan details and other information. For example, how much do they have to pay, or when is the next payment due?

13] Push Notifications

Users can receive payment reminders for the upcoming loan installment. The app sends reminders before each due date, so users don’t forget to make a payment.

14] Apply Anytime, 24/7

Users do not have to wait for business hours. They can apply at any time, day or night, since the app works 24/7.

Steps to Build an App Like CashNow

So, how can you develop a mobile app in Dubai?

Creating an instant loan app like CashNow requires thorough expertise and proper planning. So, here is the step-by-step process of instant loan app development you must check out.

Step 1: Plan Your Instant Loan App Idea

Start by creating a basic idea of how your instant loan app will work. To do this, you should focus on three things: the Target audience, competitors, and industry. Validating mobile app ideas is essential for making your app successful.

Now, do a thorough market research on apps available on the Play Store and App Store and check what users like or complain about. Also, visit websites like G2, Clutch, and Capterra to understand popular instant loan apps, features, and business models.

Now, check how other instant loan apps earn money and what services they provide. Besides, you must understand the laws related to lending in your region.

Moreover, just think about the future, like what features will users need later? Also, make a plan and strategy for your app so it can grow and adapt. This will help you develop a visually appealing and scalable instant loan app for the future.

Step 2: Choose the Right Tech Stack

For building a successful and future-ready instant loan app like CashNow, it is vital to pick the right set of technologies. It covers the programming languages, frameworks, and platforms that help run your loan app.

The right tech stack ensures your application is fast, reliable, and safe for users. Since finance applications like CashNow deal with sensitive data and real money, using a trusted technology is a must.

You can think of it like choosing the best materials for building a strong house. Once you have finalized the right tech stack, you will need to hire skilled developers who have expertise working with these technologies.

With the right team and technology in place, your instant loan app can be developed to handle users smoothly and grow over time without issues. Thus, this step can set the foundation for the rest of the app.

Step 3: Hire a Development Team

Now you need to hire an experienced fintech app development team. Start by choosing an experienced app development team that has already worked on Fintech projects. They understand the unique needs of instant loan apps like security, speed, and user experience.

Your team should include a project manager to keep everything on track, a team lead to guide the developers, and UI/UX designers to create a simple and user-friendly interface.

Front-end and back-end developers will build the app’s structure and features, while Android and iOS developers will make sure it works smoothly on both platforms.

Lastly, a QA specialist will test the app to catch any bugs before launch. You can hire this team full-time, part-time, or on an hourly/fixed price basis, depending on your budget and project needs.

Hire Expert Mobile App Developers for Your Loan App Project from Nimble AppGenie!

Get Your App Developed!

Step 4: Build an MVP Version of a Loan App

Before you develop an app like CashNow, it is smart to start with an MVP version with core features. This helps you test the idea quickly without spending too much time or money. With the MVP, you can see if the audience is actually interested in using your loan app to get quick loans.

You will gather real feedback from users, understand what works, what is missing, and what needs improvement. If users love it, you will know you are on the right track and can develop the full app. If not, you can make changes early on.

This can save money, time, and effort. Plus, you might start earning and gaining loyal users even before the full app is launched. Once the MVP is ready and tested, you can move ahead and launch it.

Step 5: Test and Publish the App

Once your instant loan app is developed, it is vital to test it properly before making it live. Testing helps ensure the app works smoothly and without any lag. Testers can check that personal data stays safe, and all login and security steps work well.

Just ensure the app can safely handle storing, sending, and receiving data. Now test all the core features like applying for loans, etc., just keep in mind that everything should work exactly as expected. Also, check how the loan application performs under pressure.

Many loan apps crash when lots of people use them at once. Your app should stay fast and stable, no matter how many users it has. Proper testing gives users a smooth and secure experience, helping your app stand out and succeed in the long run.

Cost to Develop an App Like CashNow

So, how much will it cost to build a CashNow-like app?

On average, the cost to build an app like CashNow typically ranges between $25,000 and $150,000. However, this is not the actual instant loan app development cost; it is just a ballpark estimation.

Your app size, app complexity, features, technology, and the development team’s location can highly affect the actual cost. So, it is vital to first set your budget for the CashNow app development project, then make a proper plan and strategy.

Moreover, you can easily calculate the cost to develop an app like CashNow with the given formula.

Total CashNow App Development Cost = Developer’s Hourly Rate * Development Time

Factors Affecting the Cost to Develop an App Like CashNow

Factors play a very significant role in changing the overall mobile app development cost. Let’s now check out the crucial factors affecting the cost to create an instant loan app like CashNow.

-

App Complexity

The complexity of a CashNow-like application can highly affect the cost to build an app. The more complex your instant loan application is, the higher the cost will be. So, it is crucial to first set your budget and then build an MVP version to test the app accordingly.

Once it is successful, then you can make the actual version of instant loan apps. However, if you develop a customized app, it can enhance the loan app development cost.

-

Platform Compatibility

Platform compatibility directly affects your app development cost. You can decide on which platform you want to publish your app. You can go for Native app development or hybrid app development.

In general, hybrid app development is more cost-efficient than Native app development. In Native app development, the iOS app development cost is considered more than the Android app development cost.

-

App Features

The next factor that highly influences the cost to create an instant loan app is app features. If you develop an instant loan app from scratch, it is advisable to first add only the core features. It will help you minimize the development cost.

Functionalities can be a major element that can affect the overall budget. So, it is vital to choose the features as per your budget and business needs to reduce the cost.

-

Development Team’s Location

The mobile app development company in Dubai you hire can affect the development cost. The geographical location of the development team is essential because it plays a major role in cost fluctuation. The economic factors, living costs, and market demand are all important.

For example, if you hire a development team from a country like Europe, Australia, the United Kingdom, etc, the cost of development will be higher. However, if you hire app developers from a country like the UAE, the cost will be less.

-

App Design

Lastly, the app design you want to create can highly influence the cost to create an app like CashNow. It is the first component that catches the user’s attention. So, it should be designed in a way that it looks visually appealing and is intuitive.

The loan app design cost is dependent on the intricacy of the app, the experience of designers, and the particular design needs for multiple platforms. Keep in mind to create a minimal design if the budget is limited.

How to Make Money With an App Like CashNow?

Now, once you have created an instant loan application like CashNow, what’s next? Well, obviously, to earn money. So, we will look at the following monetization strategies that can help you earn a good revenue from your instant loan app.

➢ Charge Interest on the Loan

CashNow makes money by charging a higher interest rate on short-term instant loans. Unlike traditional loans, it provides quick access to loans with minimal paperwork, but it comes with a higher risk.

Instant loans are high-risk, but customers pay for the speed and convenience. So, you should also charge a slightly higher interest rate on instant loans, around 10%-30%.

➢ Take a Small Processing Fee

The next way CashNow makes money is that it takes a small processing fee for each approved loan. It can be between 1% to 5%. You can also charge a small processing fee from users when they take out a loan.

This fee can be either a flat amount or a small percentage of the loan amount. It assists in covering the admin costs and brings in some extra income. Basically, this amount is deducted from the loan before the user receives the money.

➢ Charge Late Fees

Charging a late fee can be the best revenue stream for earning money. You can apply late payment fees to encourage users to repay their loans on time.

For example, you can charge a small daily penalty or a fixed fee if someone misses the due date. This not only encourages users to stay on schedule but also adds to your revenue.

➢ Earn Commission from Partners

Another one of the most crucial monetization models is by partnering with a financial institution or service. For example, you can recommend insurance plans or credit score services inside the instant loan app and earn a commission when users sign up.

These partnerships can provide useful services to your users while generating income for you.

➢ Offer Paid Premium Features

You can provide premium features like faster loan approval, higher loan limits, or advanced financial tips. These can be part of a premium subscription or a one-time purchase.

Some users will be willing to pay for extra benefits, especially if they use the app regularly. This way, you can generate enough revenue from premium features.

Why Choose Nimble AppGenie to Build an Instant Loan App?

Nimble AppGenie is the best fintech app development company in Dubai. Since 2017, we have been creating high-quality instant loan applications. Our expert team focuses on your business requirements and delivers customized solutions to boost your business.

We leverage advanced technology to ensure your mobile application runs smoothly and safely. We are always ready to help our customers and give them post-launch support.

At Nimble AppGenie, our clients are satisfied with the projects we deliver to them within their budget. So, if you want a visually appealing and reliable instant loan app, we are the right choice for you.

Conclusion

Developing an app like CashNow may seem hard, but it is possible with the right steps. You need a clear plan, a good development team, and a focus on helping users. Keep the app easy to use, safe, and fast.

However, just make sure your target audience can get help when they need it. So, if you’re ready to dive in, you can begin with research, stay focused on your target audience, and keep improving.

FAQs

Why should I develop an app like CashNow?

Developing an app like CashNow provides profit potential, solves urgent financial needs, ensures recurring users, and taps into fintech growth. So, you should develop an app like CashNow.

How much does it cost to develop an app like CashNow?

The cost of building an app like CashNow ranges between $25,000–$150,000. It totally depends on the project requirements.

What are the key features of an app like CashNow?

You can integrate the following features in your CashNow-like app.

- Instant loans

- Secure transactions

- Credit evaluation

- KYC verification

- Repayment tracking

How can I make money with an app like CashNow?

You can monetize an app like CashNow through below methods.

- Charge Interest on the Loan

- Take a Small Processing Fee

- Charge Late Fees

- Earn Commission from Partners

- Offer Paid Premium Features

How long will it take to develop an app like CashNow?

The time to build an app like CashNow can take 2–6 months. However, it depends on features, team size, budget, and platform complexity.