The scope of digital banking in the Middle East is increasing since the government aims to bring a digital revolution in every aspect of financial services.

Moreover, the high penetration of smartphone usage in the UAE brings the demand for smart mobile apps that make their daily lives easier. So, this demand has encouraged many businesses and financial institutions to create robust fintech apps; one such revolutionary name is the Al Mulla Exchange.

This app has reshaped the remittance industry and made life easier by offering a fast and reliable money transfer solution. Are you also one of those who wish to develop an app like Al Mulla Exchange to strengthen your entrepreneurial journey in the UAE, but don’t know where to start?

Well, you are in the right place. This blog will let you discover the app development process and information that will make the whole process much easier.

Let’s unfold!

A Know-How About the Al Mulla Exchange App

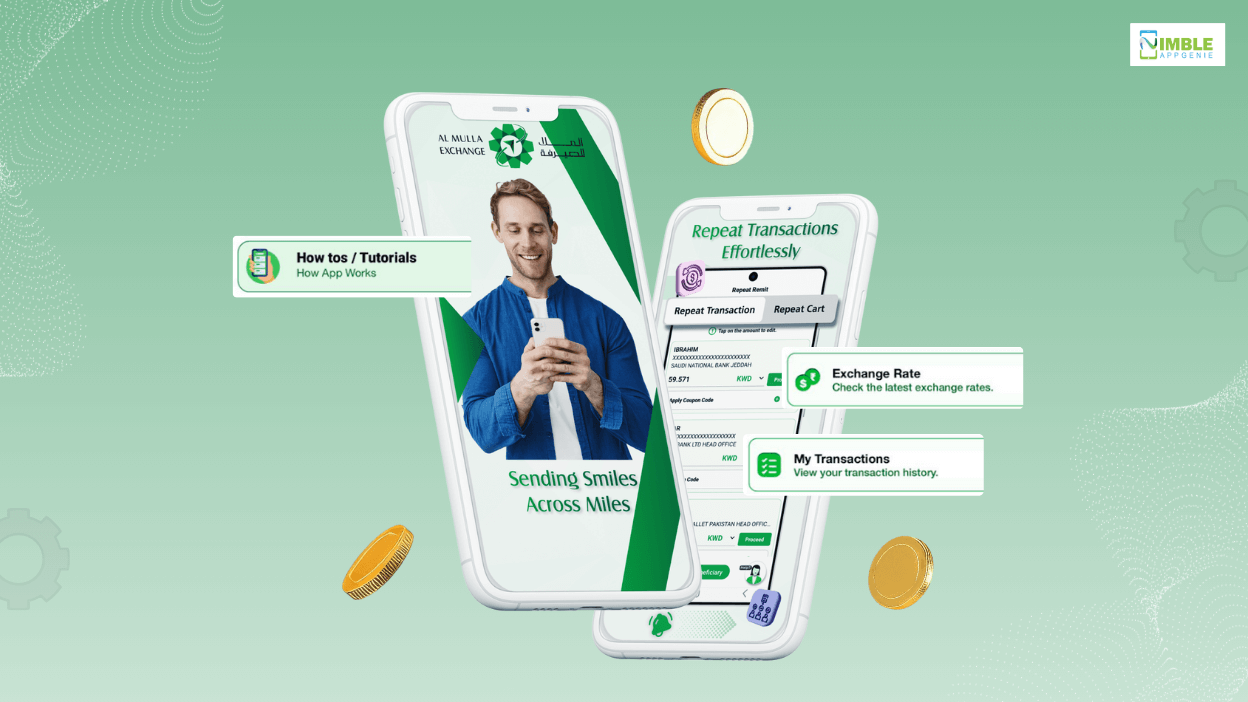

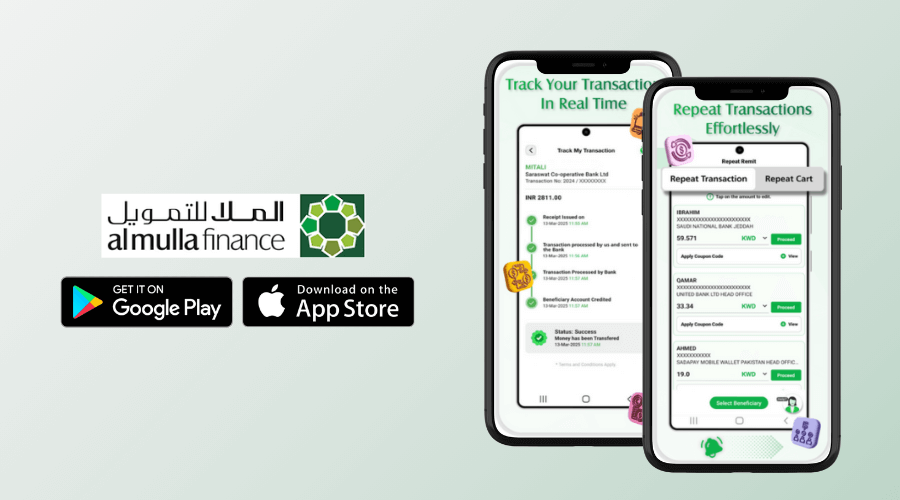

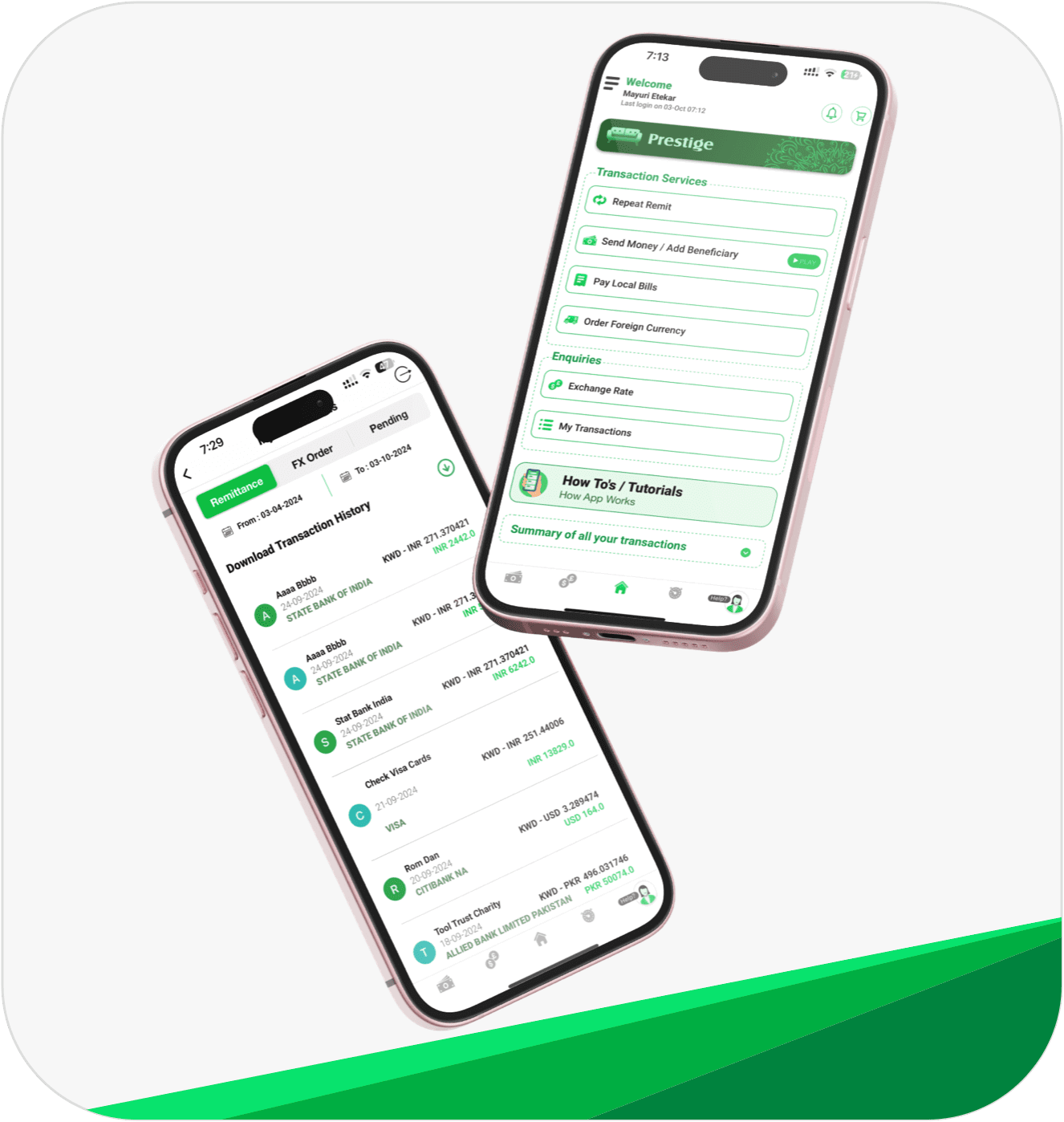

Al Mulla Exchange is a popular remittance service app developed by Al Mulla International Exchange Company, Kuwait’s leading financial services provider.

The aim with which this app was created is to make it easy for the people of the UAE to transfer money across borders. After the launch of this app, international money transfer has become a faster, safer, and more convenient process.

The Al Mulla Exchange app is one of the best fintech apps in the UAE since it comes with several great features. Users can link their bank accounts and cards with the app to send money directly to others’ bank accounts, eWallets, or cash pickup locations in multiple countries.

This app also provides real-time exchange rates, allowing customers to see the latest rates and make transactions accordingly. The app also has a strong focus on security, which is why it lets users access security features like biometric login, OTP verification, and encrypted transactions.

Thus, it keeps the app and its sensitive data protected from potential cyberattacks. Additionally, users can easily track their transactions in an instant, access digital receipts, and receive push notifications on status updates or special offers.

This app has become a go-to solution for people seeking to seamlessly transfer money anywhere in the world from the comfort of their home, right from their smartphones.

Observing the Global Money Transfer Market

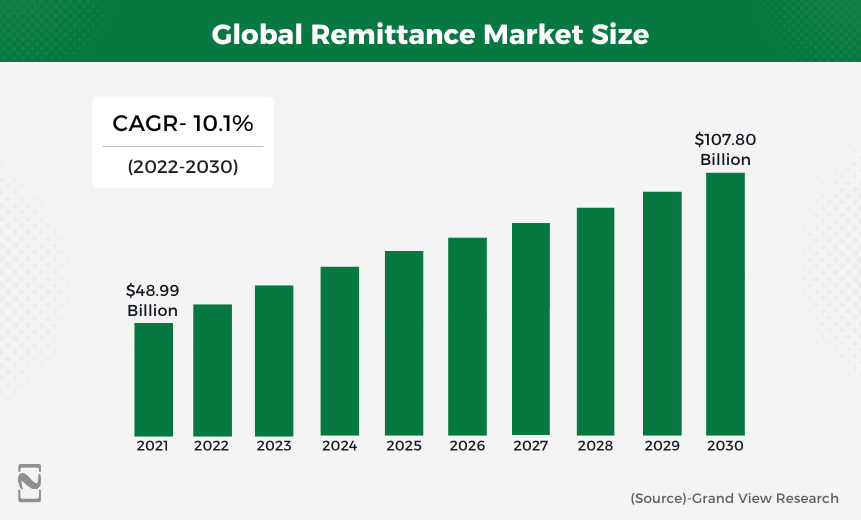

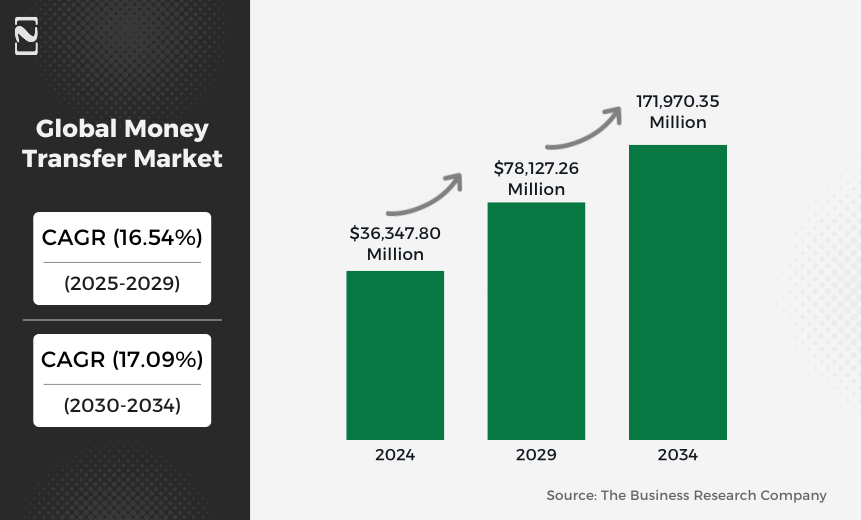

The importance of money transfer apps is becoming stronger, and to prove this fact, we have done part of our research. As per our research, we were able to bring some interesting numbers that show the rapid growth of the global money transfer market.

Global remittance market:

- The size of the global remittance market in the year 2021 was $48.99 billion.

- It is expected that the size of the global remittance market by the year 2030 will become $107.80 billion.

- Thus, between the years 2022 to 2030, the size of the global remittance market will grow at a CAGR of 10.1%.

Global money transfer services market:

- In the year 2024, the global money transfer services market reached the value of $36,347.80.

- It is expected that the global money transfer services market will reach the value of $78,127.26 million in the year 2029.

- Thus, between the years 2025 and 2029, i.e., during the forecast period, the value of the global money transfer services market will grow at a CAGR of 16.54%.

The above reports from the experts who have observed the remittance market and money transfer services closely are saying that the money transfer app has a thriving future globally.

Thus, if you have good mobile app ideas that will make it easy for people to transfer money worldwide, you should start working on them right away.

Primary Features of the Al Mulla Exchange App

You know about the Al Mulla Exchange app; to match the level of its quality and success, you must have knowledge about its features.

This app offers a wide range of excellent features to its users, which makes it their best choice in the UAE. To match the quality of your app to Al Mulla Exchange, you should learn about its features.

In this section, we have shared the list of a few primary features of the Al Mulla Exchange app below. Let’s take a look at them.

1] Instant Money Transfer

The core feature of the Al Mulla Exchange app is that it allows users to transfer money instantly anywhere in the world.

Whether users need to send money locally or abroad, this app makes it possible in a flash. Users can send money directly from their bank account and also through other mediums.

2] Live Exchange Rates

The app offers its users to check the live exchange rates right from the app in real time. When users get to check the currency exchange rates, this will boost transparency.

Moreover, knowing the exchange rates helps users to make better decisions with their money before they make the transactions.

3] Biometric Authentications

Since Al Mulla Exchange is a fintech app, this means it will be vulnerable to the growing cyberattacks.

Remembering this, the app offers the feature of biometric authentication, which allows users to activate face recognition or fingerprint authentication. This will allow users to keep their money exchange app safe from any kind of cyberattacks.

4] Track and Repeat Transactions

The app offers a feature that allows users to see their transaction history, i.e., the transactions that were made previously via the app.

Using another feature of the app, “Repeat Cart”, users are able to see the previous transaction made and also repeat it if needed. This offers convenience to the users.

5] Recurring Transfers

With this app, there is no way for users to forget any recurring transfers, and even if they do, the transaction will automatically be done.

Thus, the app offers a feature that allows users to automate the transactions for rent, tuition, or any other payments. So, when the right time arrives, transactions will be done easily via the app.

6] Multilingual Support

This app has global recognition since it allows users to send money internationally to any country. Every country has its own types of currencies, and this app offers multiple languages.

So whenever users wish to make a remittance transaction to another country, the app makes it easy. So, it offers a solution for global remittance needs.

Steps to Develop an App Like Al Mulla Exchange

To build a mobile app like Al Mulla Exchange, you need to follow strategic steps if you expect the best outcomes for your app. This app is one of the best remittance mobile apps that makes it easy for people in the UAE to transfer money globally, check exchange rates, and more.

Thus, we have made it easy for you to understand the development process with a step-by-step development guide. This will surely help to build a money transfer app that leads the competitive market.

Step 1: Research and Planning

Before you start the development process, you should do your part of planning and research to make things smoother. First of all, you have to conduct thorough market research to know about competitors and the targeted audiences.

Know about the features of the competitor apps, including Al Mulla Exchange, to point out the loopholes and understand the demand of the audience. This will help you to create an app with unique offerings that fulfill the needs of the target audience and lead the competition.

Step 2: Choose the Right Features

Next, decide upon the features that you want to include in your app, which makes all the difference. You must remember that the features of the Al Mulla Exchange app are what make it the best choice for people.

Thus, if you want your app to enjoy a competitive edge, then features are the core element you need to focus on. The choice of the features for your payment transfer app will define your USP. We have already listed and explained the features of the Al Mulla Exchange app; you can take them as your reference.

Step 3: Choose the Right Tech Stack

Now comes the step where you have to choose the right tech stack to build an app like Al Mulla Exchange, that one of the famous names in the UAE.

The choice of technologies you will use while creating your app is an important factor that decides the quality and performance of the app. Every part of the app needed to be created using different technologies.

Thus, choose the technologies wisely to build a scalable and secure payment transfer app. We have mentioned the technologies in a table below.

| Categories | Required Tech Stack |

| Frontend development | React Native or Flutter, Swift or Kotlin |

| Backend development | Node.js, Ruby on Rails, Python |

| Databases | PostgreSQL, or MongoDB |

| Cloud services | AWS and Google Cloud Platform |

Step 4: UI/UX Design

Now comes the step to design the interface of the remittance mobile app that needs an expert hand. Carefully carry out the UI/UX design of the app like the Al Mulla Exchange app, which comes with excellent features and an app interface that makes it the best choice.

Use the wireframe to create the prototype of the app. It will allow you to create the layouts and a detailed model of the app. You must create attractive app features, icons, and colors that match the brand.

Must maintain an interactive user interface (UI) of the app, as it is the secret to offering the best user experience (UX).

Step 5: App Development

Now comes the step where you have to start the development process of the money transfer app like Al Mulla Exchange. It will consist of the frontend and backend development of the app using the right tech stack and integrating the right features & core functionalities.

First, you have to build the frontend of the app, which consists of creating an interactive and functional app interface. The frontend development consists of transforming the UI/UX design of the app into a functional app screen.

After the frontend development, start with the backend development of the money transfer app. In the process of backend development, you have to make sure the smooth functioning of the features and the backend system of the app.

In this stage, you have to integrate the APIs, build security systems, and integrate the payment gateways.

Step 6: QA & Testing

Now that you have finished the development of the payment transfer app, it’s time to test the app thoroughly before you launch it. QA and testing are one of the crucial steps in the development process because they make sure the app is free of bugs and recurring issues.

Presenting the audience with an app with issues will affect its reputation in the market. You have to carry out various kinds of testing, which consist of functional testing, usability testing, performance testing, and security testing, to prepare the app for the audience to install.

Step 7: Launch & Marketing

After you are done with the testing, you are ready to launch the app on various download platforms like Google Play and App Store. Potential users can easily install the app from the relevant platforms for their use.

Before the launch, you should market the app through various marketing channels, like social media, email marketing, and others. Promoting the app has vitality in making it a successful launch.

Marketing will create a buzz about the app, which will attract more people to install the app, use and bring huge success.

Step 8: Post-Launch Maintenance

You have developed an app like Al Mulla Exchange successfully and also launched it for public use; it doesn’t end here. It is very important that the app works well after people start to use it.

This is when the post-launch maintenance comes into play, as it helps the app to keep working in a stable position. As part of post-maintenance of the app, you have to keep its performance in check.

You must look for the emerging bugs and solve the recurring issues from time to time to offer the best after-sales experience. As the cyberattacks are increasing, ensure to keep the security patch of the app updated all the time.

If you feel that it is tough to follow the steps to build the app, then it is best to hire a mobile app development company in Dubai. They will seamlessly create an app like Al Mulla Exchange using their years of expertise and skills.

Cost to Develop an App Like Al Mulla Exchange

Before you start to develop an app like Al Mulla Exchange, you must plan your budget, which helps you to set realistic goals, control the cost, and avoid any delays. To make the budgeting easy, you must have a rough idea of the development cost.

Thus, the average cost to develop an app like Al Mulla Exchange typically ranges from $30,000 to $250,000, or in some cases, more. The app development cost is decided by various factors of development, which include complexity, features, tech stack, developer’s location, and others.

You can build an MVP version of the app, Al Mulla Exchange, integrating basic features that will cost you no more than $70,000. However, if you plan to develop a money transfer app integrating trending technologies like AI/ ML and the advanced & unique features, then it will cost you more than $250,000.

Build a Leading Money Transfer App Like Al Mulla Exchange with the Expert Help of Nimble AppGenie!

Get a Quote Now!

Factors Affecting the Development Cost of an App Like Al Mulla Exchange

You are well aware of the fact that the cost of remittance mobile app development is driven by several factors. Having a clear knowledge of those factors is crucial for you to make the right decision.

Here is the list of the few key factors driving the development cost of the money exchange app we have mentioned below.

➢ Location of Developers

The location of developers affects the cost to make an app like Al Mulla Exchange in the UAE. There are two types of app developers you can hire: those belonging to offshore locations and those in onshore locations.

The former is the one that belongs to another country, and is less costly than the latter, which belongs to the same country.

➢ Feature Complexity

The complexity of the features used in the app is another factor that determines the cost of app development.

If you are choosing the advanced features like integration of AI or ML for your app, then it will take more time to create the app, and hence the development cost will increase. On the other hand, choosing basic features will not increase the development cost.

➢ Choice of Platform

The choice of platform is another factor that drives the cost of payment transfer app development.

There are two types of platforms: native- iOS or Android, and cross-platform, both iOS and Android. If you are creating an app for cross-platform, it will be costlier than native app development.

But in native app development, typical iOS app development costs are higher than Android app development costs.

➢ Post Maintenance

Post maintenance of the app is also one of the prominent factors that determine the cost of app development. To keep the app stable after the launch, while people use it post maintenance, holds great significance.

From keeping the app updated with the latest features to secure software, there is a lot of work that increases the overall development cost.

How Does an App Like Al Mulla Make Money- The Strategies to Follow

Your app can be an important channel for your business. Investment in mobile app development can be a good source to make income. You should not miss the chance to create a stream of revenue from your app. There are various ways that help your app make money for you.

If you don’t know how you can make money from your app, then you should consider reading a few of the mobile app monetization strategies listed below.

● Exchange Margins

Exchange margins are a good strategy for the app to make a good amount of revenue. Every time the app converts currencies, it adds a nominal charge on top of the exchange rate.

The tiniest difference between the real market rate and the customer’s rate can generate a good volume of revenue because lots of transactions happen.

● Transaction Fees

Transaction fees can also help to generate a good amount of revenue from the money transfer apps. Lots of transactions happen through the app, so for each of the transactions, a fixed percentage of fees should be charged to the users.

Lower charges will work best; they will attract more customers and help apps make a steady income.

● Partnership Commission Fee

To provide a better service experience and boost the credibility of the app, you have to partner with the banks, payment providers, and local agents.

This is a good idea to earn revenue through your app. When you make a partnership, you get the chance to earn partnership fees when users use the services, and this will also boost trust.

● Value-Added Services

You should add extra features to your app, like instant transfers, tap and pay, schedule payments, etc. These additional or premium features should be available for the users at payment of extra charge.

So, when users pay for these premium services of the app, this will help the app generate revenue.

Partnering with Nimble AppGenie to Develop an App Like Al Mulla Exchange

Want to develop an app like Al Mulla Exchange, the money transfer app, to compete in the digital banking market of the UAE? Then you should take the smartest step to partner with Nimble AppGenie, an expert development company of the UAE.

We do more than just code to build a secure and reliable money transfer app for you that thrives in the competitive market. Our team of skilled developers has deep knowledge of financial technologies, regulatory compliance, and UI/UX design.

Nimble AppGenie has a proven excellent track record, which has made it the best fintech app development company in Dubai. We ensure to handle every stage of the development process with precision.

Conclusion

To develop an app like Al Mulla Exchange means to create a secure bridge for the population of the UAE to send money across borders. Your app will be a successful outcome only when you creatively blend innovation, compliance, and user trust.

You have the secret sauce in your hand to create a robust payment exchange app, which you just read in the above blog. The future of the money transfer system is strong with such apps that offer users convenience, transparency, and speed.

Now, this is the time you should turn the idea of offering a world-class remittance solution with a futuristic and innovative app into reality.

FAQs

What are the key features of the Al Mulla Exchange app?

To create such an efficient remittance mobile app like the Al Mulla Exchange app, you must be aware of its features that make it the best.

This app works as a tool for updating Civil ID information, locating branches, and offering multilingual support. A few of the key features of this money transfer app have been listed below for your understanding.

- Global money transfer

- Foreign money order

- Live exchange rates

- Manage transactions

- Civil ID update

- Secure transactions

- Branch locator

What will be the average cost to develop an app like Al Mulla Exchange?o

If you plan to create a remittance mobile app like Al Mulla Exchange, you should also allocate a budget for it. Knowing the cost of development will support the budgeting process.

The average cost to build an app like Al Mulla Exchange falls between $30,000 and $250,000 or more. The development cost depends on various factors, including complexity, features, the developer's location, and others.

How much time will it take to develop the money exchange app?

You need approximately 6 to 12 months to build a money exchange app like Al Mulla Exchange in the UAE; in some cases, it takes even more. The development time is based on the type of app.

If you are creating an MVP version of the money exchange app, then it will take almost 4 to 5 months. If you are planning to create an advanced money transfer app with unique features and advanced technologies, then it will take more than 12 months.

Is it possible to integrate a currency converter into my app?

Yes, you can easily integrate a currency converter into your app just by using a currency converter API, or you can also use existing SSKs or third-party apps providing the same functionalities.

The integration of a currency converter API will allow you to fetch real-time exchange rates and perform conversions. Additionally, customise the integration to display conversion using the basic format, like JSON.