The digital payment sector of the UAE has set a record with its dynamic growth. This has become possible because the government aims to build a fully cashless economy by the end of 2031.

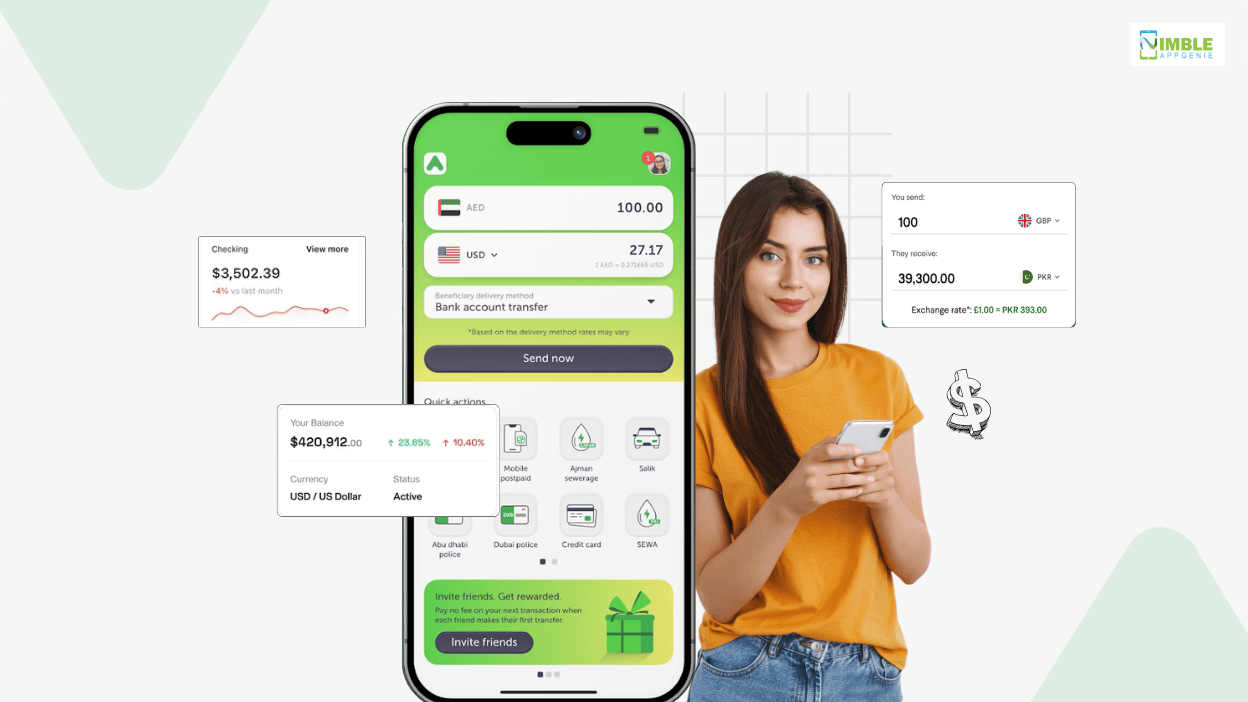

By taking advantage of the government initiatives, the AlfaPay app has set a benchmark with its exceptional offerings. Users can make international money transfers seamlessly, pay bills, and more from a single platform.

This app has encouraged many fintech businesses in the UAE to make an app like AlfaPay to offer a seamless digital financial solution to the people.

Are you planning to build a complete digital payment solution like AlfaPay? But where to start? We have the answer for you.

Explore this blog till the end to get a complete money transfer app development solution.

Get to Know about the AlfaPay App

AlfaPay is one of the top fintech apps in the UAE, established by a trusted financial institution, the Al Fardan Exchange. This app was created to make it easier for the people of the UAE to send and receive money across the world.

This app offers features beyond just international money transfer; it includes paying local bills, managing prepaid cards, and much more. The app allows users to connect their debit or credit cards and bank accounts easily to offer flexible payment options.

The AlfaPay app is the one-in-one payment solution that aims to meet the government’s target of replacing cash with quick, safer, and convenient digital transactions.

Fintech and Payment App Market of the UAE

Digital banking in the Middle East is growing rapidly, which has given a great scope for fintech startups to create their hub in the UAE. For these reasons, more apps like AlfaPay are taking over to offer digital financial solutions to the people.

We have come up with excellent market statistics on both the fintech and payment app markets of the UAE, below, to give you a deep understanding of the above claims.

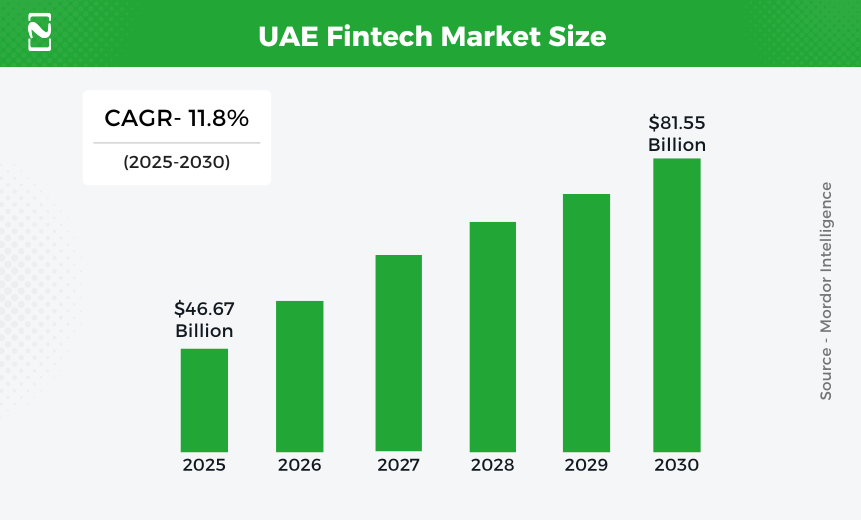

UAE Fintech Market:

- The fintech market size of the UAE in the year 2025 was expected to reach the value of $46.67 billion.

- Further, it is expected that by the year 2030, the fintech market of the UAE will reach the value of $81.55 billion.

- So, between 2025 and 2030, the fintech app market size of the UAE will grow at a CAGR of 11.81%.

Digital Payment Market of the UAE:

- The digital payment market of the UAE is expected to reach the transaction value of $60.20 billion in the year 2025.

- It is expected that the value of the digital payment market of the UAE will reach $117.98 by the year 2030.

- So, during the years 2025 to 2030, it is expected that the digital payment market of the UAE will grow at a CAGR of 14.40%.

Thus, if you have mobile app ideas that can thrive in the fintech industry of the UAE, you should turn them into reality and enjoy their successful outcomes.

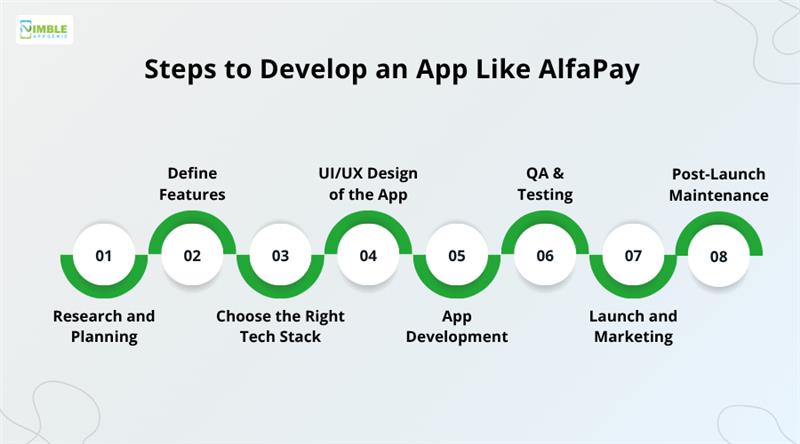

Steps to Develop an App Like AlfaPay

If you are planning to create the best instant loan apps in the UAE, similar to AlfaPay, you need to follow the dynamic steps. We have shared with you the steps that will make the whole app development process easy.

However, if you feel that it will be challenging for you to follow the steps and build the app, you can hire mobile app developers for that. This will make your work less stressful.

Here are the app development steps and the key features below.

Step 1: Research and Planning

The first step to develop an app like AlfaPay is to do research and planning for your app. Research about the competitor apps, which include the AlfaPay app, to know about their unique features and the gaps.

Further, learn about the potential audience and what their demands are. This will help you to plan your app, fulfill audience needs, and address gaps.

Step 2: Define Features

The next step is to recognize the features that you should integrate into your money transfer app, such as AlfaPay. Features are the main component of the AlfaPay app that make it one of the leading names in the UAE.

To make it easy for you to choose, we have listed and explained a few of the core features of the AlfaPay app below. Let’s take a look at them.

-

Seamless User Onboarding

The users of the app must be able to sign in to the app seamlessly without any problems. Make sure the onboarding process doesn’t overwhelm the users, so allow them to sign in with email, contact number, social media, etc.

-

KYC Verification and Manage Profile

Since you will be creating a money transfer app, you should integrate the feature of easy KYC verification via UAE pass, mobile number, or email.

The users must be able to manage their profile, which allows them to enter all the related information, like their bank account, etc.

-

Instant Money Transfer

Instant money transfer is one of the core features of the AlfaPay app, so you must consider it for your app. This feature of the money transfer will allow people to transfer money to more than 120 countries via bank account, cash pickup, or mobile wallet.

-

Receive and Send Money Instantly

The users can send and receive money instantly through the AlfaPay app. Therefore, consider incorporating this feature into your money transfer app.

The user just needs a mobile number to transfer and receive money; it is that easy. These features offer the best user experience.

-

Low Fees & Competitive Rates

The AlfaPay app offers low transfer fees to its users, and its money exchange rates are also competitive without any hidden charges.

Your app should also have the same features so that it can gain user trust easily. It is one of the crucial features of a money transfer app.

-

24/7 Customer Support

The app AlfaPay offers 24/7 customer support to its users, which is also available via AI-powered chatbots. This app should be a part of your app’s features as it will make sure to resolve the queries of the users as soon as possible, at any time of the day.

Step 3: Choose the Right Tech Stack

In this step, you have to choose the right tech stack to create an app like AlfaPay. This is a crucial task as the tech stack will define the quality of your app. There are several technologies available from which you can choose.

However, to build a mobile app in Dubai, secure and scalable like AlfaPay, you need to be specific to offer users the best.

Step 4: UI/UX Design of the App

Start by creating an intuitive design for your payment app, like AlfaPay, that clearly defines the user flows. Create wireframes to design the app interface and database architecture.

Next, develop the prototype to visualize the user experience. Consider developing an intuitive app interface, incorporating features, integrating secure payment gateways, and others.

Step 5: App Development

The next step after creating the design of the app is to start its development. In this step, you have to carry out both frontend and backend development. The front-end development consists of turning the UI/UX design into a functional interface of the app.

Then comes backend development, which consists of creating server-side infrastructure to handle transactions, user data, integration with financial networks, and required APIs.

Step 6: QA & Testing

When done with app development, don’t jump straight to launching the app first; carry out the testing and QA of the app. This is one of the crucial steps of the app development process, which helps to fix the bugs or any potential issues of the app.

This will allow you to offer users a money transfer app that gives them the best experience with transactions.

Step 7: Launch and Marketing

Now that you are sure that your app is free from any potential bugs and issues, it’s time to launch it on several app download platforms. There are Google Play, Apple Store, and more, from which potential users can install the app to use.

It is suggested that before the launch, promote the payment app to create buzz through social media, emails, and other media.

Step 8: Post-Launch Maintenance

Launching the app is not the end of the app development process. Make sure your mobile app development company in Dubai offers you post-launch support.

This will include monitoring the app after the launch to make sure it can work properly without any issues or bugs. Keeping the features, security patch, and software of the app updated from time to time.

Launch a Feature-Rich Money Transfer App Like AlfaPay in the UAE Today!

Get a Quote Now!

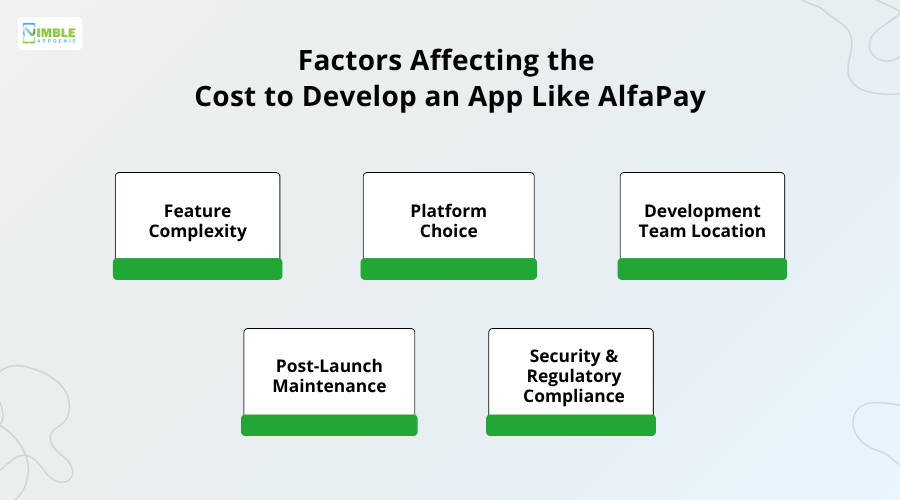

The Cost to Develop an App Like AlfaPay

It is suggested that before you start the development process of your money transfer app, like AlfaPay, you must plan your budget. So, to plan the budget, you should know how much it can cost you to develop the app.

Thus, the average mobile app development cost, like AlfaPay, typically ranges from $30,000 to $200,000, which sometimes depends on various factors. If you are creating the MVP version of the app, then it will not cost you much, and it could be less than $40,000. But to create a full-stack app with smart features and advanced technologies, it will cost you more than $200,000.

We have explained a few of the factors that decide the cost of app development for your understanding.

➢ Feature Complexity

It is one of the crucial factors of app development that decides the cost. The more complex feature you decide on for your app, the longer it will take, and hence it affects the cost.

➢ Platform Choice

The choice of platform is also one of the factors that determines the payment app development cost. An app for the native platform costs less than a cross-platform one.

➢ Development Team Location

The location of the development team decides the cost of app development. On-shore developers (from the same country) are fewer than offshore developers (belonging to another country).

➢ Post-Launch Maintenance

Then comes post-launch maintenance, in which developers make sure the app is working properly. Keeping the features, software, and security patches updated affects the cost.

➢ Security and Regulatory Compliance

Since you will be developing a fintech app, keeping it secure from the threats of potential cyberattacks is crucial. Handling sensitive financial information adds substantial costs.

Monetize Your Money Transfer App Like AlfaPay- The Strategies

Your app can be a great medium for your business to earn money. Yes, that’s right, there are several app monetization strategies that you can use to make your app earn money.

We have listed a few of the core strategies below that help a mobile app startup or an enterprise to monetize their app.

● Transaction Fees

The key strategy is the transaction fees that will help you make good money from your app. This will help you make money from the core features of the app that facilitate payments and transfers. This is a great strategy for an app with a huge user base.

● Premium Subscriptions

Premium subscription is another excellent monetization strategy for a payment app like AlfaPay. This will allow users to unlock premium features for an annual or monthly payment of a particular amount. It also includes a freemium subscription model.

● Affiliate Revenue

The affiliate partnership model is a good channel for businesses to earn revenue. The app partners with institutions to promote products like loans, credit cards, or insurance policies to the users. Every sale made by the institution through the app is a chance to earn money.

● Data Monetization

Then comes the data monetization, which is another excellent strategy to make money for the app. As per this strategy, the AlfaPay app provides third-party businesses with anonymized data about customers and market trends in exchange for money.

Nimble AppGenie is the Ultimate Partner to Develop an App Like AlfaPay

If you want to develop an app like AlfaPay with the help of developers, it is crucial to choose a good app development company. There are several ways to evaluate whether you have chosen the correct app development, but that can take a lot of time.

We have tried to save your time and efforts by telling you about the perfect app development partner, Nimble AppGenie. We are the leading fintech app development company in Dubai, your one-stop solution to create a robust app that makes it seamless for users to transfer money internationally.

Nimble AppGenie provides you with expert and professional app developers who can handle the whole app development service from scratch.

We are transparent about the costs our clients must invest, and our service is one of the budget-friendly options. Moreover, we have developed innovative apps across various industries, ranging from fintech to fitness.

Conclusion

Don’t just replicate the features of the AlfaPay app. Rather, aim to create a successful payment solution that meets the need for seamless international money transfer and more. By perfectly blending the robust fintech architecture with features, you can achieve this.

This blog has told you in detail the secret to build an app like AlfaPay that can thrive in the digital-first world of the UAE. Thus, don’t just create another money transfer app, but create a financial ecosystem that offers the tech-savvy population a perfect digital financial solution.

Build the app with vision, agility, and user trust.

FAQs

What are the core features that I must integrate into an app like AlfaPay?

Features are the main element of this app that give it a leading position in the UAE fintech app market.

Thus, while creating an app like AlfaPay, you have to make sure you have chosen the right features for your money transfer app. We have mentioned a few of the core features of the AlfaPay app for your knowledge.

- User onboarding and KYC verification.

- Multi-currency wallet.

- Instant money transfer.

- Mobile top-ups and bill payment.

- QR code payment.

- Instant loan.

How much must I invest in the development of an app like AlfaPay?

Before you start to develop an app like AlfaPay, you should know how much it will cost you. This will help you plan a budget for your app. The average cost to develop a money transfer app ranges from $30,000 to $200,000 or more.

This cost totally depends upon the various factors of development, such as the developer’s location, choice of platform, tech stack, etc.

Can I make money from an app like AlfaPay?

Yes, you can make money from your money transfer app like AlfaPay. There are various strategies that you can apply to monetize the app and enjoy the financial growth of your business.

The strategies you can use to monetize your app include transaction fees, subscription fees, merchant partnerships, premium services, in-app advertisements, and many more.

How can I ensure the security of my money transfer app?

You will be creating a money transfer app, and keeping it safe from potential cyberattacks is crucial. Their various security features that you can integrate into your app help you keep your money transfer app from growing cyberattacks.

Thus, you must implement end-to-end encryption, tokenisation, biometric authentication, secure APIs, fraud detection systems, and many more.