Millions of people in the UAE do online transactions every day. With more than 9 million expats living in the country, money transfers are a big part of their daily life. In fact, more than AED 165 billion is sent from UAE every year, according to the UAE Central Bank.

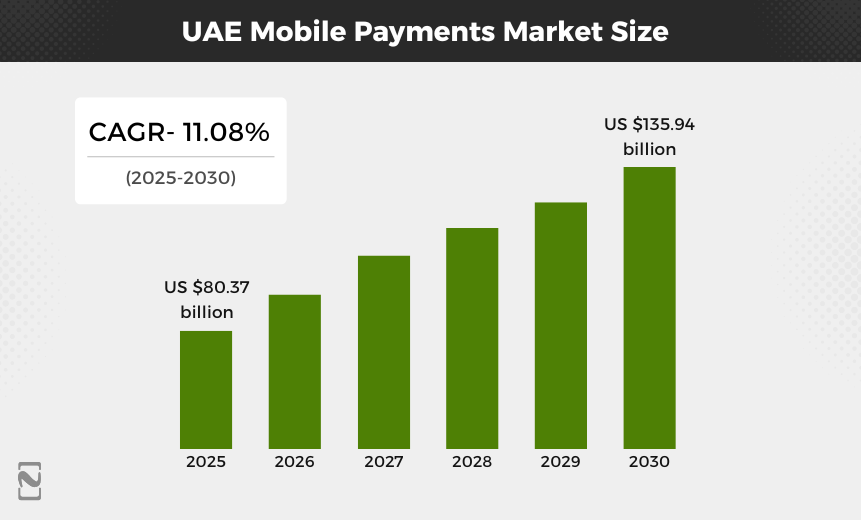

People want a safe and fast way to transfer their money, and that is where the money transfer app comes in. The UAE’s market size of mobile payment apps is forecasted to reach $135.94 by 2030.

As the demand for money transfer apps grows, entrepreneurs are seeking ways to develop a money transfer app. But making an app means following rules, keeping user data safe, and ensuring everything works smoothly.

Thus, if you are planning to develop a money transfer app in UAE, there is a lot to think about. We will discuss the process of creating a money transfer app and its features through this blog.

So, let’s begin!

What is a Money Transfer App?

A money transfer app is a mobile application that allows users to easily pay or receive money through a mobile phone. It is totally cashless, which means users don’t need physical cash or cheques.

It is also known as P2P or peer-to-peer or e-wallet apps. Users just need to have a receiver’s email address and phone number to send money. It is the most secure and fastest way to transfer money overseas or domestically.

Overview of Money Transfer Apps in UAE

The UAE’s online money transfer market is booming at a fast pace. So, before you develop a mobile app in Dubai, it is important to understand the UAE’s money transfer market scenario.

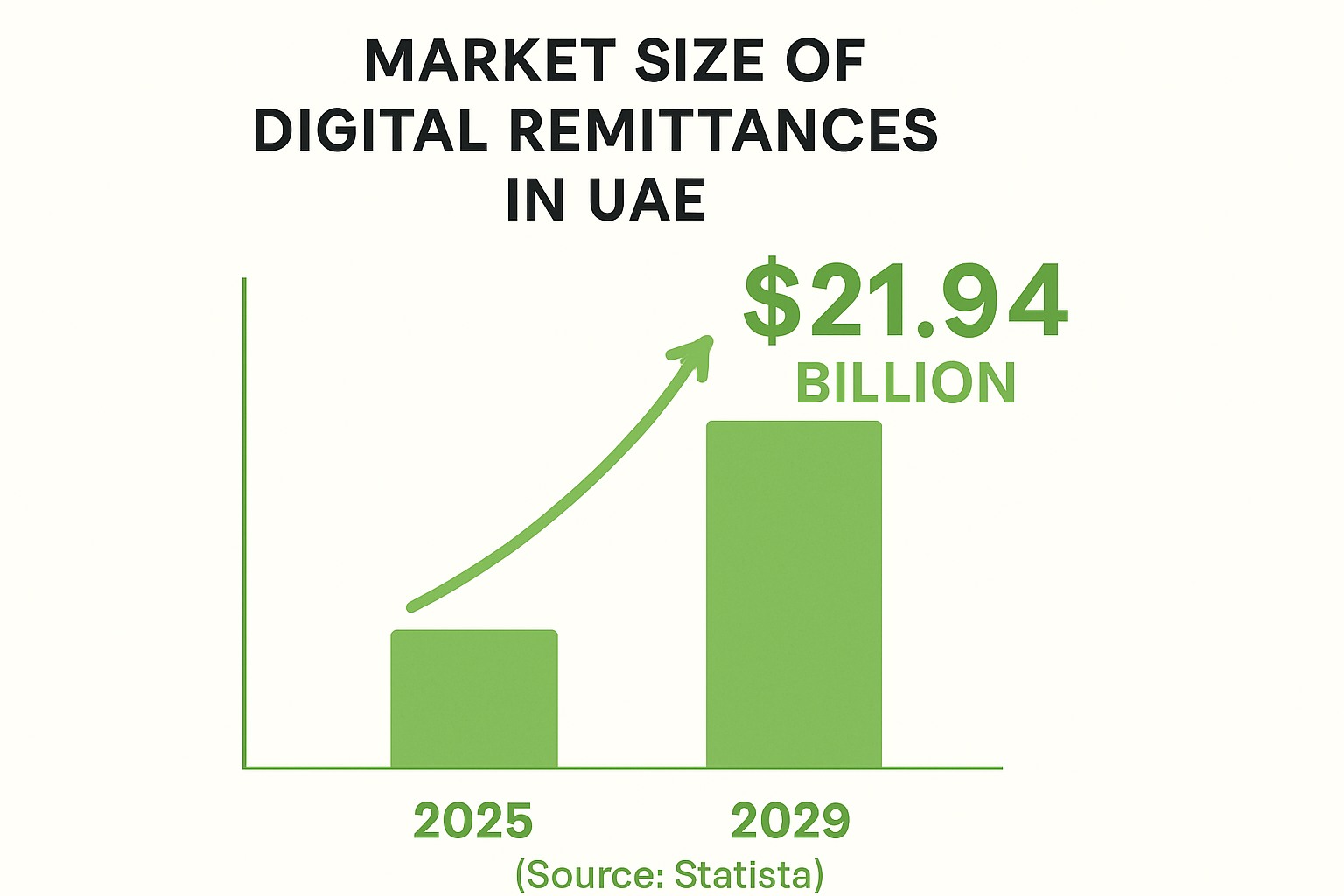

- As per Statista, the market size of digital remittances in UAE is forecasted to reach $21.94 billion by 2029.

- The total number of users in the digital remittances market is projected to rise to 1.38 million users by 2029.

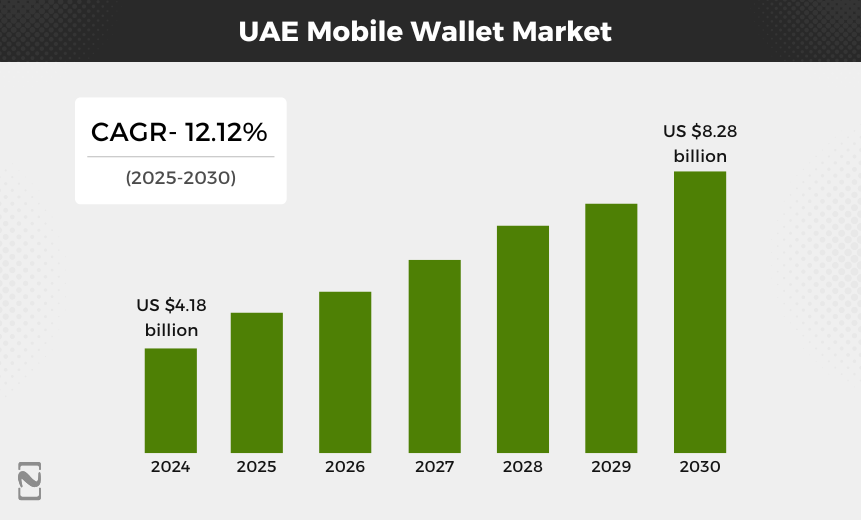

- Tech Sci Research reports show that the UAE mobile e-wallet market is projected to hit $8.28 billion with a CAGR of 12.12% BY 2030.

- As per Mordor Intelligence, more than 70% of retailers experienced revenue increases after implementing contactless payments.

- The retail and e-commerce industry has accounted for a 48% share of eWallet payment apps in UAE.

How Does a Money Transfer App Work?

Want to know how money transfer or P2P apps work? Well, here is the step-by-step workflow explained.

- Firstly, users download the money transfer app on their mobile phones and register for an account.

- Now they need to do identity verification through fingerprint or a PIN.

- To transfer money, users need to enter the receiver’s details, enter the amount, and confirm the payment.

- Now, users complete the transaction, and both the sender and receiver get a notification or receipt once the money is sent successfully.

What Are the Types of Money Transfer Apps?

Money transfer apps come in various types. It totally depends on how they function and what purpose they serve. If you are planning to build one for your business, just check out the 4 major types of money transfer applications.

1] Peer-to-Peer Money Transfer App

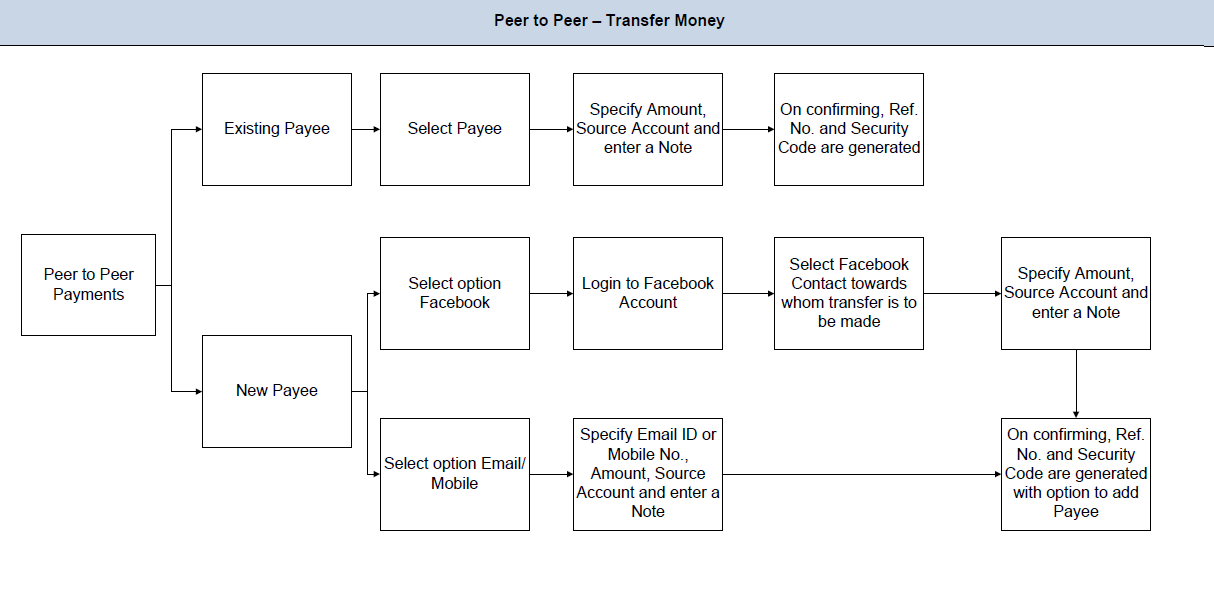

P2P or peer-to-peer money transfer apps allow users to send money directly to other people. As you have seen, apps like Venmo, Google Pay where users can transfer money to friends, family members, and so on.

These often require phone numbers, emails, or QR codes for faster payments. If your main target is a large user base that wants quick personal payments, this is the best model.

2] Mobile Banking Application

In the digital banking era in the Middle East, mobile banking apps are created on top of an exciting banking system. These types of apps allow users to send money from one bank account to another.

They just need to use an account number or a mobile number that is linked to a bank. So, if you want to partner with a bank or provide secure and regulated transfers, mobile banking apps are the best model.

3] Digital Wallet Application

Another type of money transfer app is a digital wallet application. It is just like an online purse where users keep the money and use it to shop, pay bills, or transfer to other people. One of the biggest examples is Apple Wallet.

Users load money into the app and use it without going through the bank each time. This is best if you want eWallet app development with a full ecosystem that enables users to hold, spend, and send money with your platform.

4] International Money Transfer App

The international money transfer app allows users to send money across the country. These types of money transfer apps usually provide services like currency exchange, transfer fees, and delivery times.

Wise is a popular example that helps users send remittances home or pay global contractors. Thus, if you are aiming for cross-border payment app development, this is the perfect model.

How to Build a Money Transfer App in UAE?

When you decide to develop a money transfer app in UAE, it is best to first start with an MVP. If you want to test your mobile app ideas on the market with less budget, this is the best. Let’s have a look at the process to create a money payment app.

Step 1: Know the Purpose and Do Market Research

Before you begin the development, just take some time to understand what your money transfer app will do. Who is your app for? Will it be used for sending money within one country or internationally? Will it support bank transfers, mobile wallets, or both?

Just think about what features your users will need. Whether they want features like sending money, receiving money, checking transaction history, or currency conversion, if it’s international.

At this stage, you should also do market research of other similar apps just to check what they provide and how yours can be different or better.

Step 2: Plan Out the Features List

Once you have a clear idea of what you want to develop, the next stage is to list out the crucial features for your app. You should first select the core features or must-have features like user login, bank account link, send or receive money, etc.

These are mandatory features for any money transfer app, and they should not be neglected. Also, keep this in mind that if your budget is low, you can always start with MVP features.

Once your app starts getting a user base, then you can think of adding advanced or custom features. Just try to categorize features into two groups. Must-haves and nice-to-haves to create a money transfer app in Dubai.

This can help you remain focused. It also keeps the development costs and time under control.

Step 3: Create a UI/UX Design

Now it is time to give your money transfer app idea a visual. Just sketch out what each screen of the app should look like. For instance, how should the home screen look? Where should the send money button go? What should the users see after they have completed the transaction?

Just remember to keep the UI clean and simple. It should be simple to use. You can take advantage of the design tools like Figma to create prototypes. Now test your app design with real people to check that it looks visually attractive.

Step 4: Build an MVP Version

Once the design is ready, you can start to develop an MVP. This is the easiest form of your money transfer app. It only includes the core features. MVP helps to test your idea with real people, like whether it really works.

You can focus on adding core features like user registration, basic account linking, simple money transfer, working first, etc. You do not need to integrate all the features at this stage; only the basic features are sufficient.

This approach aligns with our milestone-based process. It helps us catch issues early, stay on schedule, and build a secure, user-friendly app ready for future upgrades.

Step 5: Test and Launch the App

Before you finally launch the money transfer app, it is vital to test everything carefully. The testers check if transactions are being processed correctly. If the app crashes anywhere, or if the user data is safe.

Besides, you can also ask real-time users to use the money transfer app and give feedback. You can fix any bugs or errors that come up. Once everything is tested and your money transfer app works properly, it is ready for launch.

You can release the app on both app stores by following their respective guidelines. After launching the app, do not forget to timely update and maintain it for better performance.

Key Features of a Money Transfer Application

Every money transfer app should have core and advanced features that can make your app successful. So, when you develop a money transfer app in UAE, try to include both features in it.

1] Core Features

You must integrate the core features in your money transfer app for efficiency and security. As an admin, you must carefully choose the core features for fintech app development. Here are some of them.

- User Registration

- Account Verification

- Send Money

- Receive Money

- Transaction History

- Multi-Currency Support

- Exchange Rate Converter

- Contact Management

- QR Code Payments

2] Advanced Features

Now that you are well-versed with the core features, it is best to add some customized advanced features to make your users enjoy it. Let’s have a look at them:

- Biometric Authentication

- AI-Based Fraud Detection

- Real-Time Transaction Tracking

- Blockchain Integration

- NFC-Based Transfers

- Voice Command Integration

- In-App Chat Support

- Instant Refund Mechanism

Want to Launch a Feature Rich Money Transfer App in UAE? Nimble AppGenie Can Help!

Connect With Experts!

Cost to Develop a Money Transfer App

The cost to develop a money transfer app in UAE can be between $25,000 – $150,000 or go beyond. Your money transfer app development project budget depends on app complexity, tech stack, level of expertise, and the development team’s location.

All these factors can affect your budget. So, it is smart to outsource development and use cross-platform frameworks to save money without lowering quality. Additionally, you can calculate the mobile app development cost in UAE with the formula given below.

Total Money Transfer App Development Cost = Development Time * Developer’s Rate

| App Complexity | Cost Estimation |

| Simple Money Transfer App | $25,000 – $40,000 |

| Medium Money Transfer App | $50,000 – $100,000 |

| Complex Money Transfer App | $150,000+ |

How Money Transfer Apps Make Money?

Money transfer applications make money through charging transaction fees or subscription fees, and so on. So, let’s have a look at the app monetization strategies they follow to earn huge revenue.

► Transaction Fees

One of the best ways money transfer apps make money is by charging a small amount of transaction fees. When users send money to another person, the app charges a small percentage of the amount.

If you are a mobile app startup in Dubai that wants to create your own money transfer app, you can also add this monetization model to it. You can charge users a small fee for sending money.

► Currency Exchange Margins

When users send money in one currency and the receiver gets it in another, the money transfer app earns money by charging a markup on the exchange rate.

They provide the users with a lower rate than usual and keep the difference as profit. If your app supports international transfers, you can also apply a small portion to currency conversions.

► Subscription or Premium Features

Some money transfer apps provide premium plans for users who want extra features. For example, faster transfer, higher limits, better exchange rates, and so on.

These come with some monthly charges. You can also provide a free basic plan with limited features and a premium plan with benefits. This gives users a choice and generates consistent income for your application.

How Nimble AppGenie Can Help You Build a Money Transfer App?

Nimble AppGenie is an experienced mobile app development company in Dubai that can create a robust and user-friendly money transfer app. We have experience in developing the best fintech apps with unique features. Our expert team manages everything from ideation to deployment.

At Nimble AppGenie, we ensure that your money transfer app follows legal and banking rules. You can get a customized money transfer app developed just for your requirements.

Our objective is to create a seamless user experience and boost your app’s performance in the competitive market.

Final Thoughts

Money transfer apps are becoming a popular way to send and receive money quickly. Instead of going to the bank, people can now transfer funds in just a few taps on their phones.

Thus, if you’re planning to develop a money transfer app in UAE, it’s important to focus on strong security, follow legal rules, and include useful features that users need.

We’ve shared the key steps to build the app and what to include in the MVP to get started. Now it’s your turn to put these insights into action with the help of the right development team and bring your app idea to life!

Frequently Asked Questions

How can I monetize my money transfer app?

You can monetize your money transfer app by implementing different monetization models. Some of them are transaction fees, currency exchange margins, subscription or premium features.

What are some advanced features to add to a money transfer app?

Biometric authentication, real-time currency conversion, and expense tracking are some of the popular innovative features. Social payment options and QR code transfers also enhance the user experience.

How much does it cost to build a money transfer app?

The cost to make a money transfer app ranges between $25,000-$150,000 or varies depending on factors like app complexity, features, tech stack, platform choice, and so on.

How much time does it take to create a money transfer app?

The average time to create a money transfer app depends on your project complexity and customization levels. A simple app can be built in 2 -4 months, while a complex app can take more than 8 months to develop.