The fintech industry of the UAE is transforming the way people use banking services and manage their money. Due to fintech transformation, traditional banking has shifted to be more seamless and a mobile-first experience.

In this transformation, a mobile banking app like Muscat is standing as the shining example. This app is a personalized financial companion for its users, who can take full control of their financial decisions.

Thus, to develop an app like Muscat is not just about creating a platform to check account balance or transfer funds, but more than that. A professional guide will make your work easier, which you can find in this blog.

Explore this blog till the end for the complete information.

An Overview of the Muscat Banking App

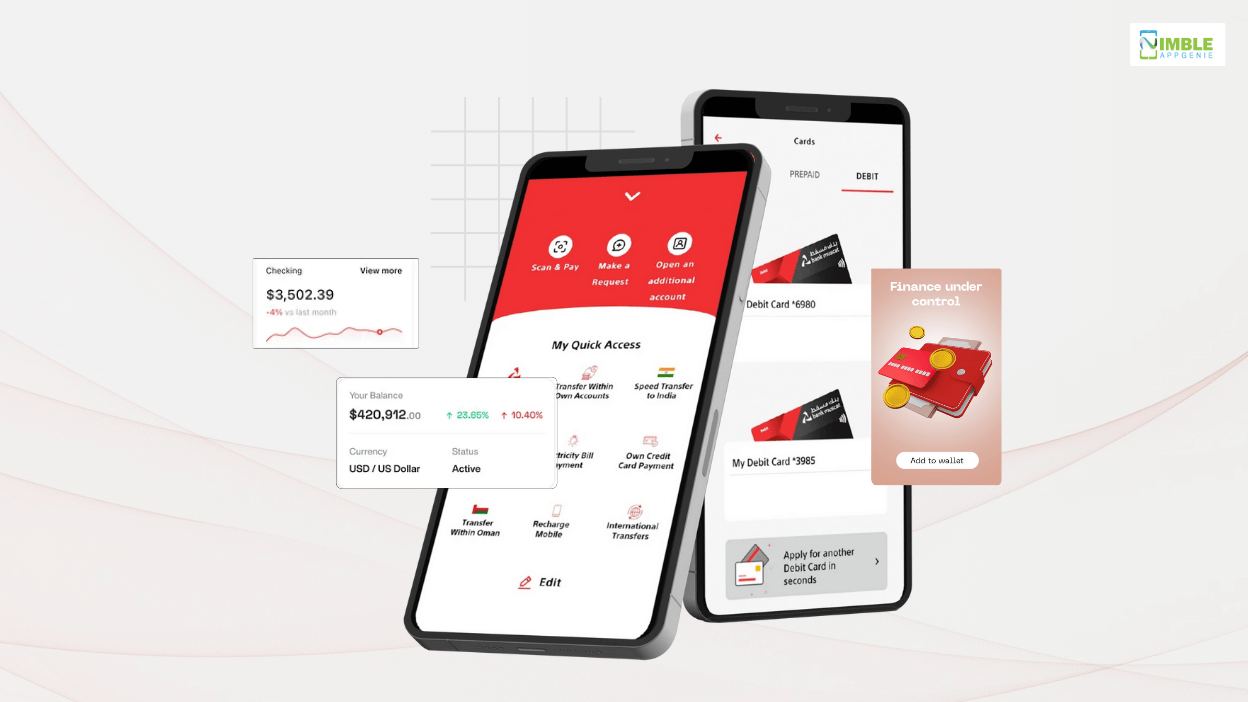

The Muscat mobile banking app is the idea of Muscat Bank of Oman, designed specially to make banking convenient for the people of the UAE. This app helps users take control of their finances and manage them effectively. Users can access banking services right from their smartphones, and there is no need to visit banks physically.

Users can securely connect their bank accounts, credit cards, and digital wallets with the app to import financial data in real time. Using the app, Muscat users can pay utility bills, deposit checks, check account balance, send & receive money, and locate Muscat ATMs.

The Muscat app allows its users to record and categorize their daily financial transactions. It can be done either manually or automatically. For Muscat, privacy and security are the key priorities to ensure that the app uses bank-grade encryption with two-factor authentication.

All these were done by Muscat so that it can keep the user data protected from any potential cyberattacks. Thus, Muscat is the complete financial tool for the population of the UAE.

Looking into the Mobile Banking Industry of the UAE

Digital banking in the Middle East is growing drastically due to the smart initiatives of its government to empower digital transformation. Additionally, people in the UAE are also looking for a convenient option to access multiple banking services.

This has fueled the growth of mobile banking apps like Muscat in the country. We have some interesting numbers that will prove our above claims.

- Banking innovation in the UAE has a strong foundation, as eight in ten, i.e., 83% of the people, access banking services through mobile apps.

- 87% of the people in the UAE have accepted the fact that they would prefer an app that can offer them personalized insights into their finances.

- It has been found in a report that nine in ten people which is 89% of the people, have digital-first accounts in the UAE.

- 86% of the people in the UAE prefer banking apps that can integrate their services with non-financial services that they use in their daily life, like ride-hailing or eCommerce.

The above reports are clearly giving you a signal that if you have mobile app ideas that can simplify banking in the UAE, like Muscat, then give effect to them.

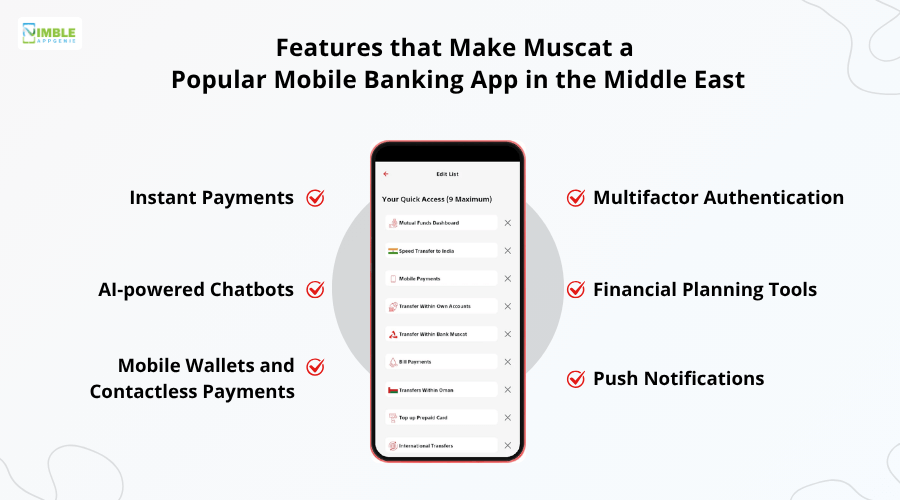

Features that Make Muscat a Popular Mobile Banking App in the Middle East

The Muscat Bank online banking app is a popular choice among people in the UAE. You must be thinking of the reasons why the majority of people prefer this app.

The robust features of the app make it a worthy choice in the whole UAE. You should know about these features, as they will also help in your evaluation.

1] Instant Payments

Instant payments are one of the must-have features of the Muscat-like mobile banking app. The users can use this feature to send and receive money instantly to their friends and family, which makes splitting bills, rent payments, and other financial transactions easier.

2] Multifactor Authentication

Since Muscat is an online banking app, keeping it secure is of utmost importance. That is why the app has the feature of multi-factor authentication, which is just an extra layer of security. Users have to verify their identity through multiple methods: fingerprints, passwords, etc.

3] AI-Powered Chatbots

Muscat makes the best use of AI in mobile apps with chatbots that can help in resolving issues of app users. The AI-powered chatbots can even initiate transactions within the app. Chatbots can interact in natural language, making it easier and faster to get things done.

4] Financial Planning Tools

The Muscat app offers an excellent feature for its users, which is financial planning tools. This tool is an excellent feature for users who want to track their spending, set goals, and make informed financial decisions. This will be a good feature for you to consider.

5] Mobile Wallets and Contactless Payments

Now comes another important feature, which is a part of the Muscat mobile banking app: mobile wallets and contactless payments. This feature will make it easy for users to make online financial transactions safely at stores or other merchants from their smartphones.

6] Push Notifications

Push notification is one of the crucial features for an online banking app like Muscat. This feature will help users have real-time information about all the financial activities, from deposits, withdrawals, to money transfers. This will help identify suspicious activities.

Steps to Build an App Like Muscat

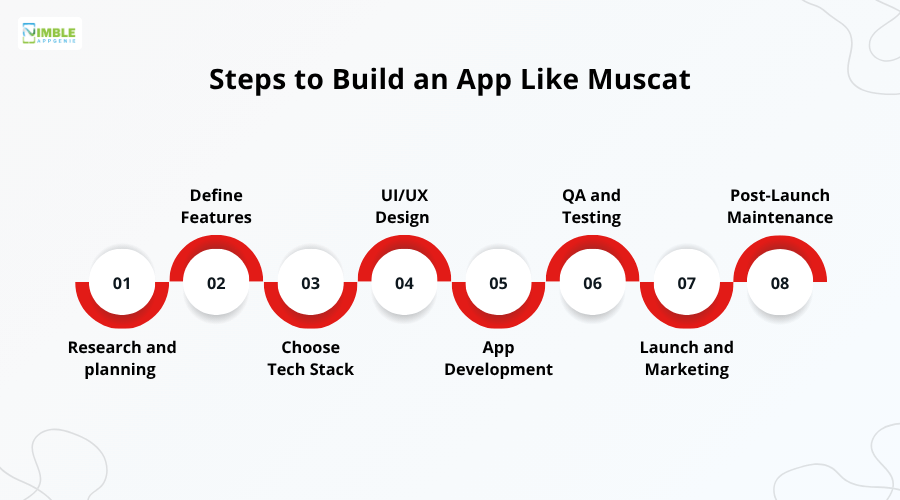

As you are planning to develop an app like Muscat, you have ended up on this blog, so without wasting any more time, we will jump into that. It is crucial to follow the strategic steps of development only when you can create the app successfully.

So, to make it easy for you, we have explained the steps below. You can either follow the steps or, for the best result, hire app developers.

Step 1: Research and Planning

Start the app development process with proper research and planning of your mobile banking app, like Muscat. Research about the competitor apps along with Muscat to learn about their features, functionalities, and audience demands.

This will help you to plan your own app, choosing the right features and functionalities that help you to stand out.

Step 2: Define Features

After that, define the features of your app that help you to get a competitive edge. Choose features that can uniquely represent your mobile banking app and also help attract more users.

You can check the features of the Muscat app, which gives you clarity about the types of features. We have told you about Muscat’s features in the above section.

Step 3: Choose Tech Stack

After choosing the features for the app, it’s time to decide on the tech stacks that you want to use to create a Muscat-like mobile banking app.

Choosing the right tech stack is very important because the quality of your app depends on that totally. There are several technologies, and there are also a few advanced technologies that are must have.

Step 4: UI/UX Design

Now, start to create the UI/UX design of the online banking app. The design of the app will decide the quality of the app interface, so create a prototype of the app first and let potential users decide.

It will help you to include a feature that is needed the most, design the icon, and the colour of the app. The app must be attractive and have an intuitive interface.

Step 5: App Development

After creating the design, start the development of the mobile banking app like Muscat. To develop a money transfer app in the UAE, just like Muscat, you have to carry out frontend and backend development. In frontend development, you have to turn the UI/UX design into a functional app screen.

In backend development, make sure the backbone of the app is working perfectly, integrate payment gateways, APIs, databases, and others.

Step 6: QA and Testing

After developing the app, perform QA and testing to make sure the app is working in its optimum quality. The app must be free from every potential issue and bug so that it can offer the best user experience.

You have to run several tests, which include performance test, functionality test, security test, usability test, compatibility test, and others.

Step 7: Launch and Marketing

Now that you are sure your app is free from issues and bugs, it is ready to be launched on app download platforms like Google Play, Apple Store, and others.

Users can easily install the app from them to use it. Before the launch, promote the app through various channels like social media to create buzz and attract more potential users to your app.

Step 8: Post-Launch Maintenance

Launching the app is not the last step of app development; even after the launch, it continues with post-launch maintenance.

So, your app should keep providing the best experience to the users who are using your app. Monitoring the app to keep it updated with trending features, new OS, security patches, and free the app from bugs.

Build a secure and user-friendly banking app like Muscat in the UAE. Partner with Nimble AppGenie today!

Talk to Our Experts!

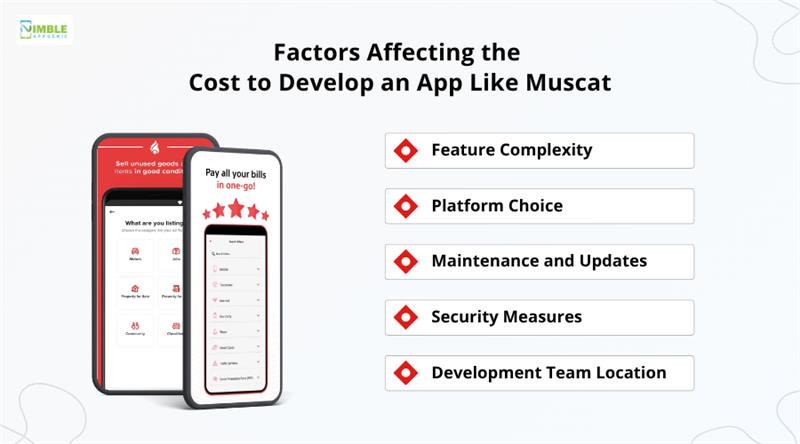

Cost to Develop an App Like Muscat Bank

So, we suggested in the above section to invest in an app development company, but before doing so, you should know how much it can cost you. Knowing how much it can cost to develop a mobile app like Muscat helps you to create a budget.

The average cost of creating a similar mobile banking app like Muscat falls between $30,000 and $250,000 or more. If you are creating the MVP version of the app, then it will cost you less, but to create a full-stack version of the app, you need to invest more than $250,000.

There are several factors that influence the development cost of the app. These factors have been listed and explained below for your understanding.

➢ Feature Complexity

The complexity of the feature will decide the cost of developing a similar app to Muscat. This mobile banking app consists of several advanced features that include integrated technologies like AI, GPS, and others. So, this will increase the cost of development.

➢ Platform Choice

The choice of platform will also decide the development cost. There are two types of native platforms for iOS or Android, and a cross-platform for both iOS and Android. If you invest in creating a native platform app, then it will cost less than creating cross-platform apps.

➢ Maintenance and Updates

Keeping the app updated and maintained requires lots of effort, which automatically increases the cost of app development. You have to make sure the app is free from bugs, updated with new features, OS, and security patches that require ongoing cost.

➢ Security Measures

It is crucial to keep the mobile banking app secured from potential cyber attacks and keep the users’ data safe. You must implement advanced security features, like biometric, two-factor authentication, and others, which increase the development cost of the app.

➢ Development Team Location

The location of developers also decides the development cost of your modern mobile banking app, like Muscat. There are two types of developers: onshore (within the country) and offshore (outside the country). The former will be costlier than the latter teams.

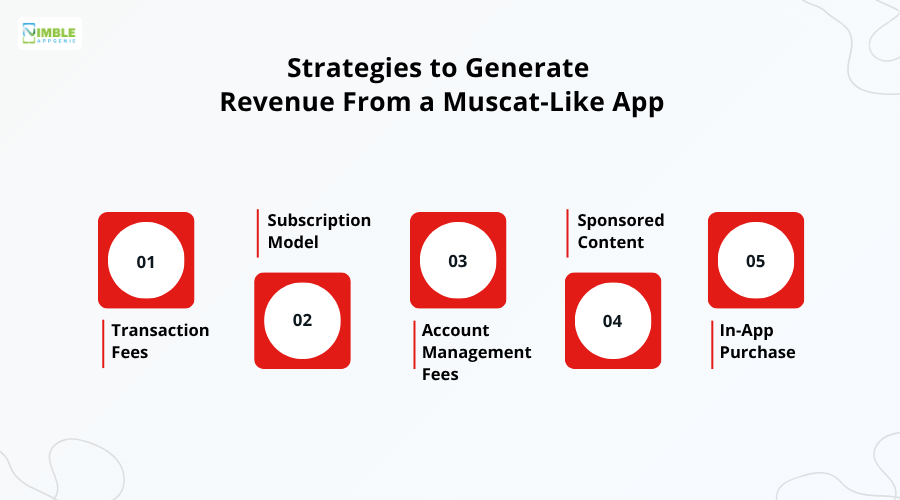

Strategies to Generate Revenue From a Muscat-Like App

Your online banking app can be a great source of revenue for your business. There are a few strategies that apply, which will help you to make money from your app, like Muscat.

We have shared a few mobile app monetization strategies below for your knowledge. Let’s take a look at them one by one.

● Transaction Fees

Implementing transaction fees can be a great way to monetize your online banking app. For every small transaction, like fund transfers, bill payments, and foreign remittances, you can charge small fees. This will create revenue while maintaining competitiveness.

● Subscription Model

Create a payment plan for different premium features other than the basic features. So when users need to use the premium features, they have to buy their preferred annual or monthly subscription models. This will help you earn money and target different classes of users.

● Account Management Fees

Account management fees can be a good way to make money from the app. Some users have premium accounts, so the bank charges annual or monthly service fees to manage those accounts. Users will get benefits like a higher limit, priority support, and others.

● Sponsored Content

You can allow the financial partners to run strategic advertisements or display sponsored content of financial products on your app. This will come with great scope to make money, for every purchase of credit cards, insurance, and other products made through your app.

● In-App Purchase

You can add value-added offerings like instant credits, credit report monitoring, or financial planning applications. These services have to be purchased by the users within the app. So, whenever users buy any in-app services, this will add alternate revenue streams.

Nimble AppGenie is the Perfect Partner to Develop an App Like Muscat

Want to build an app that can simplify the banking processes for the people of the UAE and can be accessed from anywhere, just like Muscat? To fulfill this goal, you need a reliable partner that can help you with the project and complete it before the deadline. Nimble AppGenie will be the perfect solution to turn your idea of a mobile banking app like Muscat into reality in real quick.

Nimble AppGenie is famous for being the best fintech app development company in the UAE, who have a team of the most skilled developers. The team has the experience of handling every project from scratch. They will plan the mobile banking app and will seamlessly build it, fulfilling all the specific requirements.

Conclusion

To develop an app like Muscat, you have to make sure it is smarter, human-centric, and simplifies the way people connect with money. Your app must be the perfect blend of security, speed, and features that empower its users.

You have learned it already, how your fintech app, like Muscat, can be created successfully. Don’t forget to make the app innovative and secure with the integration of smart technologies like biometric authentication, AI-driven analytics, and others.

Don’t give your customer an app that can just manage money, but become the reason to make them feel confident about their future financial decisions.

FAQs

How can a mobile banking app like Muscat benefit?

By developing a mobile banking app like Muscat, users can enjoy several noticeable advantages. To make it easy for you to understand, we have talked about the advantages below.

- On-the-go accessibility- A mobile banking app like Muscat will help users to manage their finances from anywhere, make payments seamlessly, and access their bank account, which saves time.

- Enhance security- The mobile banking apps have become a more secure banking option. These apps come with several security features so users can make each of the transactions more secure.

- Cost saver- Users can save a lot by making transactions through the mobile banking app, like Muscat. For every transaction, users can enjoy lower fees, which slowly reduces the dependency on physical branches.

- Efficient payment processing- Users of these mobile banking apps can make single or bulk transactions from anywhere and at any time. Users can also enjoy scheduled or immediate transactions.

How much will it cost me to create a mobile banking app like Muscat?

If you want to create a robust and efficient mobile banking app, just like Muscat, then it will approximately cost you between $30,000 and $250,000 or more.

Several factors are affecting the development cost of the mobile banking app, from the choice of platform to developers' location and more. The basic version will cost less than the full-stack version.

Can an app like Muscat help businesses make money?

Yes, a mobile banking app can efficiently make money for businesses to help them gain financial growth.

There are several strategies that businesses need to follow to create a stream of revenue from an app like Muscat. These strategies are mentioned below for your understanding. Take a look.

- Transaction charges

- Monthly fees

- Internet on loan

- Partnership or collaboration

- Subscription services

How can I ensure the security of my banking app?

Since you will be developing a mobile banking app that will help users make seamless financial transactions, strengthening its security is paramount. There are several ways you can ensure the security of the app.

You have to integrate security features into your mobile banking app. The features include biometric login, data encryption, two-factor authentication, and a real-time fraud detection system.