Let your customer break the long queues at the branch and offer convenience, personalization, and instant access with an app just like ENBD X.

In the UAE, the Emirates NBD X app has redefined digital banking for the tech-savvy population by allowing them to access banking services on the go. This app has a perfectly blended, sleek design, top-notch security, and AI-powered features, making it a strong choice.

Its success has encouraged many fintech businesses to invest in the creation of similar apps. If you are also one of those who want to create a successful app like ENBD X, then choose an app development company for a seamless solution.

However, if you want to learn the development process and do it on your own, read this blog till the end for complete information.

Let’s get started.

A Know-How of the ENBD X App

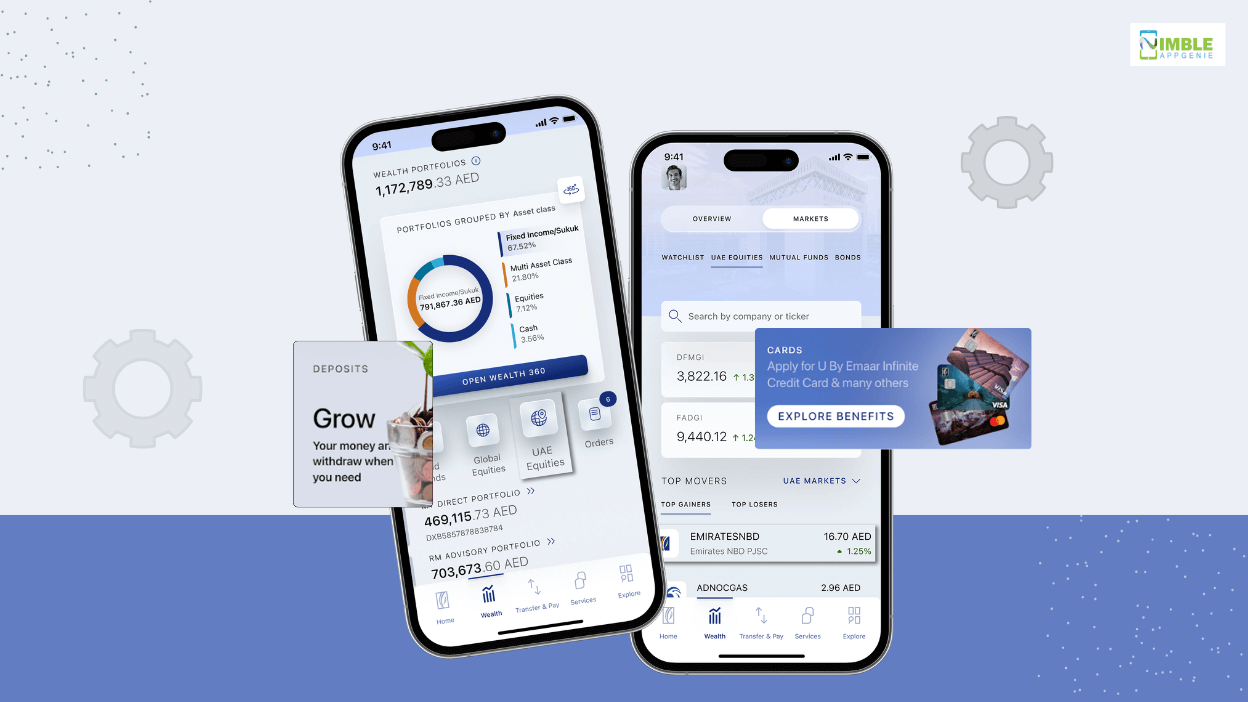

ENBD X is the mobile banking app created by Emirates NBD X, a bank based in the UAE. NBD stands for the National Bank of Dominica. This app aims to let the people of the country manage their finances on the go.

So, this app has made it seamless to conduct banking activities without going to physical banks. Emirates NBD X app offers a wide range of advanced features to its esteemed users.

The features that make this app a popular choice in the UAE include account management, international and local money transfer, bill payments, managing cards, and investment services like trading, bonds, etc.

Mobile Banking Industry Statistics

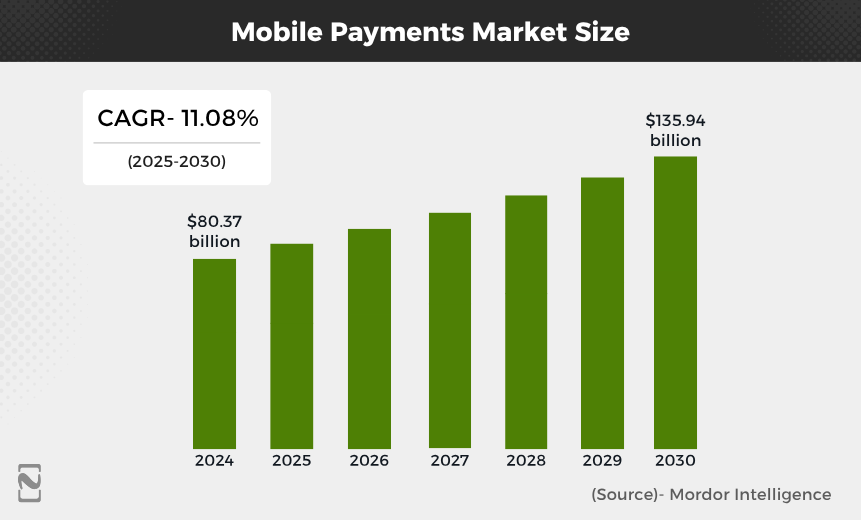

If you are confused, why your fintech business needs to develop a money transfer app like ENBD X in the UAE, you need to look into the market reports. So, here are a few statistics as per our research, which we have mentioned below, that need your attention.

- The market size of the UAE mobile payments is expected to grow at a CAGR of 11.08% as it is predicted that it will reach $135.94 billion by 2030 from $80.37 billion in 2025.

- The growing demand for mobile payments is projected to mean that the UAE Digital Banking Market will reach $38.7 billion by 2031 from $12.5 billion in 2025. Thus, it will grow at a CAGR of 20.5%.

- Now, the market statistics of ENBD X say that it has over 4 million active users across the UAE. Users have increased by 49% since the year 2023.

The above statistics clearly say that digital banking in the Middle East is getting stronger, making financial transactions easy. So, if you have mobile app ideas for online banking, then you must turn them into reality and be a part of this ever-growing industry.

Steps to Building a Banking App Like ENBD X

Creating a mobile app similar to ENBD X doesn’t feel challenging if you follow the right process. For that, you need to learn it, so here we are to help you out with a step-by-step guide below.

However, if you want to save time and invest it in your business planning, then the perfect solution is to hire mobile app developers.

But right now, let’s learn the steps of banking app development.

Step 1: Research and Planning

A leading mobile app development company in Dubai starts with research about the app Emirates NBD X and other competitor online banking apps.

This research will help you to know about their features, which make them the leading choice, and know about their audience preferences. Now the information will make it easier for you to plan your mobile banking app.

Step 2: Select the Right Features

Now jump to the step where you have to choose the right features for your modern mobile banking app. Since you will be building a mobile banking app like ENBD X, you must have good knowledge about its features.

You should know that the popularity of this app in the UAE market is shaped by its features. We have listed a few of the core features of this app below.

-

Centralized Account Information

Users of the ENBD X app can view all of their account details in a centralized place and even the account balance in real time.

This feature of the app shows the account name, numbers, and available funds of the users, making it very intuitive. It also offers visual representations through charts for an easy, quick overview.

-

Seamless Money Transfer

Emirates NBD X mobile banking app offers a money transfer feature that makes it easy for users to send money directly from their bank account to others’ accounts.

The app offers several transfer options, which include one-time transfers, planned transfers, and payments that can be done more than once.

-

Card Services

The app offers card services to its users through which debit or credit cards can be seamlessly linked with the app. Cards can be managed directly from the app easily.

Users can activate their cards, block them, and set up other settings. The app also makes it easy for the app users to apply for loans via cards.

-

Redeem Points Instantly

The feature allowing users to redeem points is great, which allows them to convert their accumulated reward points into real cash.

Every transaction made via cards, online shopping, and by others allows customers to earn loyalty or reward points every time. Within the Emirates NBD X app, users can view live reward points and can redeem them instantly.

-

DirectRemit

DirectRemit is the feature of the app that makes international remittance convenient, fast, and at a very low cost. It offers a lightning-fast money transfer feature to multiple countries.

This feature makes this app a strong choice for all the foreign workers in the UAE, making it easy for them to transfer money.

-

ATM and Branch Locator

This app offers a feature that makes it seamless for anyone to locate Emirates NBD X ATMs anywhere in the UAE.

Additionally, the app also helps its users to locate a dedicated branch of the bank in their locality and anywhere in the UAE.

Step 3: Choose the Correct Tech Stack

After choosing the right features, it’s time to consider the right tech stack to build a high-quality banking app. You must use the tech stack that can match your business goals and the budget as well.

Each part of the app must be created with dedicated technology, or else it could affect the outcomes.

Step 4: UI/UX Design

Next, start UI/UX design to build a mobile app like ENBD X, which helps you to create a great user experience (UX) with an interactive user interface (UI).

Carry out wireframing and prototyping of the app to build features, icons, colors, and design elements. You must aim to match the app design with the brand’s USP.

Step 5: App Development

Now start to develop the app with a clear vision to match the success of the ENBD X. To develop an app like Emirates NBD X, you have to carry out both backend and front-end development. In the frontend, you have to transform the UI/UX design of the app into its intuitive interface with the magic of coding.

Then comes backend development, as per which you have to make sure it is working in its optimum condition. From features to database, security, and other functions of the app are in the hands of backend development quality.

Step 6: App Testing

After finishing the app development, you have to perform rigorous testing, which is crucial in the app development process.

This step makes sure you can develop a banking app that is free from potential issues or bugs and maintain the highest quality. Testing consists of performance testing, security testing, functionality testing, and others.

Step 7: Launch & Marketing

Now that you have tested the app and fixed potential problems that affect app quality, it’s the perfect time to launch the app.

Numerous app download platforms exist, which include Google Play, Apple Store, and third-party apps. Launch the app on those platforms for users to install. Promote your app beforehand to attract more users.

Step 8: Post-launch Maintenance

App development done, testing done, deployment done, but the work is not complete yet.

Post-launch maintenance is also a part of the app development process, which makes sure the app is offering the best performance even after deployment through feature updates, OS updates, security patch updates, and other updates.

Cost Breakdown to Develop a Mobile Banking App like ENBD X

Looking at the growing competition in the fintech industry, you must invest in mobile apps to stand out. However, it is important to ensure this investment doesn’t feel heavy on your pocket, so choose technologies and features as per your budget.

To plan the budget, you need to know the mobile app development cost, like Emirates NBD X, which typically ranges between $30,000 and $250,000, or can be more. Several factors determine this cost, which you must be aware of. So, we have discussed three of the top factors below that need your attention.

➢ Complexity of Features

The complexity of building the features you have selected for your online banking app determines the cost of development.

Basic features are easy to integrate as compared to the advanced options, which include AI in mobile apps. If you have a budget constraint, go for basic features for your app.

➢ Choice of Platforms

Your platform choice decides the app development cost. Platforms are two Native for either iOS or Android, and cross-platform creates both under a single code.

The former is costlier than the latter; also, the iOS app development cost is less than the Android app development cost, primarily due to device fragmentation.

➢ Location of the Development Team

Where your development teams belong is a factor that decides app development cost. There is an onshore team that belongs to the same country, and an offshore team that belongs to a foreign country.

The latter is the budget-friendly option and is more talented than the former. So, hire developers wisely.

Strategies to Make Money with a Mobile Banking App like Emirates NBD X

Whether you are a fintech startup or a well-established organization, investing in fintech app development in the Middle East will create a stream of revenue. This will not only allow your business to achieve a competitive advantage but also to enjoy financial growth.

To allow mobile apps to make money, you must know the strategies and apply them accordingly. Below are a few of the monetization strategies we have discussed. Let’s take a look.

● Transaction Fees

This is a common and must-follow monetization strategy for your online banking app. It will allow your app to make money for your business by charging small fees for every transaction made by users through this app.

● Collaboration Model

Next, here is the collaboration model, in which you have to partner with financial institutions, insurance companies, and other businesses to sell products. For the sale of each product and service, you can earn a percentage of commission.

● Subscription Model

An app can offer its users basic features to premium features, and they can access them as per their requirements. To access premium features offers users are offered tiered prices and can only be unlocked through an annual or monthly subscription.

Create a Banking App like ENBD X with Nimble AppGenie

Are you hunting for a fintech app development company in Dubai that can make it easy for you to create and deploy your online banking app like ENBD X? Your search ends here, as Nimble AppGenie is the popular and trustworthy name in the UAE.

Once a mobile app startup, we have now become a global name with proven experience in multiple niches, from fintech to fitness and more. Our expert team of app developers is an asset to our esteemed organizations that create apps from scratch as per the client’s requirements.

Conclusion

Seize the opportunity to redefine the banking experience for the tech-savvy customers of the UAE. Don’t just focus on features and technology, but create a safer online banking app, which is the key to success.

You have access to the whole process, which will help you to create an app like ENBD X that helps your business to stand out in today’s fintech landscape.

Turn the idea into a next-gen mobile bank app that delivers a top-notch experience.

FAQs

How much will it cost you to build an app like ENBD X?

The average cost to create a mobile banking app like Emirates NBD X falls between $30,000 and $250,000 or more. Various factors affect its development cost, like the developer's location, platform choice, feature complexity, and many more.

Depending on the type of app, the cost varies. Basic app development costs less than a full-stack one.

How much time do I have to invest to create an app like ENBD X?

The average time you have to wait for the whole development process to complete and finally create an app like ENBD X falls between 7 to 12 months or more.

The development time is totally based on the complexity of the process and the types of features being integrated into the app. The MVP version takes 5 to 7 months, and a feature-rich app takes more than 12 months to complete.

Can I earn revenue from my online banking app?

Your mobile banking app can become a strong bridge for your business to earn a good amount of revenue.

So, yes, of course, you can seamlessly earn revenue by creating a mobile banking app, for which you need to consider and incorporate a few strategies.

The strategies have been listed below for your better understanding. Let’s get to them.

- In-app purchases

- In-app advertisements

- Collaboration model

- Licensing and merchandise

How to keep a mobile banking app secure from cyberattacks?

With the rising threat of cyberattacks, it's a good idea to safeguard the app beforehand. There are a few robust security protocols that need to be considered, which makes it easy for you to keep the user data of the banking app secure.

You must know about the security protocols, which is why we have shared a few of them below.

- End-to-end encryption.

- Mukti factor authentic (MFA).

- Secure API management.

- Regular security audits and compliance with PCI DSS, GDPR, or ISO/IEC 27001 standards.