In the UAE, where digital transformation is at its peak, the population no longer puts their time and efforts into traditional banking.

They rely more on an innovative, secure, and simple all-in-one, powerful mobile banking app that can be accessed anytime and from anywhere. In this CBQ bank, Qatar has set a higher standard by building an ecosystem for digital banking that delivers convenience and improves the financial journey of its customers.

Many fintech enterprises and startups in the UAE are investing in mobile apps. Are you also someone who plans to create a thriving banking app like CBQ, but doesn’t know where to start?

Explore this blog till the end to get complete information on planning, features, cost, and more.

Explaining about CBQ (Commercial Bank of Qatar) App

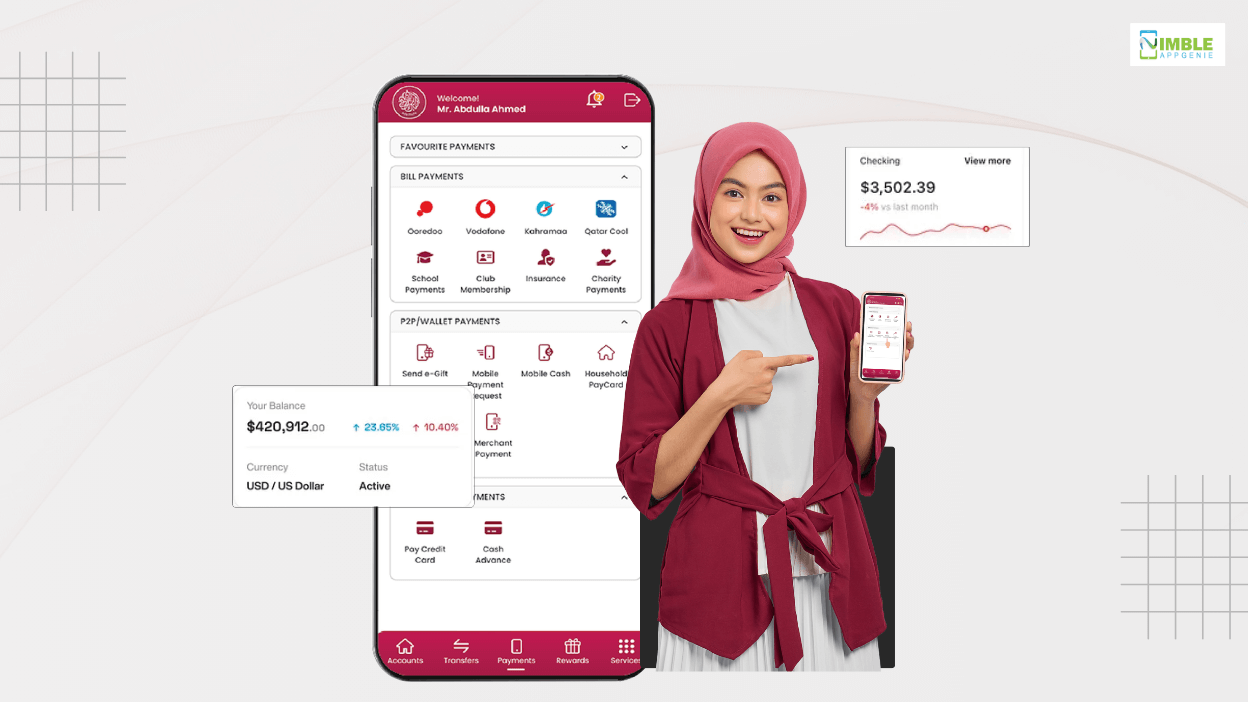

The CBQ app is the official online banking application, established by the Commercial Bank of Qatar to make banking easier for the UAE population. This app lets its users manage their banking services from anywhere and at any time directly from their smartphones.

Through the CBQ app, users can check their account balance, view transaction history, send & receive money both locally and internationally, pay utility bills, manage credit cards, open a new account, and apply for loans.

This is one of the top fintech apps in the UAE that helps both individuals and businesses to do their banking work without visiting the branch physically. This app also has several other features, which include biometric login, real-time notifications, card controls, and spending insights.

The Market Info of the Mobile Banking App in the UAE

Digital banking in the Middle East has witnessed an all-time high growth due to the demand of the tech-savvy population of the nation. It brings convenience, allowing individuals & businesses to save time. As a result, the number of online banking apps, such as CBQ, is increasing.

We will let you look into the market of mobile banking apps in the UAE and also the CBQ app, so that you can understand the significance more clearly.

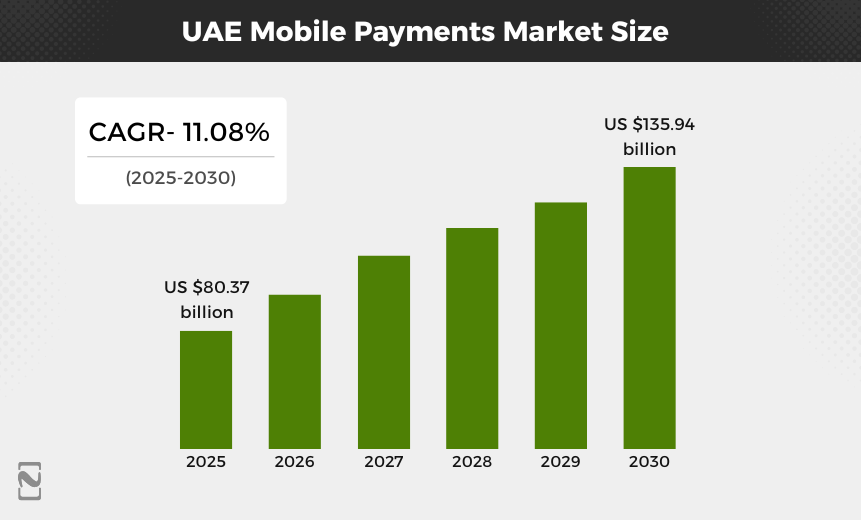

- The mobile payments market of the UAE has reached the market size of $80.37 billion in the year 2025, and it is expected that by the year 2030, it will reach the value of $135.94 billion.

- Between 2025 and 2030, the mobile payment market in the UAE is expected to grow at a CAGR of 11.8%.

- The rise in the mobile payment market is due to the 83% of people who use mobile apps to access banking.

- 87% of respondents are attracted to using banking apps that offer personalized finance services.

- 89% of the people in the UAE have a digital-first account.

- This shows that 95% of customers of the CBQ app have registered for their digital channels, and the app has witnessed more than 4 million logins per month.

Thus, if you have mobile app ideas similar to the online banking app CBQ, you should turn them into reality. You can fulfill the rising demand for digital banking apps, and you will also get the chance to thrive among the competition.

Features of the CBQ Mobile Banking App

To develop a money transfer app in the UAE just like the CBQ, you need to be familiar with its features, which is the reason for its popularity. Knowing about the features will also help you later in the development process, when you have to choose the right features.

We have listed the features below for your knowledge. Let’s take a look at them.

1] Account and Card Management

CBQ gives users the ability to manage their whole bank account directly from the app. Users can manage their credit and debit cards from the CBQ cards section. Activate, block, or replace credit and debit cards seamlessly. Users can also manage the credit card limit.

2] Pay Bills & Transfer Funds

Since users can manage their bank account in the CBQ commercial bank app, it also allows them to transfer funds and pay bills. Transfer funds to yourself or to friends easily, and also make international transfers seamlessly. Users can also pay merchant and utility bills.

3] Faster Remittance Transfer

Using the CBQ app, users can also do remittance transfers anywhere in the world. This online banking app permits users to transfer money to more than 40 countries. Within 60 seconds, users can transfer remittance as a bank account transfer, wallet transfer, or instant cash pickup.

4] Security and Personalization

The CBQ app is one of the secure online banking apps that allows users to register for fingerprint, face ID, and voice activation to make safe transactions. Users can personalize their account, main dashboard, and card names. With that, they can access e-statements.

5] Rewards

CBQ rewards are also one of the crucial features of the app, through which users of the app can earn rewards for every transaction. Further, the reward points can be instantly redeemed by the users.

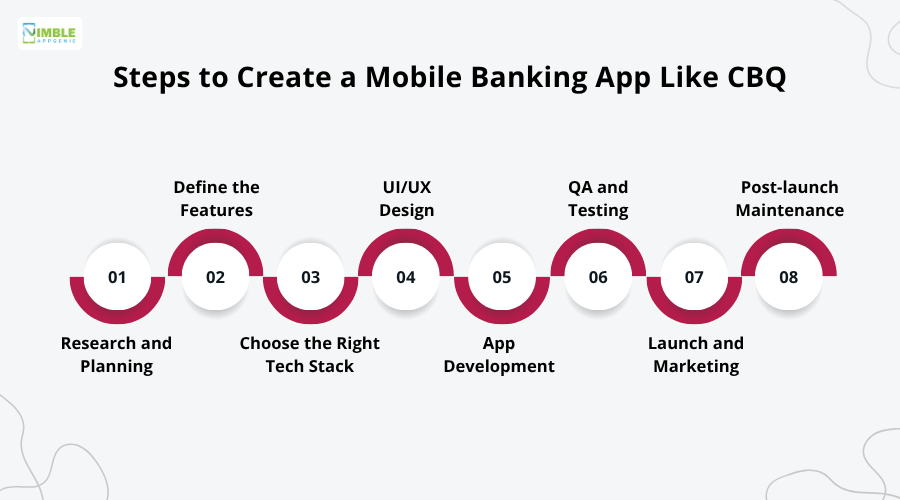

Steps to Create a Mobile Banking App Like CBQ

You have ended up on this blog to learn the process of creating an online banking app like CBQ Bank Qatar. You have learned about this app and the mobile banking app market of the UAE that influenced the growth of such apps. Now you will learn the dynamic steps to create such a mobile banking app.

We have explained all the dynamic steps that an app development company in the Middle East follows to create a mobile banking app similar to CBQ. Let’s get started.

Step 1: Research and Planning

Start the development of your app like CBQ online banking with thorough research and planning. Carry out competitor research of similar apps, including CBQ also and learn about the audience as well.

This will help you to know the features and functionality you can add to your app and understand audience demand to fulfill them. The app development will become easier with the information.

Step 2: Define the Features

The next step is to define the features that you wish to integrate into your online banking app. To choose the right app features, you must evaluate the features of the CBQ bank app because you are creating a similar app, and its features are what make it the popular choice.

You must have already explored the features of the CBQ app that we have listed in the above section. It will be a help.

Step 3: Choose the Right Tech Stack

Now, after the features, you must learn about the tech stacks that will be used to create the app. The quality and functionality of the apps are highly dependent upon the choice of tech stacks.

So, be very careful while you choose the tech stacks for your mobile banking app in the UAE. We will create a table below so that the required tech stacks can be clearly mentioned for your better understanding.

| Categories | Tech Stack |

| Frontend development | Swift, Kotlin, React Native, Flutter |

| Backend development | Node.js, .NET, Java, Spring Boot |

| Authentication services | Biometric login, fingerprint, and face recognition |

| APIs | Open Banking APIs, Payment Gateways (Visa, MasterCard), AML/KYC verification APIs |

Step 4: UI/UX Design

Now, start the UI/UX design of the app, similar to the CBQ mobile app. Ensure the design of the app is visually attractive and has an intuitive interface. Create the prototype of the app so that potential users can use it and suggest required changes.

In this step, you have to design the features of the app, like CBQ cards, the icon, and choose the correct background color. The user interface (UI) of the app must offer the best user experience (UX).

Step 5: App Development

Now, start developing a mobile banking app similar to CBQ, where you first have to do the front-end development and then the backend development. For the frontend development, you have to turn the UI/UX design of the app into an intuitive app interface that users can navigate seamlessly.

Now, create the backend of the app that will make sure all the features of the app are working perfectly, integrate APIs, payment gateways, and more.

Step 6: QA and Testing

After you’re done with developing your app, start testing the app, which is a crucial step to make sure the app is free from potential issues and bugs. Don’t skip this step before launching the app if you want the users to get an excellent app like CBQ internet banking.

The testing includes functional, performance, security, and more. This will ensure how much the app can handle loads, protect user data, and more.

Step 7: Launch and Marketing

After testing the app, making sure everything is working perfectly without any issues, you can proceed to launch the app. There are several online app download platforms where you can launch the app, which include Google Play, Apple Store, and third-party platforms for users to install.

Before the launch, promote the app through various channels social media, email, and others, to create buzz and attract more users.

Step 8: Post-launch Maintenance

Launching the app is not the ultimate step of the mobile app development process. You need to keep the app in its right state, for which you have to carry out post-launch maintenance.

Ensure the app doesn’t lag or break down while customers are using the app, for which you have to keep the app under monitoring. Track its performance, address the issues to fix it, keep the operating system updated, and keep security patches updated.

Build a CBQ-style app with Nimble AppGenie to offer a digital banking experience to your customers!

Talk to the experts today!

Cost to Develop an App Like CBQ Bank

You have learned the way an app like the CBQ app can be created, and to simplify the process, you can hire app developers. However, before you proceed, you should know how much it will cost you so that you can create a budget.

Thus, the cost to develop a mobile app like CBQ with the help of app developers will fall between $30,000 and $250,000 or more. If you plan to create a basic version of the app, then it will not cost you more than $40,000. But to create a full-stack app with the latest technologies and integrating advanced features, it will cost more than $250,000.

The cost totally depends on several factors of the app development. We have listed a few of the factors below for your understanding. Let’s take a look at them.

➢ Feature Complexity

The complexity of the features that you will be integrating into the app will determine the development cost of the app, like CBQ. The more sophisticated the features of the app, the development expense will be.

Suppose you are integrating AI in mobile apps like chatbots, fraud detection, and others; it will increase the cost.

➢ Technologies

The choice of technologies for a mobile banking app will influence the app development expenses. If you are choosing sophisticated frameworks like React Native or Flutter will cost less compared to individual development for iOS and Android.

Additionally, backend infrastructure, cloud services, and third-party integrations also contribute to cost.

➢ Developers Location

The location of the developer team will also decide the development cost of the online banking app, like CBQ.

There are onshore and offshore developers; the former are located within the country, and the latter are located outside the country. Onshore is costlier as compared to the offshore team and is less experienced as well.

➢ Choice of Platforms

The platform for which you want to build your online banking app will also decrease its development cost. There are native platforms for iOS or Android and a cross-platform for both iOS and Android.

If you are creating a cross-platform app, then it will be expensive for you. But to create a native app, you have to invest less.

If you are creating a native app, then the iOS app development cost will be on the higher side than the Android app development cost.

➢ Maintenance & Support

Keeping the app maintained is very crucial so that users don’t face any issues while using the app. Giving continuous technical support, tracking the performance of the app, and maintaining the app can increase the development cost.

This is because you have to keep the OS, security patch, and features of the app updated for better performance.

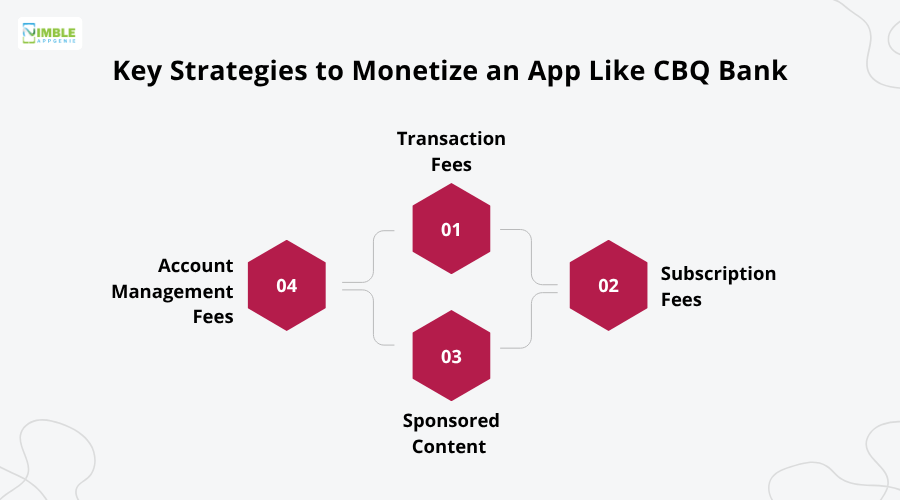

Key Strategies to Monetize an App Like CBQ Bank

Your online banking app can offer you long-term profits for your business, but you have to follow strong mobile app monetization strategies. To help you create a positive stream of revenue for your businesses, we have shared a few of the monetization models below.

Let’s take a look at them quickly.

● Transaction Fees

You can apply small transaction fees to every fund transfer, bill payment, and foreign remittance made through the app. This will help you create a consistent stream of revenue for your business.

● Subscription Fees

You can charge subscription fees to your users who want to use premium features. There should be several monthly or annual plans that users have to buy to use the premium features of the app. This way, your app can make money.

● Sponsored Content

Sponsored content is also a good strategy for your app to make money. You can run sponsored content for products like insurance, credit cards, or investment plans on your app. This is a good way to make money without affecting user experience.

● Account Management Fees

Some users of the app have premium accounts, and banks apply monthly or annual charges to manage these accounts. This is a good way for your app to make money for your business. Premium accounts come with several benefits.

Nimble AppGenie will create a Leading Banking App in the UAE like CBQ Bank

Confused about how you can create a banking app similar to CBQ Bank all by yourself? Don’t worry, you have the option to partner with a mobile app development company to lessen your hassle.

Nimble AppGenie will be the perfect partner in your banking app development journey. We are the leading fintech app development company in the UAE that has the best team of expert developers.

Moreover, we have more than 7 years of experience in creating mobile apps for vast industries. From fintech to fitness and music to restaurant and more, our team of expert developers can create any app from scratch as per the client’s needs.

Conclusion

In the end, the fact is clear that CBQ is quite a demanding mobile banking app in the UAE as it offers a secure, seamless, and personalized experience to the users. Thus, to create such a digital banking solution or app that thrives, it must be capable of earning the trust and loyalty of the customers.

You know the secret to crafting a similar app like CBQ that redefines convenience in the modern banking world. You must carefully combine intuitive design, advanced security protocol, real-time banking features, and AI-driven insights.

Thus, keep your vision straight while creating the next big digital banking app in the UAE.

FAQs

How much will it cost to create an app like the CBQ app?

The ideal range of investment that you have to make to create a mobile banking app like CBQ is between $30,000 and $250,000 or more.

The cost totally depends upon several app development factors like features, tech stacks, developers' location, and more. If you create an MVP version of the app, it will cost less than the full-stack version, which may surpass the value of $250,000.

How can I ensure app security and compliance?

Since you will be creating an online banking app like CBQ, you must keep it safe from potential cyberattacks. Thus, you must ensure app security and compliance; for that, you have to maintain the following:

- End-to-end encryption

- Multi-factor authentication (MFA)

- Secure APIs

- Regular penetration testing

- Compliance with PCI DSS, GDPR, and QCB (Qatar Central Bank)

Is it possible to integrate third-party services or fintech APIs?

Yes, it is possible, and one of the crucial parts of the app development process is where you have to integrate third-party services or fintech APIs. If you are creating a banking app like CBQ mobile, then you should integrate third-party services, which include payment gateways, remittance systems, and investment platforms. It helps to improve app functionality.

Is it a must for my app to support fintech trends like AI or blockchain?

You will be creating a mobile banking app like CBQ, which is one of the leading names in the UAE, because of its advanced features and functionality.

So, your mobile banking app must support the fintech trends to design a scalable architecture. The advanced features that you must consider to integrate into a mobile banking app include the following:

- AI-based personal finance management

- Voice banking

- Blockchain-based security

- Predictive analytics for customer insights