Digital banking in the Middle East is transforming rapidly, with more traditional banks aiming to offer seamless and user-friendly financial services.

The secret behind the transforming aim of the traditional bank is the customers. Yes, about 89-90% of the customers in the UAE rely on digital-first bank accounts.

This has encouraged mobile banking apps like ADCB to rule the fintech market of the UAE. Further, ADCB’s success encouraged many businesses to turn mobile app ideas into reality.

If you look into the statistics below, it will clearly tell you the growth story of digital banking in the UAE:

- It is projected that the UAE Digital Banking Market will reach $12.5 billion in 2025 and $38.7 billion by 2030.

- So, the Digital Banking Market will grow at a CAGR of 20.5% during the forecast period.

Did it encourage you as well to invest in the development of a mobile banking app? You must choose a mobile app development company that can help in the development process.

However, if you want to take the task into your hands, then learn the full development process, and much more, in this blog.

Let’s dig in.

An Overview of the ADCB App

ADCB is an application that has made banking a smoother, more convenient experience, originally established by Abu Dhabi Commercial Bank (ADCB).

The idea was to let users manage their bank accounts and do several banking transactions on the go. ADCB is also known as a popular money transfer app in the UAE.

Users use this app to pay bills, transfer money, apply for loans or credit cards, and keep their spending in check right from their smartphones.

Digital onboarding is an excellent feature of this app that allows users to open an account without the need to visit the branch. Further, this app allows users to find nearby ATMs, request new checkbooks, and others.

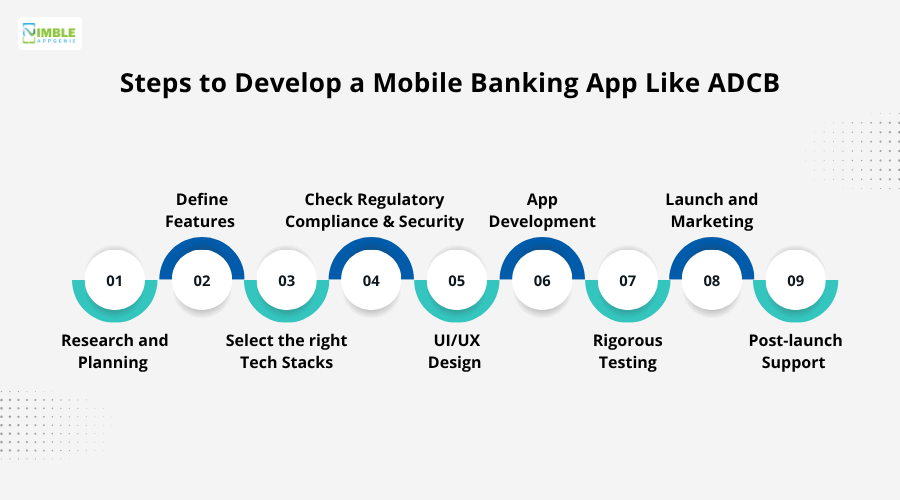

Steps to Develop a Mobile Banking App like ADCB

There are two approaches to creating a banking app: either you can do it by yourself, or you can partner with a company that provides fintech app development in the Middle East.

Creating the app with the help of a development company can save you time, effort and make it seamless. However, if you choose the self-development process, you must understand the dynamic steps.

To make it easier for you, we have thoroughly explained the steps to develop an app like ADCB below. Take a look.

Step 1: Research and Planning

Start by doing thorough research about the competitor banking apps, along with the ADCB app. This is a good tactic to know what your banking app needs.

It will help you to understand the functionality of the app, learn about features, and the audience’s demand. All this information will help you to create an excellent plan for your app that will thrive.

Step 2: Define Features

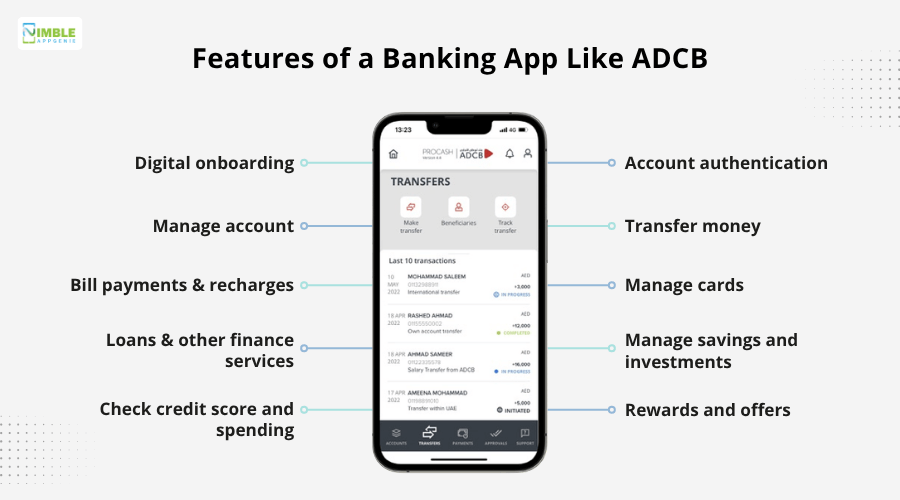

Now, next comes the step where you have to choose the features for your app. Features are a crucial element of an app, and for the ADCB mobile banking app, they’re its secret to success.

Since you aim to create a similar app, you should know about its core features. So, for your knowledge, we have listed the must-have features. Take a look.

-

Digital Onboarding

Seamlessly open your ADBC account digitally with eKYC verification, using your Emirates ID and facial recognition. An account can be activated instantly without any paperwork.

-

Account Authentication

You can authenticate your digital ADBC account with biometric login, i.e., fingerprint or face ID. There is also the option for 4-digit PIN, password, and OTP verification for transactions.

-

Manage Account

This app makes account management easy. Users can view account balance, mini statements, transaction history, download e-statements, and categorize accounts.

-

Transfer Money

This online banking app allows you to transfer money instantly from an ADCB account to any other bank. Users can also make international transfers and automate regular payments.

-

Bill Payments and Recharges

Pay your utility bills from anywhere and at any time through this app. Users can recharge their mobile numbers and Salik accounts. Can save frequent biller, automate bill payments.

-

Manage Cards

The app can manage both a credit card and a debit card. Users can view card balance, statements, and spending limits. Further, block/unblock cards, request card replacements, & activate new cards.

-

Loans & other Finance Services

Users of this app can apply for several loans, from personal, car, to home loans, and others. Further, keep outstanding loan balances, payment schedules on check, and track application status.

-

Manage Savings and Investments

This app allows users to open fixed deposits or savings accounts. Investment portfolios can be managed and viewed easily. App users can even set up recurring savings plans.

-

Check Credit Score and Spending

The ADCB app offers its users to view the Al Etihad Credit Bureau (AECB) score. Tracking where and how much is spent is easy by category. The app also offers users budgeting tips.

-

Rewards and Offers

Users of the app can get access to TouchPoints Rewards, where they can view, earn, and redeem points. Spending habits give personalized offers and get discounts as well.

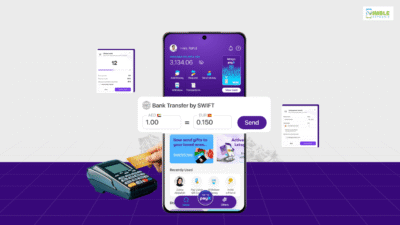

Step 3: Select the Right Tech Stack

Now that you know the features, it’s time to proceed further with a strong knowledge of the technological stacks. The choice of technology to develop a mobile banking app like ADCB determines its quality, scalability, and security.

So, be mindful while incorporating tech stacks at the time of app development. We have mentioned the tech stack in tabular form below.

| Stages | Required Tech Stacks |

| Frontend | Flutter, React Native, Swift (iOS), Kotlin (Android) |

| Backend | Node.js, Java Spring Boot, .NET Core |

| Database | PostgreSQL, MongoDB, Oracle |

| APIs & integrations | REST/GraphQL APIs, Core Banking Systems, Payment Gateways |

| Security | OAuth 2.0, AES Encryption, SSL/TLS, Biometric Authentication |

Step 4: Check Regulatory Compliance and Security

In the next step, you have to make sure the mobile banking app you will create meets the strict compliance and data protection standards.

This step should not be skipped, or else the app launch may get stuck. You must follow the Central Bank regulations, implement KYC or AML procedures, ensure compliance with PCI DSS, GDPR, or local data privacy, etc.

Step 5: UI/UX Design

Now, start UI/UX design of your online banking app. Before you develop a banking app, you have to make sure to design a clean, user-friendly interface just like ADCB.

Another reason that makes the ADCB app a popular choice is because of its minimal and intuitive design. Design clear app features, branding color schemes, and build interactive prototypes.

Step 6: App Development

Now, the main step, which will give shape to your ADCB mobile banking app. The app development step consists of significant frontend and backend development. In frontend development, you have to turn the UI/UX design into an intuitive user interface as per the platform.

Then comes backend development, where you have to make every function and feature of the app work perfectly, implement security features, and integrate third-party services and AI in mobile apps.

Step 7: Rigorous Testing

After being done with the app development, it’s time to test the app. This step is one of the crucial ones because it ensures the app will offer high performance and security to potential users after launch.

Several types of tests can be done, which include functional, security, performance, and many more. You can also build an MVP version for testing.

Step 8: Launch and Market

After testing the app, solving the potential issues and bugs, it is ready to use. So, you have to now launch the app on different app download platforms like Google Play, Apple Store, and other third-party platforms.

Users can install the app from those platforms and use it. Promote the app on various platforms to create buzz and attract more users to install it.

Step 9: Post-launch Support

Launching the app is not the end of the app development process, but there is one more thing that you have to make sure of. Post-launch support is as crucial as creating the app. In this step, you have to keep the app under monitoring even when users are using it.

Check for issues and solve them in real time, keep updated security patches, OS, features, etc.

Transform banking with an innovative digital solution like the ADCB app in the UAE.

Cost to Create an App Like ADCB

You have learned the development process, which has made you ready to invest in mobile apps for digital banking. But wait, before making this investment, you must plan a budget so that you can choose features and tech stack accordingly.

That is why you must have an idea of the mobile app development cost, which ranges approximately from $20,000 to $300,000 or even more.

If you build a basic app with normal features and tech stack, it will cost less. But to build a full-stack app with trending features and advanced technologies, it may cost more than $300,000 since it will require more time and effort.

Again, the iOS app development cost is less than the Android app development cost due to the reason for fragmentation. We have broken down the estimated cost of each app development layer in a tabular form.

| Layers | Estimated Cost |

| Research and Planning | $10,000 to $25,000 |

| Features and Integration | $50,000 to $200,000 |

| Regulatory Compliance and Security | $25,000 to $50,000 |

| UI/UX Design | $20,000 to $60,000 |

| App Development | $30,000 to $150,000 |

| Rigorous Testing & Launch | $25,000 to $60,000 |

| Post-launch Maintenance | $10,000 to $30,000 |

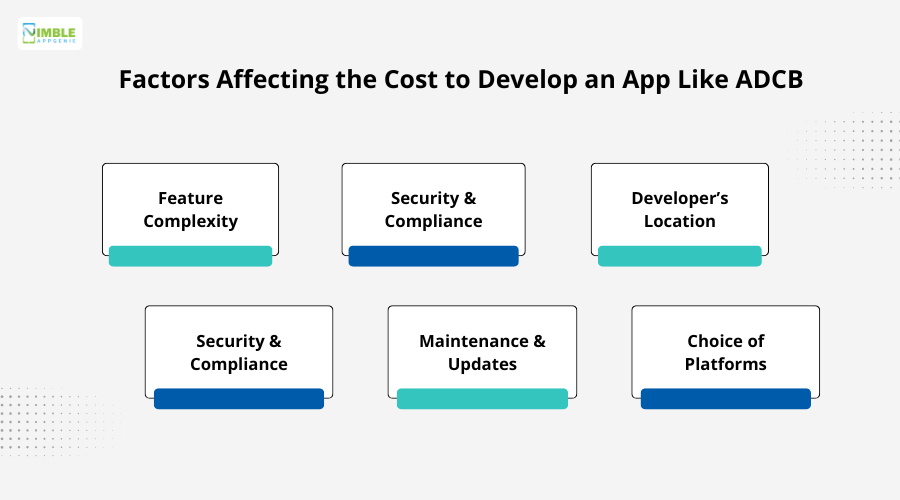

Several factors decide the whole app development cost, which consists of:

- Feature Complexity

- Security & Compliance

- Developer’s Location

- Security & Compliance

- Maintenance & Updates

- Choice of Platforms

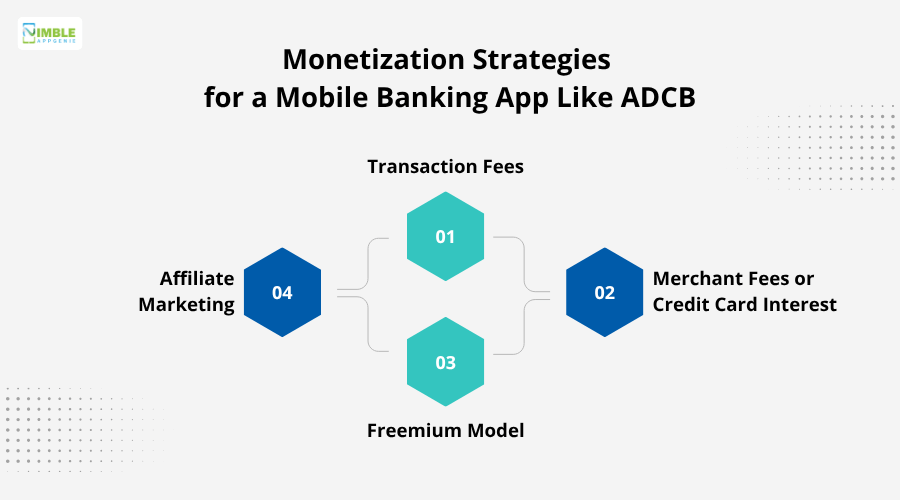

Monetization Strategies for a Mobile Banking App Like ADCB

Not just build a mobile app, but use it as a pool to create a stream of business revenue to help your business achieve financial growth. Yes, you guessed it right, mobile apps make money, even your mobile banking app can.

You must be familiar with the monetization strategies so that you can apply them effortlessly to earn money. A few of the core strategies have been listed below that need your attention.

➢ Transaction Fees

Charge transaction fees for certain transactions, which are premium or high-value services. For each international monetary transfer, foreign exchange conversions, bill payment, or fund transfer that exceeds certain limits.

➢ Merchant Fees or Credit Card Interest

Since the online banking app, like ADCB, will offer a credit card management facility, businesses get the chance to earn money. For every late payment and processing fees, interest income from credit card usage, and other sources.

➢ Freemium Model

The Freemium model is a good source to make money from an app. In this, the users of this app can access basic features of the app for free, and when they opt to use the advanced features, they have to pay for them.

➢ Affiliate Marketing

This is also a good app monetization strategy in which apps partner with other financial or retail companies to let them promote their products and services. For every product or service purchased via your app, you will earn promotion fees.

Partner with Nimble AppGenie to Build an App like ADCB

All set to make a mobile banking app like ADCB? But don’t know if you can start and complete the process? This fear is common, and that is why support from a mobile app development company in Dubai can be an excellent help.

Nimble AppGenie is the leading fintech app development company in the UAE that comes with an expert team of app developers. Our organization has been in this industry for more than 7 years, and is the secret behind the success of many well-known apps.

Conclusion

Ready to redefine the digital banking experience in the UAE with a mobile banking app just like ADCB? You should know this cannot be achieved with just the right technology.

To bring your vision into a successful reality, you should hire mobile app developers specialized in the fintech niche. Moreover, you can also try to create the app, as you know the process well now.

Create a new standard in the digital finance of the UAE with a mobile banking app more capable than ADCB.

FAQs

What is the average cost to build an app like ADCB?

Generally, the average cost to build an app like ADCB ranges from $20,000 to $300,000 or more. Several factors decide this cost range, which include the developer’s location, choice of platform, feature complexity, and more.

If you create a full-stack app, then it will cost you more than $300,000, but if you create a basic app, it will cost less.

What is the role of AI in an online banking app?

To create a modern online banking app like ADCB in Dubai must consider the power of AI, i.e., Artificial Intelligence.

Today, AI plays a quite crucial role in mobile banking applications. It helps to detect fraud, offers chatbot service, analytics, and personalized financial insights.

What is the estimated time frame to build an app like ADCB?

The time frame for building an app like ADCB is not fixed, but it is estimated to take 6 to 8 months or more. It totally relies on the functionality, technology, and features you are putting in the app.

An app's basic features and functionality take 4 to 6 months, while a full-stack app with AI and APIs can take more than 8 months.

How can I align my app with the future banking trends?

The future of online banking is changing and getting stronger due to the trends. If you want your app to stand out from the competitive crowd, offer a great experience and operational efficiency, you must follow the trends.

The app must have AI chatbots, detect fraud patterns, suggest financial products, and offer real-time assistance.