The UAE has one of the fastest-growing digital economies in the world and is home to innovative digital banking apps like MyFawry.

The reason behind this achievement is the innovative and technology-forward initiatives of the UAE government. Additionally, to meet the expectations of the tech-savvy populations to enjoy a seamless digital experience, more digital banking apps like MyFawry have been created.

Are you also one of them who wants to develop an app like MyFawry, offer an innovative cashless solution, and stand out from the competition, but don’t know how? We are here with a complete solution.

In this blog, you can explore everything related to the MyFawry app and its complete development steps.

Let’s begin!

What is the MyFawry App?

MyFawry is one of the leading digital payment platforms in the UAE that was created by an Egypt-based financial services company, Fawry. Users can directly access a wide range of smart digital financial services on this platform through their smartphones..

MyFawry app is also recognized as one of the top fintech apps in the UAE because of the convenience it offers to its customers.

This app allows people to leave the traditional behind and enjoy smart digital banking features, such as paying utility bills, recharging mobile lines, settling insurance premiums, renewing car licenses, and more, all at their fingertips.

MyFawry partners with banks, service providers, and merchants to connect with millions of users through over 1,000 daily services. The app allows users to make payments through bank cards, eWallets, and cash at Fawry outlets.

So, both banked and unbanked populations across the country can access the app.

Numbers From the Digital Banking Market of the UAE

Digital banking in the Middle East is gradually establishing a strong market, with more people inclining towards making digital payments. UAE among all witnesses excellent growth of the payment apps. If you are wondering why, the attractive numbers below will give you the answer.

- The digital banking market of the UAE is expected to grow and reach the volume of $12.5 billion in 2025.

- Further, it is expected that the same market by the year 2031 will reach the volume of $38.7 billion.

- So, between the years 2025 and 2031, the digital banking market of the UAE is expected to grow at a CAGR of 20.5%.

- The total number of transactions in the digital payment market of the UAE is expected to reach the volume of $60.20 billion in 2025.

- By the year 2030, it is projected that the transaction value of the digital payment market of the UAE will reach $117.98.

- So, during the forecast period, the transaction value of the digital payment market of the UAE will grow at a CAGR of 14.40%.

The above growth strength of the digital banking market and the digital payment market of the UAE clearly indicates that fintech businesses should turn their mobile app ideas, similar to MyFawry, into reality.

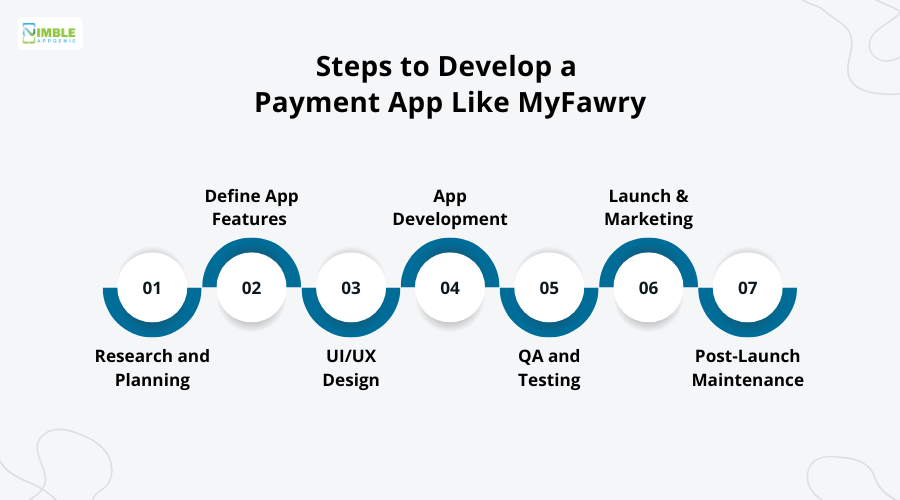

Steps to Build a Payment App Like MyFawry

The above numbers must have convinced you to invest in a payment app like MyFawry. You need to follow several dynamic steps to successfully build such an app. It can be challenging for you, which is why we came up with the whole app development process.

To develop an app like MyFawry, below are the steps you should follow. We have also mentioned a few of the core features of the MyFawry app.

Step 1: Research and Planning

The first step of the development process starts with thorough research and planning for the app. You need to learn about the features of the competitor apps, which include MyFawry.

This helps you know about the must-have features and the areas where they have gaps, and also know about the demands of the audience. Then plan your app accordingly so that you can fill the gap and meet audience demands.

Step 2: Define App Features

The next step to develop a money transfer app in UAE, similar to MyFawry, needs your attention to define the features. Features are the crucial element of the MyFawry app that gives it so much popularity in the whole Middle East.

Be sure about the features you want to add to your payment app, and make sure it is unique to help the app thrive in the competitive crowd.

Step 3: UI/UX Design

Next, design your money transfer app, ensuring it has an intuitive interface. To create the UI/UX design of the app, you must use a wireframe to create the prototype.

Focus on simplifying the complexity of the digital financial transactions and enhancing engagement with attractive features. Design the icons, include the colour palette, apply user-centric best practices, and the app must offer a secure experience.

Step 4: App Development

Now start the main step of the whole process, start to develop your payment app like MyFawry. For this, you have to carry out the frontend development and backend development of the app. In frontend development, you have to transform the UI/UX design into a functional and intuitive app.

Then jump to backend development to create the server-side logic and manage data. It takes care of the core functionality development of the money transfer app, like MyFawr, which includes integrating payment gateways, APIs, and more.

Step 5: QA and Testing

After completing the development of the app, it’s time to perform QA and testing. Before you launch the app, this is a crucial step as it will make sure the app is performing well, it is free from potential issues and bugs.

You definitely don’t want your audience to experience any kind of issues while using the app. Following the right test approach is important, which is why keeping a balance between manual and automated testing is important for the best results.

Step 6: Launch & Marketing

After successful QA and testing, determining your app is free from bugs or issues, it’s time to finally launch the app on several app download platforms. There are Google Play, Apple Store, and other third-party platforms from which users can install the app.

Before you launch the app, you should create a buzz about your app in the market. Thus, it is best to promote the app through various channels like social media, email marketing, and others so that it can attract more potential users.

Step 7: Post-Launch Maintenance

The work doesn’t end with app launch, because after the launch, you have to make sure the users are not facing any issues with the app. That is why post-launch maintenance is a crucial step, in which developers keep monitoring the app.

This will help them to recognize potential issues and solve them at the earliest. Also, developers must keep the app features updated with trending options and keep the security patches updated to protect the app from potential cyberattacks.

Cost to Develop an App Like MyFawry in the UAE

You must have learned the steps to create an app like MyFawry, but if you feel it will be tough for you to follow them, there is nothing to worry about. Like other businesses, you can also invest in a mobile app development company in Dubai.

A mobile app development company will simplify the whole work, but before that, you should make a budget so that it doesn’t feel like a burden. Thus, you must already have an idea of the mobile app development cost a company may charge.

The average cost you need to invest to create an app like MyFawry in the UAE typically ranges from $20,000 to $200,000 or more. The cost is totally based on the range of factors of app development. The factors are mentioned below.

- Location of the developer’s team

- Choice of platform

- Feature complexity

- UI/UX design of the app

- Security and compliance

Partner with experts to build a trusted payment app like MyFawry in the UAE.

Monetize Your Payment App to Achieve Financial Growth

Your money transfer app comes with the potential to make money for your business that will help you achieve financial growth. If you don’t know how this can be done, this section has the answer for you.

Below, we have come up with a list of a few of the key app monetization strategies that need your close attention.

➢ Transaction Fees

First comes the transaction, which should be the core monetization strategy for a payment app like MyFawry. Charge a particular amount of fees for every transaction made by the users through your app. For a mobile app startup, this can be an excellent way to achieve financial growth.

➢ Subscription Fees

Next, subscription fees offer a more predictable and reliable income stream. Businesses can prepare different tiers of pricing for different levels of features. This will allow businesses to cater to different levels of users, from everyday users to premium users, and bring great scope for income.

➢ Interchange Fees

Interchange services also offer an excellent scope for businesses to monetize their app. Your app must allow users to pay via debit and credit cards. Each time a transaction is made, it allows you to charge fees to merchants. This is the primary revenue driver for many fintech apps in the market.

➢ Value-Added Services

Value-added services are one of the best ways to make money through your payment app and also attract more users. Allow your app to offer various financial products in a single ecosystem. Like, allow your users to invest in stocks directly from the app, incentivize users to make more transactions through your app, etc.

Partner with Nimble AppGenie to Build Your Payment App Like MyFawry

Planning to build a mobile app in Dubai similar to MyFawry that is secure, scalable, and user-friendly? One name that has the best app development solution for you is the Nimble AppGenie.

We are the leading fintech app development company in Dubai with years of experience in creating robust banking apps. You can expect an end-to-end development solution from design, development, to post-launch support.

Our expert team of skilled developers is the backbone of our established mobile app development company in the UAE. They deliver apps that combine robust security with a seamless user experience to make sure users can perform safe and effortless transactions.

Conclusion

If you want to develop an app like MyFawry, then you must prioritize creating a trusted digital ecosystem that offers convenience, security, and innovation. Don’t just fulfill the demand for a cashless solution; create an app that offers a seamless digital experience.

You already explored this blog, so you know exactly how to achieve that. Creating such a payment app will allow you to enjoy financial growth as well.

Be the next big name in the fintech industry that drives digital transformation by empowering millions.

FAQs

Do I need a license to launch a payment app?

To create and launch a payment app like MyFawry in the UAE, you certainly need a valid licence. This is crucial because the app will be introduced to deal with financial transactions and will handle customer funds.

The types of licence you must acquire include Money Transmitter License (MTL), Payment Institution (PI) license, or Electronic Money Institution (EMI), depending upon the app’s features.

What is the average cost to create an app like MyFawry?

If you are planning to build a similar payment app like MyFawry, the average investment you have to make is between $20,000 and $200,000 or more.

The cost totally depends on the factors of app development. The factors include the developer’s location, platform choice, tech stack, and more. If you are planning to create a basic version of the app, it will cost less than a full-stack app.

Are there any challenges in creating a payment app?

The path to creating a payment app like MyFawry will not be a smooth journey; it will come with several challenges.

It is important for you to learn about the challenges and deal with them, and overcome them. The challenges should be skillfully handled by the developers so that they can create a scalable app. The potential challenges include the following:

- Must integrate robust security and fraud prevention

- Integrate different banks and payment gateways

- Efficient handling of the high traffic and transaction volumes

- Maintaining regulatory compliance across regions

- Offer a seamless user experience

Should I integrate smart technologies like AI or ML into a payment app?

Yes, you must integrate smart technologies like AI and ML into the payment app like MyFawry. This will help your app to stay competitive in the market because these technologies come with an excellent app.

With the growing risk of cyberattacks and online fraud, these technologies will detect them in the early stages and manage their risk. Also, such technologies offer personalised solutions to the app users.