The world is going cashless, and the UAE is the country that has taken this idea to the next level. By the year 2031 UAE’s target is to establish a cash-free economy.

To fulfill this target, fintech companies are playing a major role with their innovative digital payment solution. One of the leading names is C3Pay, the premier digital payment solution for the country’s salaried population.

C3Pay has become a popular name because of its user-friendly design and secure fintech solution. This has encouraged many businesses to develop an app like C3Pay in the UAE.

You should also take a step into this competitive and innovative area of digital payment with a robust fintech app like C3Pay. Don’t know where to start?

You are in the right place, where you can learn the secret to creating a leading online payment solution.

Understanding the C3Pay App

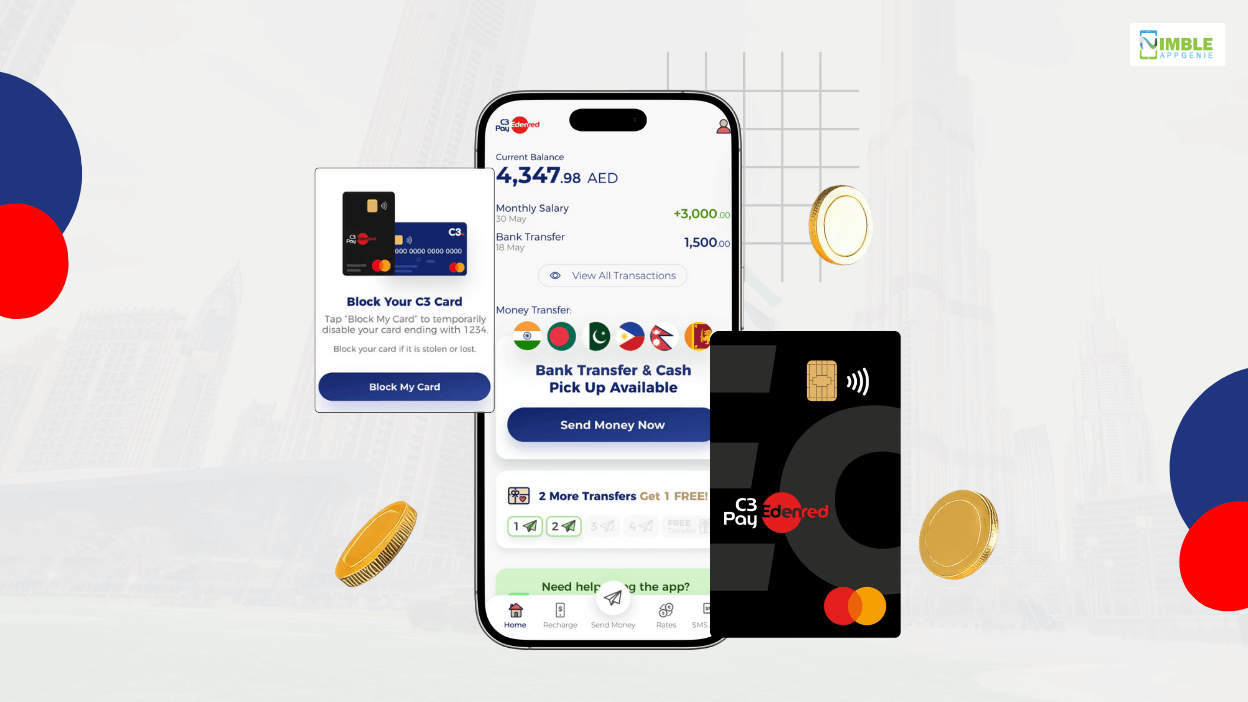

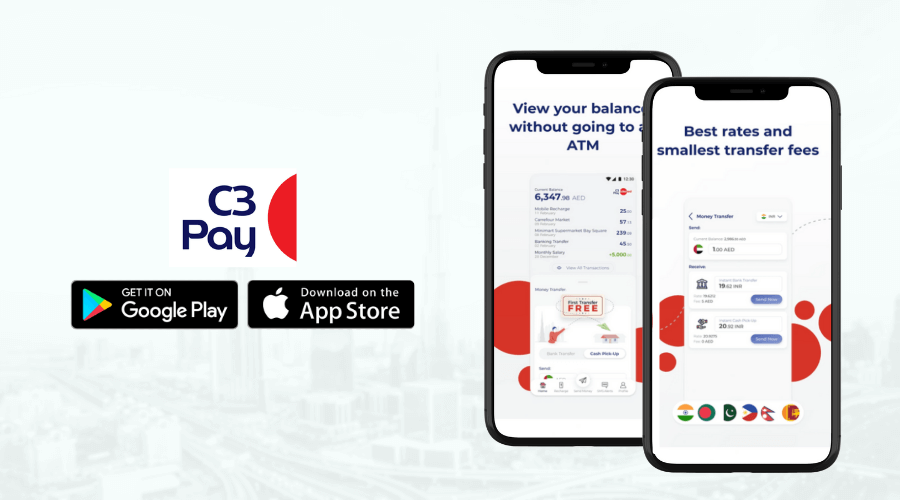

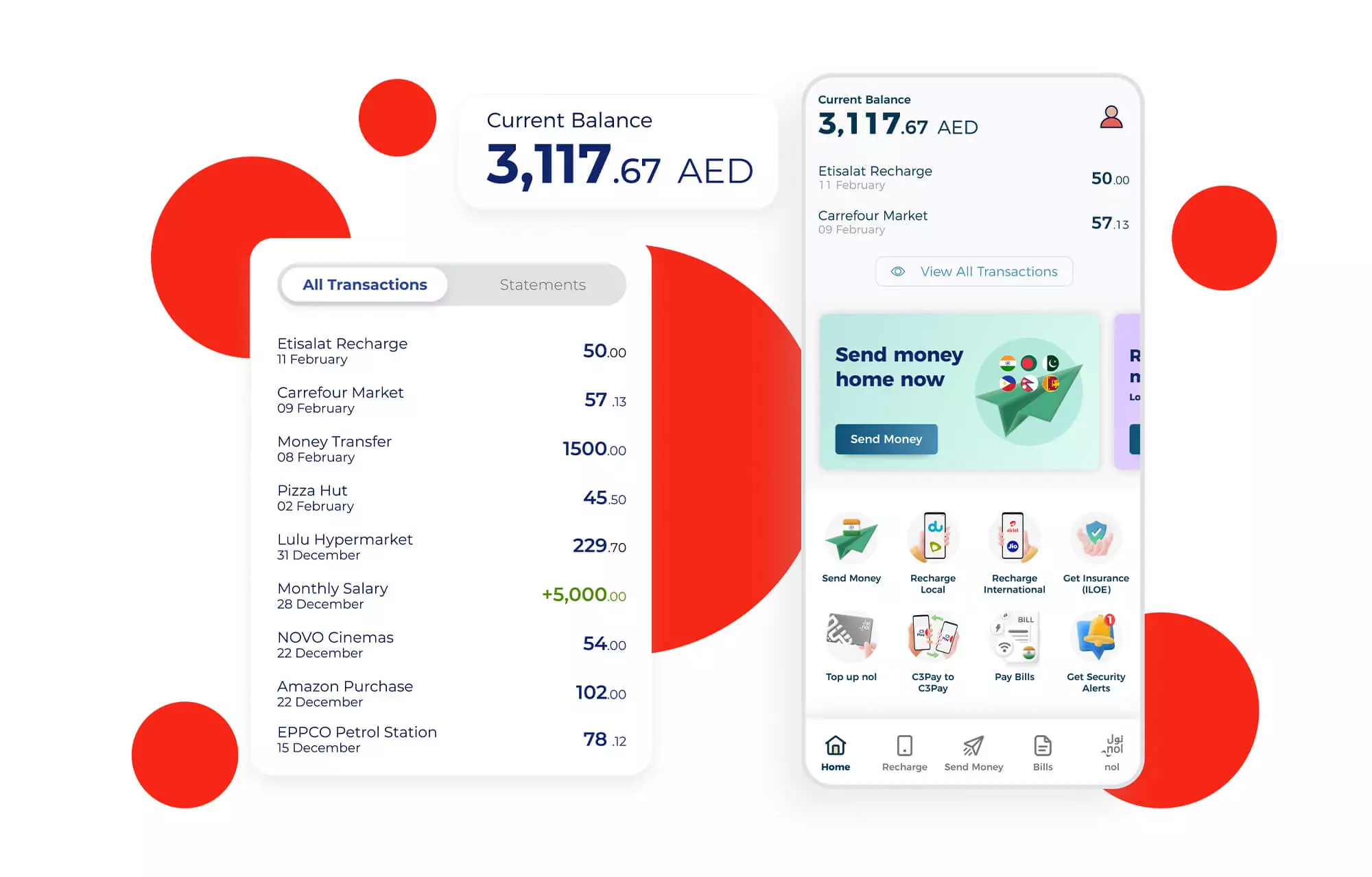

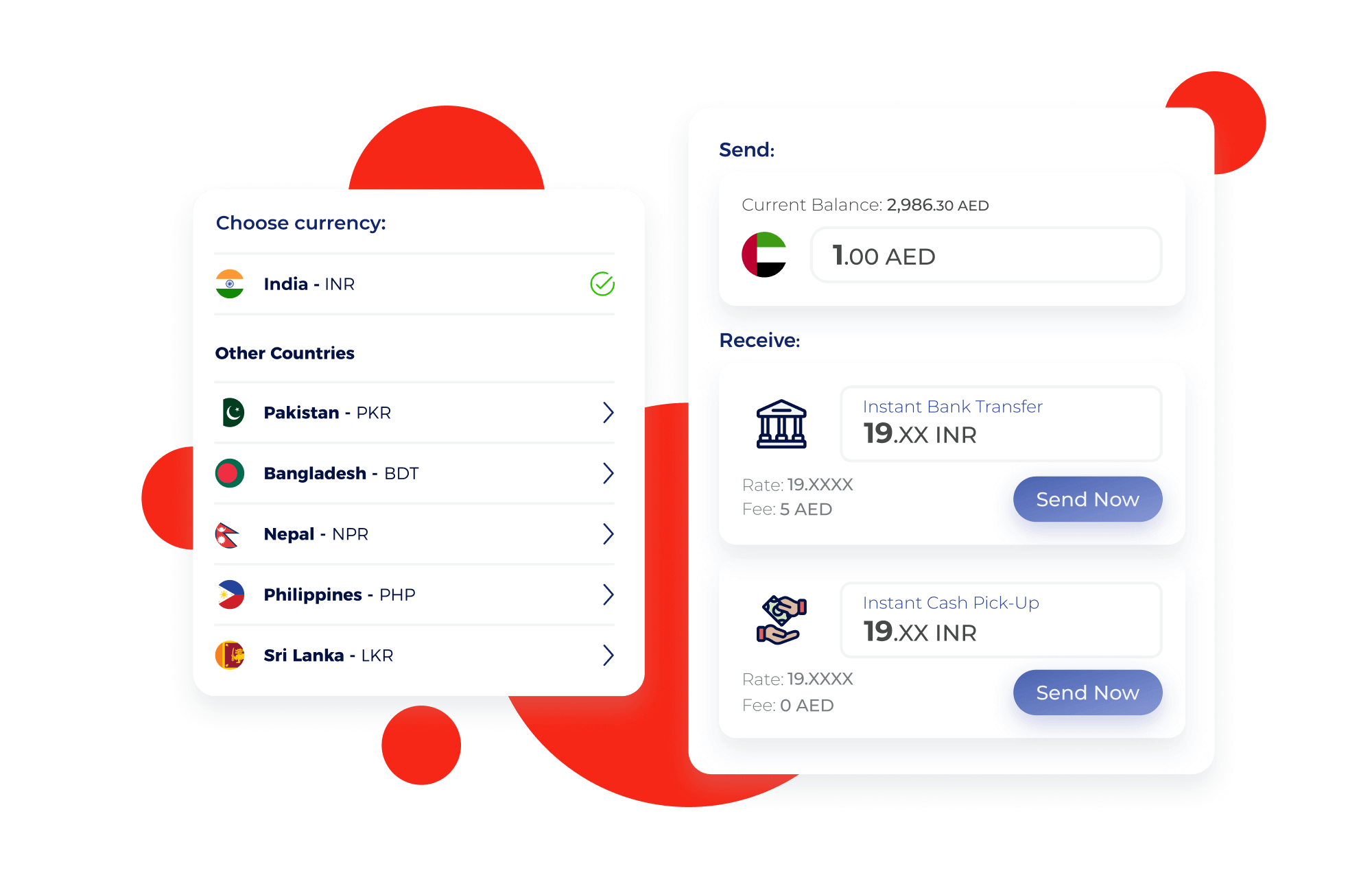

The C3Pay app is one of the smartest and best fintech apps in the UAE that helps its users manage their cards, payment details, get a paycheck, transfer money internationally, and recharge mobiles.

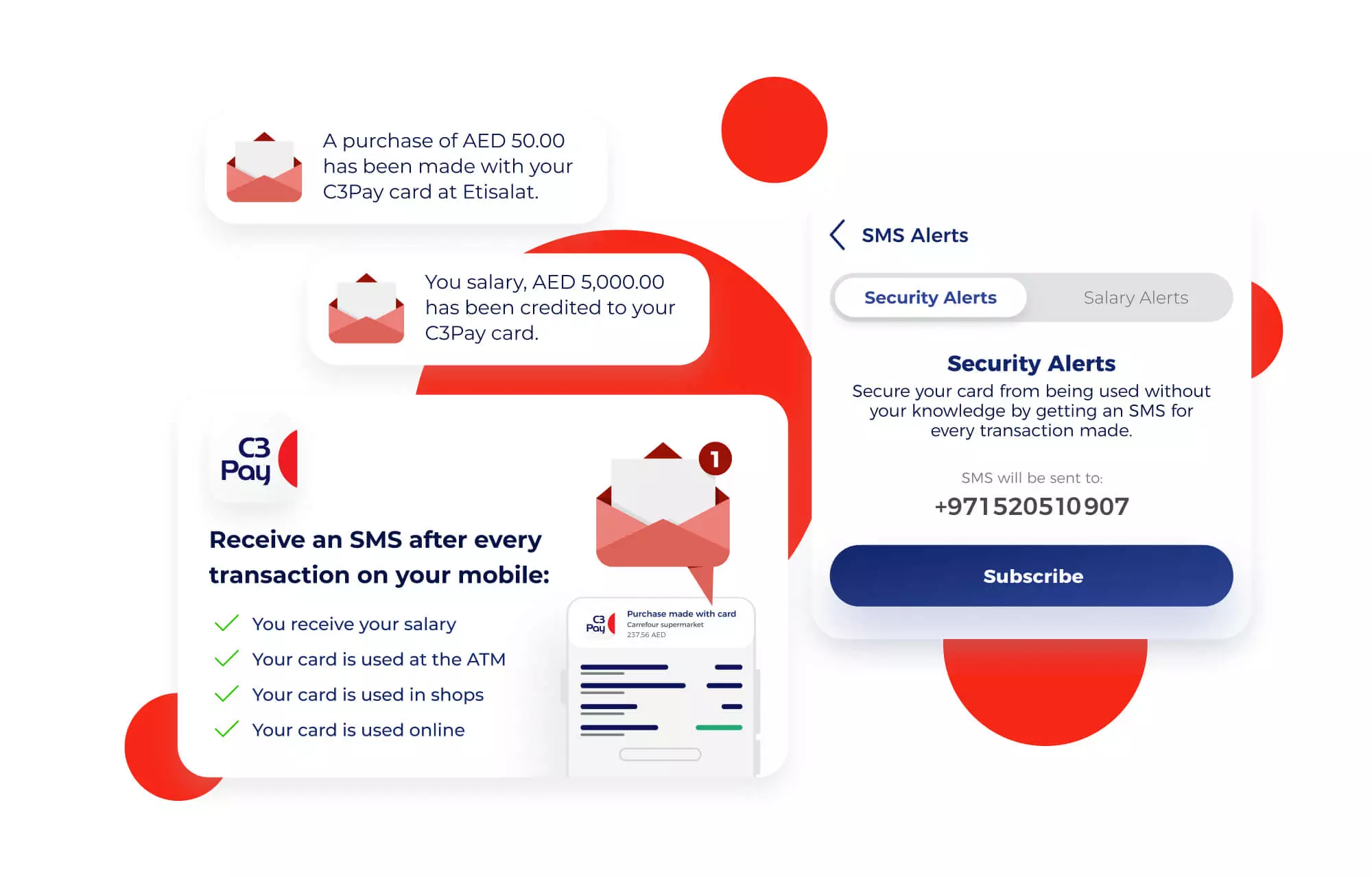

This app was created to make financial transactions and manage finances easier, especially for the salaried people of the UAE. The users of the C3Pay get their salary credited on the app and will get a real-time notification.

The C3Pay app is quite interesting as it allows users to link their cards to the app seamlessly, which makes receiving salary and making transactions much easier.

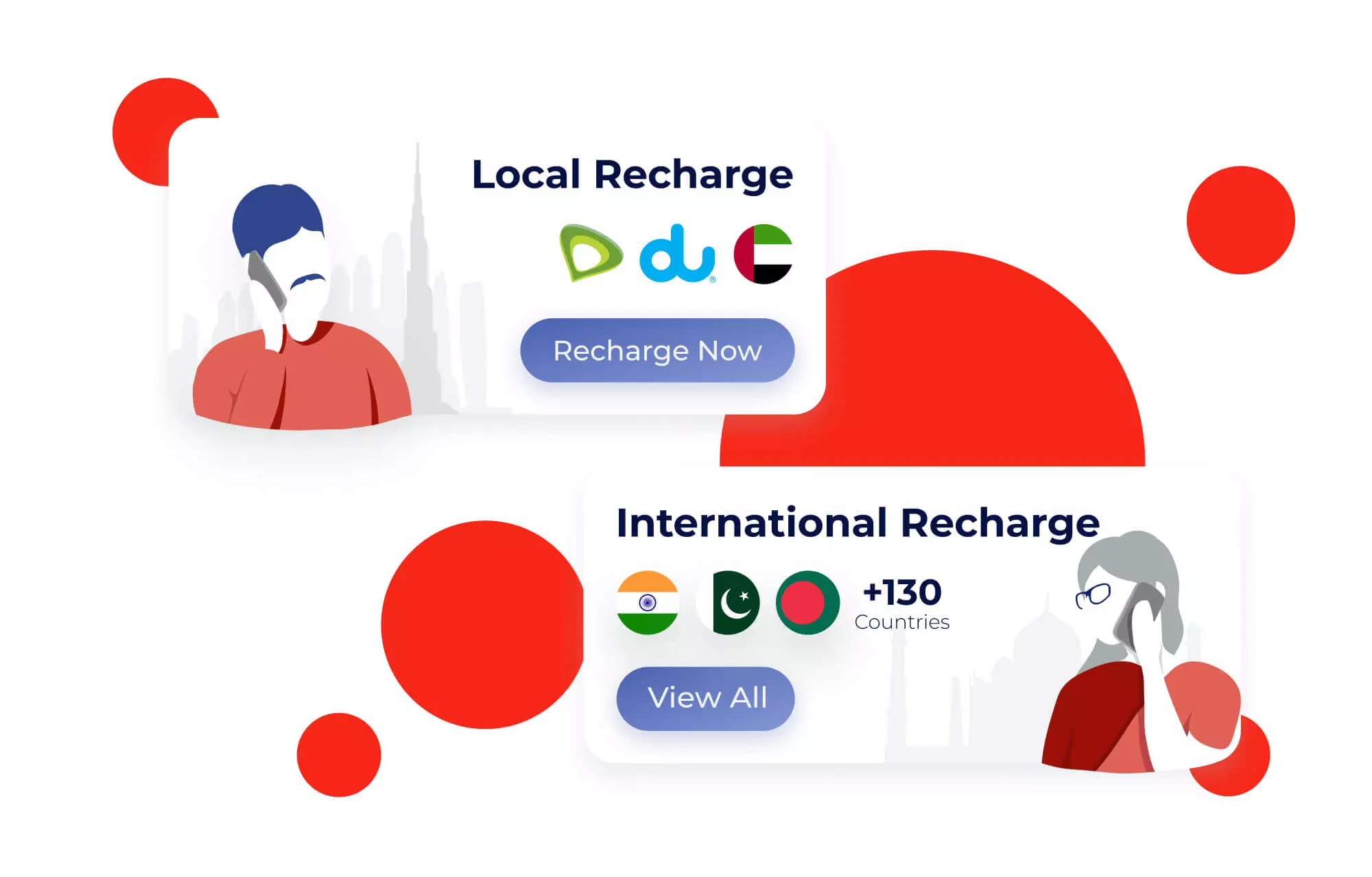

The app allows its users to check their balance & transaction history, and makes it much easier to recharge their mobile from all over the world with just a few clicks. This app also offers loans easily to its users at a fixed fee of 5% of the total loan amount, which will be payable on the next payday.

An Overview of the Digital Payment Market in the UAE

If you are planning to make an app like C3pay in the UAE, then you have made the most profitable decision. This will not only help your business to boom, but it also comes with the opportunity for you to be a part of the digital payment market growth.

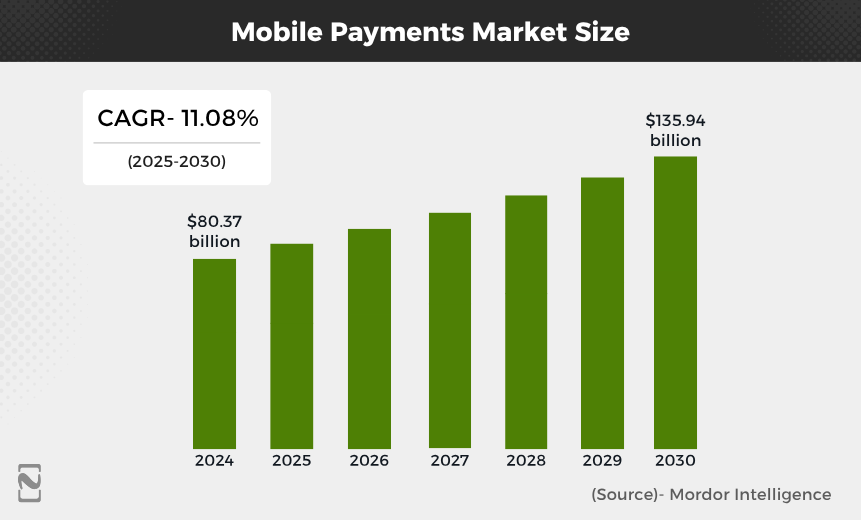

We have some statistics that will give you a picture of the boom of the digital payment market in the UAE. In the year 2025, the size of the mobile payment market in the UAE will have reached $80.37 billion. It is expected that by the year 2030, the same market will hit $135.94 billion.

So, between the years 2025 to 2030, i.e., during the forecast period, the mobile payment market of the UAE will grow at a CAGR of 11.8%.

Also, the government of the UAE is in full favor of mobile app ideas like C3Pay. This is because it aims to run a cashless economy and wants its population to adopt digital payment solutions.

The Vision 2031 agenda of the UAE talks in favor of the growth of digital payment solutions. Over 70% of the retailers in the UAE have witnessed good revenue growth by switching to digital payment solutions.

Features of a Digital Payment App Like C3Pay

You must be eager to learn the process of developing a mobile app like C3Pay. But, before that, you should know about the remarkable features that help this app stand out in the competition.

If you were thinking about how money transfer apps work, this feature that we have mentioned below will help you figure it out.

♦ For the Admin Panel

1] Fees Management

There must be a feature that helps the admins to set or modify the commission and the transaction fees. These changes are crucial depending upon the volume of traffic, the place the app is used, and their personal requirements.

2] Detecting Fraud

Since this is a fintech app, the industry is one of the vulnerable industries for cyberattacks and fraud. Thus, to detect suspicious activities in the app, there must be features that help admins and also to take quick action against them.

3] Manage the App

There must be a feature for the admin of the app to monitor and manage the merchant and user accounts in the fintech app. Giving this power to the app admin will keep the app safe from potential fraud, ensure seamless onboarding, and compliance.

4] Dashboard Analytics

There must be a feature that offers the admin access to dashboard analytics. This information will help the app admins to measure how well the app is performing. The admins can access to analyze the revenue source, transaction volumes, and user growth.

♦ For the User Panel

5] Registration & KYC

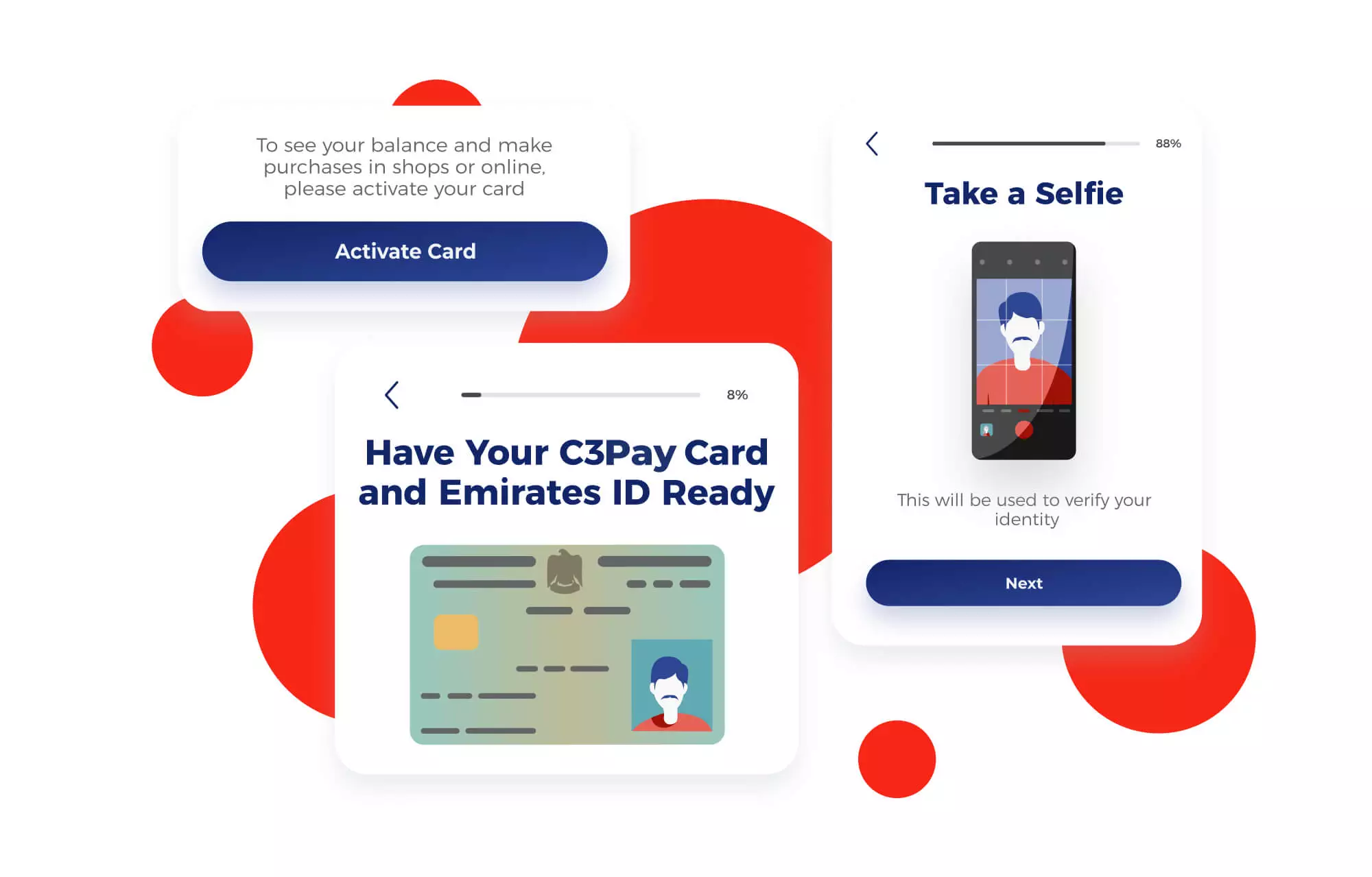

Users must be able to sign in to the app and create their profile seamlessly. There must be multiple options for singing via email, phone, and social media. They should also be able to complete KYC following simple steps that will not drain the users.

6] Transaction History

There must be a feature in your fintech app, like C3Pay, that allows users to look into the transaction history. This will allow the users to know where their money goes. When you offer your users to see where their money goes, it creates transparency.

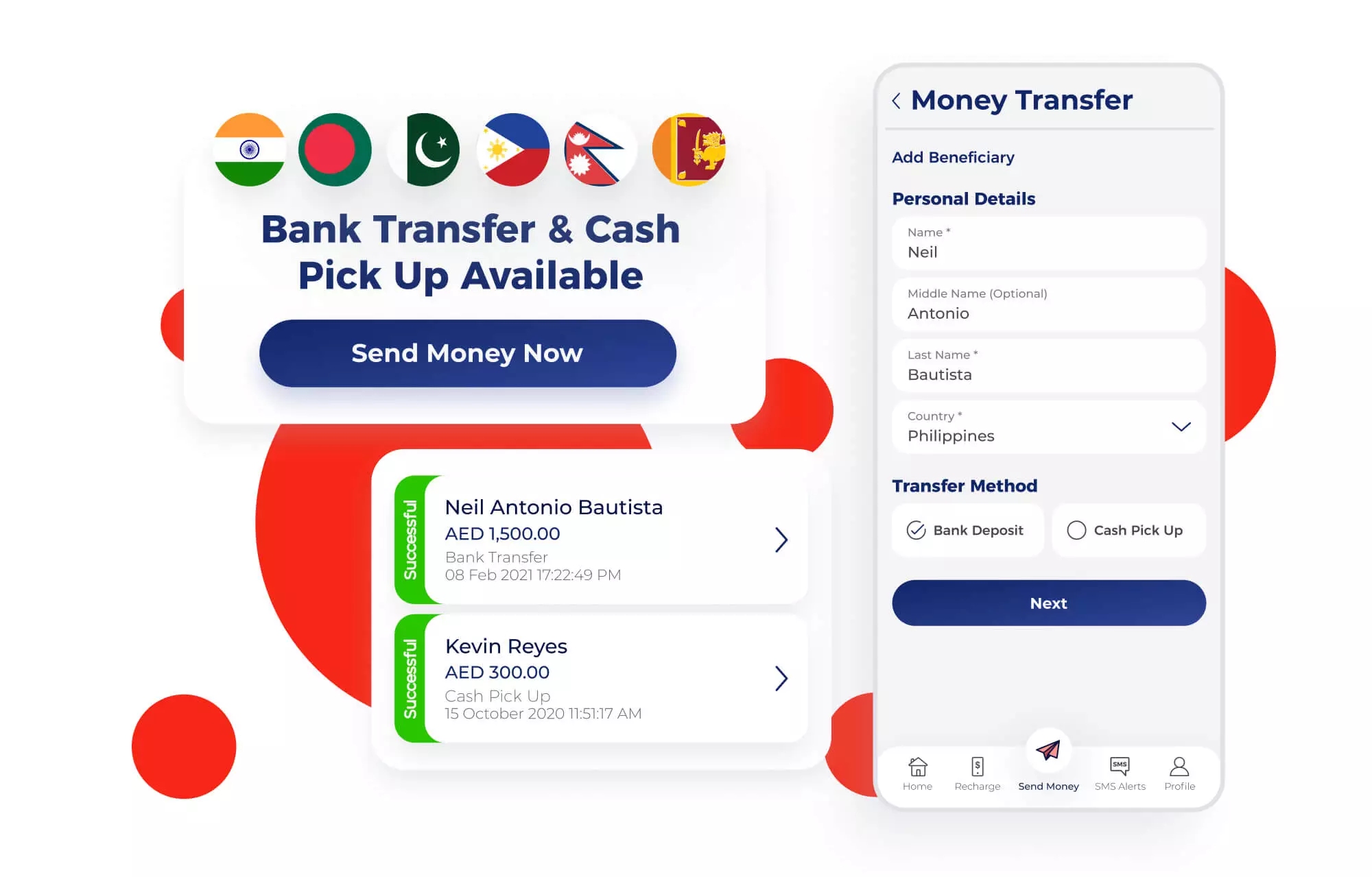

7] Instant Money Transfer

Users must be able to transfer their money instantly without any issues directly from the app to anyone from anywhere. The app C3Pay allows its users to send money internationally and to local people. The app must support multiple currencies to make transfers easy.

8] Pay Bills and Recharge

If you are on the path to make a payment app just like the C3Pay, then you should know it allows its users to pay bills and recharge mobiles. So, you must also have this feature. This helps users to save their time, go cashless, and offer convenience.

♦ For the Merchant Panel

9] Generate Invoice

Your digital payment must allow the merchant panel to streamline the billing process and track receivables. For that, the feature of the invoice generator is the perfect addition. This allows them to generate & track invoices, which guarantees the client is paid on time.

10] Customer Management

Merchants must be able to access the customer’s profile and look into the transaction history, which keeps them updated. The data insights that merchants can access help them in creating targeted ads and offers. This also helps to foster client loyalty.

11] Real-time Notifications

Merchants must know that their clients have paid them in real time. That is why the app must have the feature of real-time notifications for various transactions. So, there will be no chance for merchants to miss receiving payments from the customers.

12] Supports Multiple Currencies

The app C3Pay supports multiple currencies in its app; your a[[pp should also have this feature. These features will allow the merchants to accept different currencies, which increases the chances for them to reach broader clients. This will support smoother transactions.

Step-By-Step Guide to Building an App Like C3Pay

Now that you know about the app C3Pay, its features, and the reason why the app has made a thriving place in the UAE, you must proceed. The huge success of this fintech app has encouraged many businesses to invest in app development like C3Pay.

To develop an app like C3Pay, you need to proceed with strategic planning and be careful with each of its development steps.

Step 1: Strategize and Define Your Goal

Strategizing before starting the development is important and also defines what you wish to achieve from the app. As part of this, you have to carry out competitor research and understand your targeted audience.

Know everything about the competitor app, including the C3Pay app, features, functionality, loopholes, and the target audience. This helps you to define the goals that you want your app to achieve, like filling the loopholes and understanding the desires of target audiences to address them.

Step 2: Select the Right Features

The next step is to choose the right features for your app, like C3Pay. Since this is one of the popular choices of apps for digital banking in the Middle East, you need to carefully choose the features for the app you are creating.

The choice of your app, similar to the C3Pay, will help to stand out in the tough competition of the market. C3Pay has multiple important features, but you must choose them as per the value proposition of your app. We have already explained the features in the above section that will make your work easy.

Step 3: Right Tech Stack

After the features come the tech stack of the app, without which the app development will not be successful. If you wish to present your targeted audiences with an innovative app that works better than its competitor apps, then choosing the right stack is of utmost importance.

The development of the app is divided into different categories, and each requires unique technologies. Thus, to create an international money transfer app just like C3Pay, the required tech stack is mentioned in the table below.

| Categories | Tech Stack |

| Frontend | Flutter or React Native |

| Backend | Node.js, Java Spring Boot, or .NET Core for APIs |

| Databases | PostgreSQL or MySQL |

| Cloud hosting | AWS, Azure, or GCP |

| Payment gateways | Stripe, and others, including local banks’ API. |

Step 4: UI/UX Design

Now comes the UI/UX design of the fintech app, which is important before starting the development. The design of the app decides whether the potential customers will be drawn towards it or not. So, the app must be visually appealing and must have an intuitive interface.

To design the app, use a wireframe and create the prototype of the app, like C3Pay. You must include a simple onboarding process, easy navigation, clear feature display, and robust security features. The UI or interface of the app decides the user experience (UX).

Step 5: App Development

After completing the UI/UX design of the app comes the development part of the app. Start with the frontend development of the app, which includes the process of turning the UI/UX design of the app into an app interface.

Frontend development will allow the developers to create the features and other functionalities of the app that will be visible on the mobile screen.

Next backend development ensures that developers create the backbone of the app. Backend development makes sure all the features and functionality of the app are working in their optimum condition.

Step 6: QA and Testing

After the development, the next step is to check the app before the launch to ensure the app doesn’t have any issues or bugs. QA and testing of the app should be done so that the potential issues and bugs can be detected and fixed on time.

If you don’t want your app users to face any issues, then you should carry out thorough testing of its functionalities, performance, security, and user experience. You can also create an MPV version of the app for the use of the test audience to address issues and requirements as per the response, to make changes accordingly.

Step 7: Launch and Market

Now that you are done with the testing and everything is right with your app, move to the next step. This is the final step where you have to launch the app on different app download platforms like Google Play and the App Store. From the app download platforms, potential users of the app can install it on their devices seamlessly to use it.

Before launching the app, you must promote your app through various media like social media, emails, SMS, and more. Promotion will help you to create a buzz for your app and draw more attention from customers towards the app.

Steps 8: Post Maintenance

After the launch, this doesn’t end; you must ensure that the app is in optimum condition, which boosts its traffic and audience. That is when the post-maintenance step comes in, which helps the app to maintain its optimum functioning.

This is also part of app development. As part of this step, developers will always keep the performance of the app in check. If the app needs any upgrading, that will be carried out, and you will look into the cybersecurity part to keep the app updated with an upgraded security patch from time to time.

Cost to Create an App Like C3Pay in the UAE

You must have figured out how to create a money transfer app similar to the C3Pay app. Creating such an app without help may be challenging for an individual, so it would be the best idea if you consider hiring an app development company.

Every mobile app development company in Dubai will charge you for the app development as per the requirement, so it is best to make a budget. If you know how much it costs to develop an app like C3Pay, it will help you in budgeting.

Thus, the mobile app development cost for an app like C3Pay will fall approximately between $30,000 and $300,000 and more. The cost is completely dependent upon the factors of app development, which include complexity, features, choice of tech stack, developer’s location, and more.

So, if you are planning to develop a basic version of the app, it may cost you up to $60,000. On the other hand, if you are planning to build an app like C3pay with unique features and advanced technologies, then it will cost more than $300,000.

Factors that Affect the Cost to Develop an App Like C3Pay

As we have mentioned above, the cost of app development is based on different factors, and knowing about them will be helpful. In this section, we have helped you look over the factors that determine the cost to build a money transfer app.

The factors that drive the development cost have been listed below. Take a look.

-

Feature Complexity

Feature complexity is one of the most prominent factors that determine the cost of fintech app development. When creating an app like C3Pay, you need to be very thoughtful about its features because that’s what makes this app a leading choice in the UAE.

This kind of app must have features like instant money transfer anywhere in the world, bill payments, payroll integration, support multiple languages, and so on. The more complex the features like AI integration, machine learning, blockchain, etc., the more time it takes to complete the app development process, and it affects the cost.

-

Choice of Platforms

Next comes the choice of platform, which decides the cost of fintech app development. You have to choose the platform where you want to launch the app, iOS or Android, first. Based on the platform choice, you will either do cross-platform development or Native app development.

For cross-platform development, you have to create an app for both iOS and Android devices at the same time. For the native platform, you can either create the app for the iOS or Android platform. Cross-platform app development is costlier.

But for native platform development, the iOS app development cost will be on the higher side than the Android app development cost.

-

Tech Stack and Integration

The next thing that decides the app development cost is your choice of technologies. The choice of technologies also depends on the complexity of the app. If you are planning to create a basic app, then it will not cost you much.

But if you decide to build an advanced app with all the best features like AI/ML and VR, then you have to choose the top technologies that increase the development cost. On the other hand, correct integrations like APIs for payment gateways, banking systems, and others, which will affect the cost.

-

Location and Expertise of the Team

The location and expertise of the mobile developers you hire affect the cost of fintech app development. The developers who have the expertise to create a secure online payment system for the fintech apps will automatically increase the cost of app development.

Their knowledge is their treasure. Further, there are two types of developers: offshore and onshore. The former is the one who creates an app outside the country, and the latter is the one who creates an app within the country. The latter is a costlier option, but the latter offers the best solution.

-

Security Cost

The fintech apps handle various sensitive data of the users, which consists of banking and transaction data, so security is one of the essential elements. To give a secure app, developers have to implement encryption technologies in the app. Additionally, obtaining a compliance certificate is also important.

All these things together boost the cost of fintech app development. It is an utmost vital task to invest in a cutting-edge security system that prevents breaches and helps to build trust among the app users.

How Does Your App Like C3Pay Make Money?

Do you know that the fintech app that you are planning to develop can make money for you? Yes, various strategies are applying that you can apply to help your business achieve financial growth through the app like C3Pay.

We have listed the mobile app monetization tactics below that you must consider.

➢ Transaction Fees

To make sure your fintech app can make money for you must charge a small number of transaction fees. So, whenever the users make a bill payment, make a transfer, or withdraw payroll, they have to pay for that.

➢ Subscription Plans

You must offer your users to invest in subscription plans. Divide the features of your app into different price plans so that when they wish to use the premium tier of features, they have to pay. This is a clever idea to monetize from your fintech app.

➢ Partnership and Affiliate Programs

You can partner up with various companies to earn commission when they make a transaction using your app. Many companies in the UAE use such payroll apps to transfer salaries to their employees. So, this is a good idea to make money from the app.

➢ In-app Advertisements

One of the common strategies used by almost every app owner to make money from it is the in-app advertisement. As per this strategy, other brands will use your app as a banner to run their advertisements in exchange for money.

Choose Nimble AppGenie to be your App Development Partner

Are you someone who wants to develop a futuristic and robust fintech app like C3Pay but doesn’t know where to start? Well, Nimble AppGenie is always ready to help individuals like you and make the development journey easy.

Nimble AppGenie is the recognized fintech app development company in Dubai that is famous for building high-performing fintech solutions like C3Pay. We have proven expertise in creating different categories of fintech apps, like mobile wallets, payroll solutions, and more.

Moreover, in the past few decades, we have worked for diverse industries and created excellent mobile-first solutions for them. No doubt our team of skilled developers will be ideal to offer you a personalized app development solution from the music industry to fitness and more. Our strategic approach to developing an app brings out the best results.

Conclusion

It is best to say that to create an app like C3pay, it mainly means establishing a deeper value that it delivers to its loyal user base. You should aim to serve such a value with the app that you are planning to create.

You have learned the steps that need to be followed if your goal is to create a digital payment app that makes life easier for the salaried population of the UAE. Remember that the secret sauce to success is to start with a clear vision.

Now, set your focus and build an app that changes the landscape of digital payment.

FAQs

What technologies are needed to build an app like C3Pay?

To create a successful fintech app like C3Pay, you need to use the correct technologies that offer the best outcomes. The popular technologies to be used to create the digital payment solution are mentioned below:

- For frontend: Flutter, React Native, Swift (iOS), or Kotlin (Android).

- For backend: Node.js, Python (Django), or Java.

- Cloud server: AWS or Google Cloud.

- Security and payment APIs: Compliance tools- PCI DSS, AML/KYC, and encryption protocols- SSL/TLS.

How much will it cost me to create a digital payment app?

The cost to create a similar digital payment app like C3Pay typically ranges between $30,000 and $300,000 or more.

Various factors determine the development cost, like complexity, features, tech stack, developer’s location, and others. The development cost can fluctuate depending on its type, like basic or advanced.

What will be the estimated time to build an app like C3Pay?

To build an app like C3Pay, you have to invest approximately 5 to 12 months of time or more. The estimated time to create a digital payment solution will depend on the efforts you put into its development. If you create a premium app with advanced features and top technologies, then it may even take more than 12 months.

What are the essential security features that must be integrated into a fintech app?

Since you will be creating a digital payment solution app like C3Pay then you must give focus to its security to keep the app safe from any cyberattack.

Thus, you have to integrate top security features into the app, which include end-to-end encryption, two-factor authentication, biometric logins, and PCI DSS compliance to keep the user data and transactions protected.