Tabby is not just another payment app. It is one of the fastest-growing BNPL apps in Dubai.

Launched in 2019, Tabby has already crossed 15 million active users and partners with over 40,000 merchants. That’s a huge achievement in just a few years.

So, what is behind its success? Well, it is not just the idea of BNPL. It is how Tabby developed a business model that benefits both shoppers and retailers.

At the same time, users love the freedom to split payments into interest-free installments. Businesses enjoy increased sales and reduced cart abandonment.

Therefore, if you are an entrepreneur thinking about launching your own BNPL app, Tabby is the perfect case study to learn from. In this blog, we will discuss how Tabby makes money, and other key aspects will give you an insight into why you should invest in mobile apps like Tabby.

So, let’s begin!

Tabby Statistics and Facts

This section shares the statistics and facts about Tabby. These facts help you understand Tabby’s reach in different countries, its rapid growth, and the impact it is having on online shopping habits. Let’s explore these interesting statistics and facts about Tabby.

- Users: More than 15 million people have signed up to use Tabby.

- Stores: Tabby works with over 40,000 different shops and sellers.

- Sales: In one year, Tabby has helped people buy things worth more than $10 billion.

- Money Raised: Tabby has collected $58 million from investors in Series C to grow the business. One of the biggest investments was $160 million, which made Tabby’s value $3.3 billion.

- App Users: Every month, 14 million people use the Tabby app, and they click on Tabby’s links 5 million times to shop at many stores.

- Value: Following the significant investment round, Tabby’s overall worth increased to $3.3 billion.

- Growth: Tabby is experiencing rapid growth, particularly in the MENA region, where an increasing number of people are utilizing BNPL services.

These numbers and facts clearly show how Tabby is growing fast and helping more people shop in a better way.

With millions of users, Tabby is becoming the trusted name in the UAE’s BNPL market. Now that you understand Tabby’s market size and know why Tabby is so successful, let’s see how the Tabby app operates.

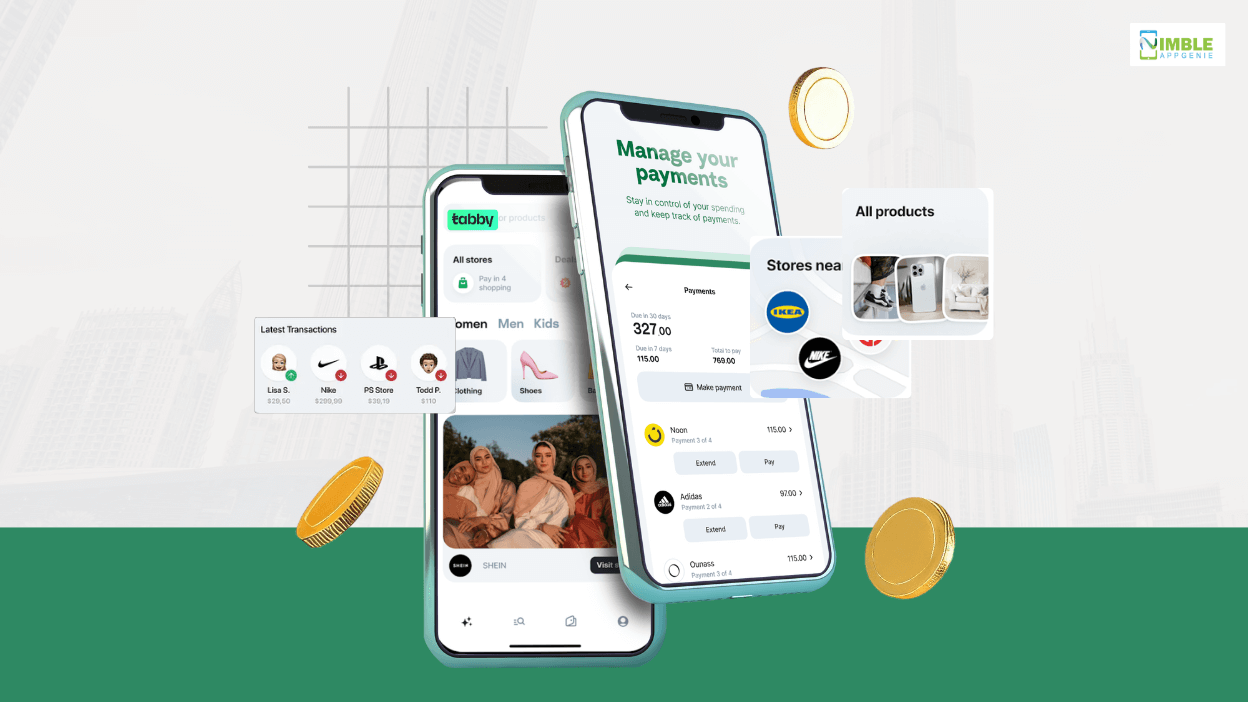

How Does the Tabby App Work?

Tabby, which is one of the best instant loan apps in UAE, works by allowing users to buy what they want today and pay for it later in easy installments.

Let’s understand this with the below step-by-step working mechanism.

- Users can start using the Tabby app by downloading the app or by shopping online that accepts Tabby as a payment option.

- Now, a user purchases like normal. They pick items they like. For example, clothes, electronics, and so on.

- At the payment section, users choose Tabby instead of paying with cash or a card.

- Now, Tabby provides two options. Pay a full amount after 14 days or split the cost into 4 interest-free payments.

- Tabby will ask for the user’s mobile number and ID. It checks if they are eligible or not. If approved, their order goes through.

- Now Tabby pays the store right away. The store ships or provides users with their product as normal.

- Lastly, users pay Tabby through the app on the scheduled date. If they pay on time, there is no interest. But if they are late, a small penalty will be added.

What is the Business Model of Tabby?

The Tabby’s business model is based on the BNPL service that aims to make shopping much easier. It allows customers to split their payments into interest-free installments.

With this technology, Tabby fills the gap between shoppers who want flexible payments and stores that want faster sales and guaranteed payments. Let’s look at how the Tabby’s revenue model works now.

1] Customer Segment

Tabby serves online and offline buyers in the UAE, Saudi Arabia, and other Middle East regions. Customers included are people who want to buy products like electronics, fashion, furniture, and more, but prefer to pay in installments.

Tabby’s customers are young adults to working professionals who want convenience and financial flexibility. The Tabby’s major customers are:

- Partner merchants

- Financially conscious customers

- Urban residents

- Millennials

- E-commerce businesses

- High-income individuals

- Online shoppers

- Frequent online purchasers

- Gen Z

2] Value Prepositions

Tabby provides customers with a simple way to shop now and pay later with no interest rates. This is possible only when a customer pays on time. Buy Now Pay Later apps offer flexible payment options.

Customers can either pay the full amount after 14 days or split it into 4 interest-free installments.

For mobile app startups in Dubai, Tabby provides instant payments on behalf of customers. This helps them increase sales and reduce cart abandonment. Tabby’s value prepositions are:

- Smooth integration with e-commerce apps

- Flexible payment options

- Improved customer satisfaction

- Expanded customer base for merchants

- Zero interest and hidden fees

- Safe and transparent transactions

- Easy management of payments

- Enhanced shopping experience

- Increased purchasing power

3] Customer Relationships

Tabby builds trust by providing a seamless and quick approval process through its application. This makes it really easy to use without any complicated paperwork.

It provides customer support through its application and website. This helps users with payments, refunds, and disputes.

4] Tabby’s Major Partners

- Technology Providers

- Marketing Agencies

- Payment Processors

- Logistics Providers

- Customer Support Services

- Data Analytics Firms

- Retailers

- Financial Institutions

- E-commerce Platforms

5] Tabby’s Crucial Activities

- Facilitating installment payments

- Running marketing campaigns

- Conducting market research

- Ensuring regulatory compliance

- Developing a software platform

- Managing risk assessment and fraud detection

- Negotiating partnerships with retailers

- Maintaining technological infrastructure

- Providing customer support

- Managing financial operations

6] Tabby’s Key Resources

- Strategic partnerships

- Legal and compliance team

- Software development team

- Relationship with retailers

- Data analytics tools

- Customer support team

- Technical infrastructure

- Marketing and branding resources

- Payment processing systems

- Financial capital

7] Tabby’s Cost Structure

- Marketing and advertising expenses

- Bad debt expenses

- Software and tools subscriptions

- Office space and utilities

- Operational costs

- Payment processing fees

- Depreciation and amortization

- Technology infrastructure costs

- Merchant fees

- Legal and compliance costs

- Employee salaries

- Customer support expenses

8] Tabby’s Revenue Streams

- Customized Fintech Solutions

- Affiliate Revenue

- Transaction Fees

- Value-added Services

- Merchant Commissions

- Late Payment Fees

- Cross-selling Services

- Interest Income

- Data Monetization

Top Revenue Models/Streams of Tabby

Tabby entered the market as one of the first BNPL services in the Middle East. This makes it very easy for customers to do the shopping and make the payment later.

But when users use the interest-free transactions, the main question arises: how does Tabby earn money?

Well, Tabby does not charge users for using their services if they pay on time. So, how does the Tabby mobile app make money in Dubai? Let’s take a look at the revenue model of the Tabby.

► Merchant Fees

This is Tabby’s main source of income. It is one of the best revenue streams of the Tabby app. When a customer buys something from Tabby’s payment system, the merchant gets full payment from Tabby.

In return, the merchant pays Tabby a commission, which is usually 3% to 6% of the order value. But why do merchants agree to pay?

It is because Tabby brings them more customers and higher conversions. So, while customers enjoy Buy Now Pay Later apps, Tabby earns from the merchant itself.

► Late Fees

If the user misses a payment due date, Tabby charges a small late fee to customers. This late fee is not just huge, but since millions of users use Tabby, these small charges add up to a good revenue model.

Besides, it is one of the ways it manages to get customers to pay on time. Tabby does not charge interest, but it is one of the best fintech apps in UAE that handles risk and pays on time.

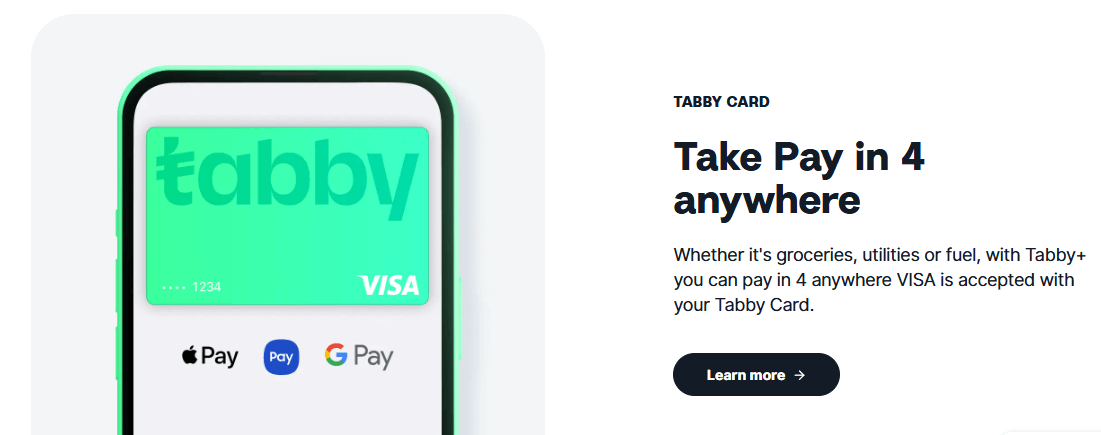

► Tabby Card

Tabby introduced a payment card for both virtual and physical cards. It enables customers to shop online and pay later in installments. The Tabby cards also come in gift cards.

Whenever a customer uses the card, Tabby can earn from processing fees, partnerships with stores, or transaction-based changes. This card works like a smart debit card, but with the feature to split the payment.

► Tabby+ Premium Membership

Just think of Tabby+ as a VIP plan for Tabby users. Many people use Tabby for free. But Tabby also provides a paid membership plan that offers extra benefits. Customers who shop very frequently may want more benefits.

For example, higher spending limits, access to special deals, extra cashback, and priority customer service. To enjoy these premium benefits, Tabby charges a small monthly fee. This way, Tabby gets a steady income every month from premium customers.

► Affiliate Commission from Partner Stores

Tabby’s app and website feature many brands and stores. When a customer shops through these links and makes a purchase, those brands pay Tabby a small commission.

But why so? It is because Tabby helped them make a sale by connecting customers to their store. Customers do not have to pay anything extra. Tabby provides customers with special Tabby deals by shopping through its app or website.

► Cross-Selling or Value-Added Service

Tabby provides a helpful service, which is known as cross-selling. This makes shopping smarter and safer for customers. For example, product insurance for electronics, extended warranties, gift cards, BNPL travel offers, etc.

When a customer chooses to buy these services, Tabby UAE earns a small referral fee or commission from the companies providing them. This enables Tabby to keep adding value for customers.

Build an App Like Tabby and Start Generating Revenue

If you want to develop a BNPL app like Tabby, Nimble AppGenie can be your best partner. We understand the BNPL workflow and know what users expect in the Middle East. We provide customized BNPL & fintech app development that fits your project requirements.

Being the leading app development company in Dubai, we assist in connecting your app to stores and payment gateways, so customers have multiple options to shop now and pay later. We leverage the latest technology to build your BNPL app that is secure and fast.

From planning to deployment, our team manages everything, and you do not have to worry about the technical details. With Nimble AppGenie, you get a partner who listens to your objectives and works closely with you to turn your mobile app ideas into reality.

Conclusion

Tabby’s journey clearly shows how profitable and successful the BNPL model can be. And we are not just talking about customers, but for businesses too. The business model of the Tabby proves that when you solve a real problem, users respond quickly.

Tabby did not just build a mobile app. It builds a complete system that connects shoppers and sellers more smartly.

Thus, if you developed an app like Tabby and want to monetize it, this model is a clear opportunity. The demand is real, and the market is growing. So this is the perfect time to take your app to the next level.

FAQs

Can I use Tabby outside the UAE?

Yes, you can Tabby in some countries. Currently, it only operates in UAE, Saudi Arabia, Bahrain, and Qatar.

Can I transfer money from a tabby to a bank account?

No, you can not do that. Tabby is meant for buying things and paying later. It is not for transferring money like a wallet or bank. It is a BNPL app that clearly says BUY NOW, PAY LATER.

What is the maximum limit for Tabby?

Your Tabby limits depend on how you use it and your payment history. For the Tabby card, the daily spending limit is AED 10,000, and the annual limit is AED 120,000.

How do I increase my tabby balance?

Tabby updates your limit based on how responsibly you use and repay. If you pay on time and use the app well can increase your tabby balance limit.

Who is eligible for tabby payment?

You just need to live in one of the supported countries, have an Emirates ID, and meet basic checks for approval.