The eCommerce sites and online stores have a booming market in the UAE. In this situation, businesses must offer their valuable customers a secure and smooth environment for online transactions.

Businesses should integrate the right and best payment gateways in the UAE to save their customers from transactional fraud. This initiative will help online businesses to build customers’ trust and thrive in the market.

Are you looking for the best payment gateway to be integrated into your website and app?

We have talked about the top 10+ payment gateways in this blog post below. Check the list and choose the preferred option for your business.

Payment Gateway Overview

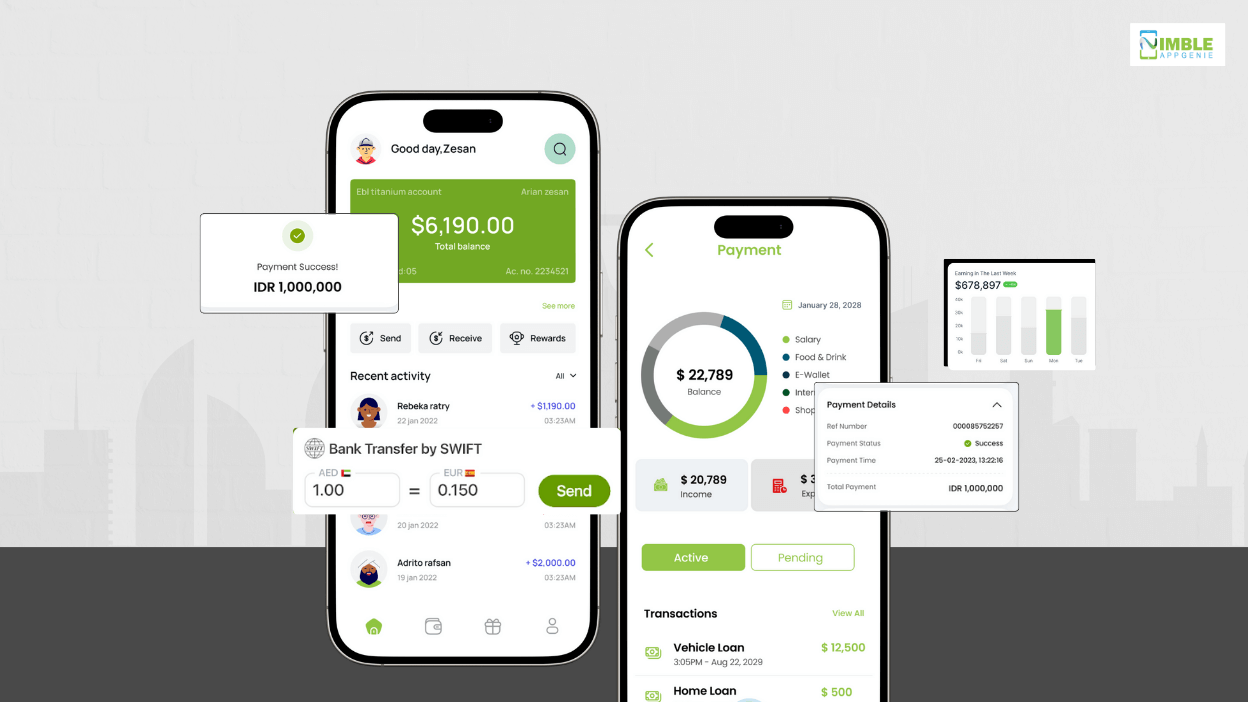

A payment gateway is a software that makes it easy for businesses to deal with their customers smoothly, ensuring them a safe and easy online transaction. It acts as a digital window between your bank account and the online website, as it says to create a gateway.

Payment gateway links and creates a gateway between your business bank account and the customer’s bank account. When customers purchase from your online store and make a payment, it securely shares the bank information of the customers with your bank account to transfer funds.

This technology offers flexibility to buyers who want to connect their debit or credit cards, debit cards, and e-wallets to make payments. Payment gateways in UAE are provided by a specialized bank or a corporate bank. So, this eases the headache of customers carrying cards and money in their wallets.

Today, 92% of the small and medium enterprises (SMEs) in the UAE have shifted to accepting digital transactions and are leading this virtual transformation.

By adopting digital transactions, companies are offering a high customer experience at a low transaction cost and have enhanced their reach. 93% of the small businesses in the UAE have promoted cross-border sales and offered a secure payment barrier to their customers.

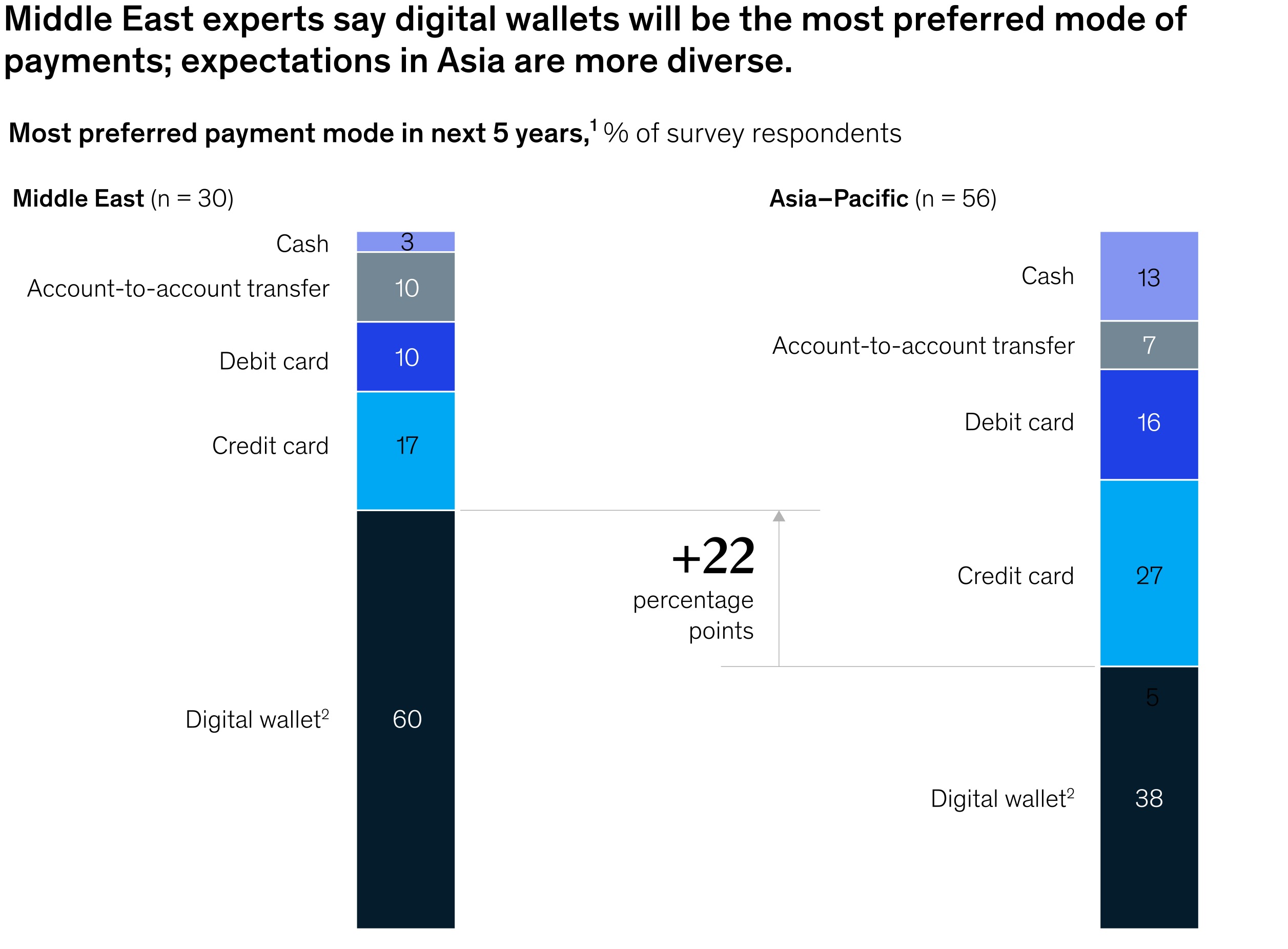

According to an estimation from McKinsey, digital wallets will be the most preferred payment method in the Middle East and Asia Pacific countries in the next 5 years.

Since secure online transactions are coming to the picture, businesses need to take the potential of the payment gateway more seriously. Moreover, integrating a payment gateway into the app and website will ensure faster online transactions.

Why Payment Gateways Matter in the UAE?

The UAE is growing in every sphere, and with digital transformation, more people are turning to online shopping sites and making online transactions. With a payment gateway for websites, businesses can offer their buyers a safer and faster environment to make online transactions.

We will get into the details of the cruciality of the payment gateway in the UAE.

► Enhance Customer Experience

Satisfied customers are the biggest reason for the success of a business. With a payment gateway, businesses can offer their customers multiple ways to complete their online transactions.

Customers can pay by credit or debit cards, UPI, and other online payment modes, which help them to enjoy the flexibility. A stress-free and easy payment process will allow customers to come back for more and enhance their experience.

► Secure Online Transactions

While making online transactions, customers are always at risk of fraud because their bank details are shared with the merchant bank. However, when businesses use a payment gateway, they offer a secure environment for transactions to their customers that prevents them from financial fraud.

This technology safeguards the sensitive financial data of both customers and merchants, which helps businesses to boost trust and build credibility.

► Allow Global Transactions

In the UAE, eCommerce businesses are gradually increasing and spreading their wings to the whole world. Today, the UAE is an important hub for international trade, and integrating a payment gateway on the business websites will allow them to accept international payments.

It’s opening the gate for online businesses to step into the global market and reach wider customers. The best thing is that customers will feel safe dealing with such businesses.

► Manage Finances Seamlessly

The traditional way of managing finances is a headache for businesses in this fast-paced world. An online payment gateway system keeps track of every transaction for businesses and generates reports automatically, so no need for manual efforts.

The reports help businesses to check through every transaction and every payment made by the customers, and they can keep an eye on the trends and make smarter financial decisions.

► Wide Range of Payment Methods

With a payment gateway, businesses can bring flexibility in the payment method for their valuable customers. Customers don’t need to depend on cash transactions or use cards for making payments today.

Payment gateways UAE allow customers to make online payments directly from credit cards, debit cards, BNPL, or online banking in Middle East to the merchant account of the businesses.

Top Payment Gateways in the UAE

If you are looking for top payment gateways in UAE, your search ends here. We have listed 10 of the top payment gateways below that a mobile app development company in Dubai can integrate into the eCommerce website.

Let’s get to the list.

1] Telr

Telr is one of the rapidly growing and best payment gateways UAE that was previously known as Innovative Payments. This is currently operating in more than 120 countries globally, making it the best choice for eCommerce businesses that wish to widen their reach.

The features offered by Telr include quick and simple transactions, security from financial fraud, and more. Currently, it offers three price structures to businesses, startups, and SMEs: entry, small, and medium.

2] Amazon Payment Services

In the year 2020, Payfort was purchased by Amazon and renamed as Amazon Payment Services. Using this payment gateway technology, businesses can help to minimize fraudulent transactions and can also receive money at a faster rate.

The business can choose the online payment options as per their needs with Amazon payment services, which help to establish a stronger connection with the esteemed clients.

It offers two price structures, regular and customized. The former doesn’t include any initial fees or monthly management fees, and the latter offers a personalized price plan as per the customer’s unique needs.

3] Hyperpay

Hyperpay is headquartered in Saudi Arabia and is operated in the whole of the UAE, making transactions easy for customers. This payment gateway software is currently connected with more than 100 banks in the UAE and leading credit card companies.

This software easily scales up with different types of businesses, whether eCommerce or subscription services. It offers features like advanced fraud protection, easy integration with eCommerce, a robust dashboard, and more.

4] PayTabs

Established in the year 2014, PayTabs has become one of the popular payment gateways in the UAE because of its advanced fraud prevention system. This is a highly adaptable software, making it possible for different types of businesses to make safe online payment transactions.

If you are a budding business, then Paytabs is an ideal choice since it offers a consistent monthly cost. It offers a safe payment method for all types of channels, an easy onboarding process, and an easy integration process.

This software can seamlessly create invoices for businesses and also send them without any intervention. It offers a transparent price structure, and you can choose a suitable package from three different options.

5] Stripe

Stripe is one of the powerful and flexible payment gateways in the UAE. This software allows businesses to accept payments easily and also send payments seamlessly globally.

Stripe gets every business covered with its offering, whether an eCommerce, in-person retail store, subscription services, or a marketplace. The software is popular for its quick fraud prevention feature and also solves issues related to physical or virtual cards, and more.

Moreover, it offers flexible payment options to the customers, integrates easily with an app or website, a global payment process, and more.

6] CCAvenue

CCAvenue is a feature-rich payment gateway in the UAE that originated in India. For businesses that are looking to offer a secure and seamless online transaction system to their customers, CCAvenue is a great choice.

This software has gained its popularity because of its 24/7 available customer support and advanced safety against online fraud. It offers its services for companies of all shapes and sizes all over the world. It does not cost a dime for its users to set up their accounts.

Its plan starts from the basic plan, which is not chargeable, and further offers customized plans as per the needs of the users. If you are a startup or a small business, then the Startup Pro plan is best for you, with no initial cost and comes under a few dollars.

7] PayPal

PayPal is a well-known money transfer app worldwide and is also successfully operating in the UAE. It is another name of convenience that offers multiple financial services to its users. It seamlessly integrates with the top eCommerce platform and offers secure online transactions to the customers.

This payment gateway in the UAE is an all-in-one solution for businesses to general users, which is a convenient way to manage transactions. This offers a user-friendly interface, secure transactions, and supports multiple devices.

8] PayCaps

PayCaps is a fully customizable payment gateway in the UAE, which is the top choice of eCommerce websites across the country. If you wish for a hassle-free payment solution for your business website, then it is an ideal solution.

Paycap is best for budding businesses because of its API driven automation. It helps businesses to enhance the checkout experience for their customers due to its fast and user-friendly interface.

The white label solution offered by this payment gateway software sets it apart. This allows businesses to customize the design of the system, payment methods, and the theme.

It offers other features like smart chargeback management, supports multiple currencies, and many more.

9] Noon Payments

Noon Payments is a fast, flexible, and secure payment gateway system in the UAE and North Africa. This is specifically designed for eCommerce, which helps in its retail growth with fast and fraud-free transactions.

This payment gateway can smoothly get integrated with the APIs and plugins so that customers can experience easy checkouts. It also accepts payment through various modes and offers the benefits of flexible transactions to both buyers and businesses.

10] 2Checkout (Verifone)

2Checkout is a popular payment gateway that lets businesses accept payments from all around the world. It is one of the popular payment gateways in the UAE, operating in 196 countries, and is made for businesses of all sizes. This system can be easily operated in 15 languages and supports 87 global currencies.

Businesses find it their ideal choice because it doesn’t charge for setup and maintenance, only pays when they make a sale. This payment gateway is easily integrated with almost every eCommerce platform, making it a versatile choice.

If you want to boost your website’s online presence by offering customers a flexible payment solution, 2Checkout is an ideal choice.

11] Cybersource

Cybersource is the name of a payment gateway that can be linked with reliability and security. With this gateway system, online businesses can accept online payments from their valuable customers seamlessly and securely.

This payment gateway is under the name of Visa, the world’s leading security compliance, making online transactions safe and secure in more than 190 countries. This system can be used by small businesses to large enterprises to run their online business smoothly worldwide.

This gateway system can easily support e-wallets like Apple Pay, Alipay, Google Pay, and more. The fraud detection system of this payment gateway is powered by AI, making it the best choice.

12] Payoneer

Payoneer is a payment gateway system that offers its users a secure and compliant environment for every cross-border transaction.

International payments are no longer a challenging task for businesses, professionals, or freelancers who work with international clients. Anyone from anywhere in the world can effortlessly make their cross-border payments in a secure environment.

This offers a user-friendly financial solution, using which one can send, receive, and manage their funds seamlessly. There are many features offered by Payoneer, but one that stands out is that users can create a virtual bank account.

This feature enables users to deal with currencies of different countries without the need for a local bank account.

13] Payit

Payit, the payment gateway in the UAE, has brought a revolution in the country’s digital transactions. It offers people of the UAE a secure, fast, and mobile-friendly digital payment solution.

Since, UAE is a mobile-first country, this gateway system was specially designed for such places globally that allow users to make instant payments.

Using this gateway system, users can pay bills, transfer funds, and do everything in just one click from their smartphones. It offers advanced security while making any kind of online transactions using the e-wallet.

It gets smoothly integrated with the website and mobile apps, both offering diverse payment options.

You Might be Interested in: Develop an App Like Payit

14] Skrill

Skrill is the payment gateway in the UAE that can make international payments securely and in no time. Whether the app is used for business purposes or personal use, it helps to manage money effortlessly.

This platform can be used for sending, receiving, and managing transactions without any headaches. Skrill can be used by people globally and allows them to deal in multiple currencies, which makes international transactions an effortless journey.

Users can create a prepaid Skrill card that allows them to access their funds anytime and from anywhere. Skrill can be easily integrated with the website and apps, both catering to diverse users.

15] Checkout.com

Checkout.com is an ideal payment gateway in the UAE that offers users seamless transactions and personalized solutions. Integrating this payment gateway into the app and online stores, businesses can ensure their customers enjoy a smooth checkout experience.

This payment gateway originated in the UK and became a popular choice in the UAE because of its seamless setup, secure payment options, and good user experience.

This payment gateway system can be adopted by businesses of all shapes and sizes. This software also offers valuable business data and can be easily adapted to the unique needs of businesses.

How Nimble AppGenie Can Help?

Do you want to build a payment gateway and integrate it into a website or app?

A professional FinTech app development company in Dubai is all you need to build a secure and fast fintech app with an advanced payment gateway. Nimble AppGenie has the best mobile app developers to hire in Dubai, and will make this possible for you effortlessly.

Moreover, if you have mobile app ideas in diverse industries, then that will also be taken care of by the expert team of Nimble AppGenie. We are a reliable mobile app development company in Dubai that can manage the A to Z of app development.

If you are looking for a reliable partner, connect with us today.

Conclusion

Mobile gateways in the UAE are a crucial element for the e-wallet app to offer users a secure, easy, and region-friendly online transaction. With growing eCommerce stores, online websites, and mobile app startups in Dubai, the payment gateways can ensure a smoother and optimal customer experience.

In the article above, you get to know about the top 10+ payment gateways that are recognized globally by offering secure and smooth online transactions. If you are launching your online store or want to optimize the old one, choose your preferred option.

Invest in a payment gateway to offer the best user experience and grow your online business.

Frequently Asked Questions

Why do I need a payment gateway for my website?

If you run an online business and have a website, you must have a payment gateway so that you can securely receive online payments. This will act as a bridge between your website and the customers to ensure encrypted transactions, detect fraud, provide efficient payment options, facilitate faster transactions, and more.

How to integrate a payment gateway into your website?

To integrate a payment gateway to your website, you have to follow a few simple steps, which include the following:

- First, choose your preferred payment processor like PayPal or Stripe..

- Then, create your merchant account.

- Generate API keys.

- Integrate the getaway into the frontend and backend of the website.

- Then, test the integration

- Lastly, launch it and keep tracking it.

If you find the process tough, you can get in touch with professional companies, hire them, and let them integrate for you.

How do I select the best payment gateway for my website?

If you want to choose the best payment gateway for your website, then we need to consider a few crucial factors. These factors include payment methods, transaction fees, security, smooth integration, worldwide transactions, customer support, and customer experience.

The prime thing that you must remember about a payment gateway is that it must protect from fraud, match your business growth needs, and support multiple currencies.

What are some top payment gateways in the UAE?

In the UAE, you can find numerous payment gateways, but the reliable and top names among them are Telr, PayTabs, Stripe, PayFort, and 2Checkout. These names top the list because of their ability to fulfill different business needs and their secure & efficient payment process.