Digital banking is a growing sector in this rapidly changing economy of Dubai & UAE.

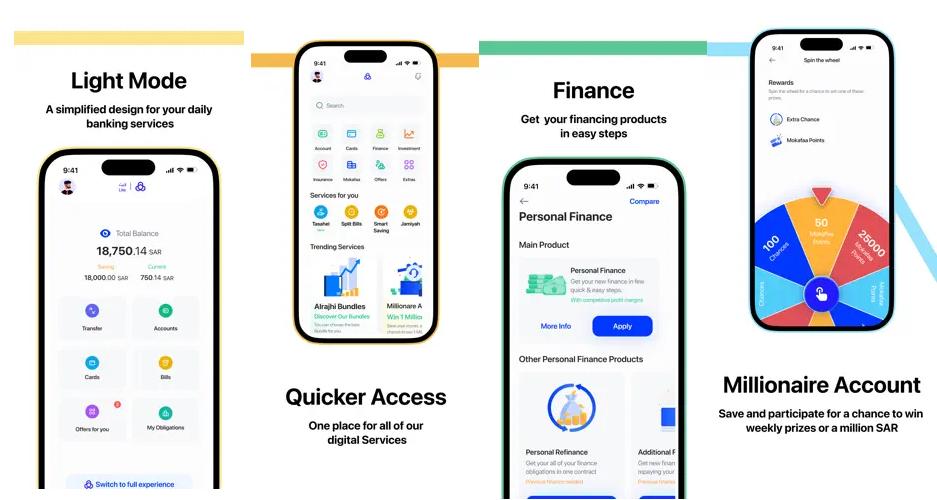

Even traditional banking institutions have jumped into the digital sector. One such app that is popular among users is the Al Rajhi Bank app.

The rise of fintech and the use of technology in financial services enable users to make transactions faster and easier to manage, and Al Rajhi Bank has surely cracked the barrier with a solid application and impromptu services.

While the market is growing day by day, the Al Rajhi Bank has surely opened doors for budding financial entrepreneurs.

So much so that people are looking for ways to develop an app like Al Rajhi Bank in Dubai, as it offers growth opportunities and serves as a great reference point for new applications.

If you, too, are wondering how to develop a mobile app in Dubai and looking for a way to make it big in the emerging fintech market of the UAE, then this post is for you!

In this one, we are going to explore everything you need to know about the Al Rajhi Bank and identify ways you can develop a similar application.

We will also take a look at the intricacies of how it works, what powers the app, and how it makes money so make sure you read it till the end.

What is Al Rajhi Bank?

Al Rajhi Bank is one of the largest Islamic banks in the world. It offers an app that is a one-stop application for all sorts of financial services for the users of the bank. Services like account management tools, bill payments, mobile deposits, fund transfers, and more.

Established in 1957, the bank has a huge network of branches functioning in different countries, including Kuwait, Jordan, and Malaysia.

The bank offers corporate, retail, and investment banking services, along with digital banking solutions in the form of the Al Rajhi Bank app.

With over 10 million downloads and 1.1 million ratings, the application is becoming more and more popular among users. Not to mention, the stature of the bank is too big for the services that it offers to be top-notch.

This is also the reason why people are highly interested in using the services offered by Al Rajhi Bank, including the application.

Market Overview and Stats for Banking Apps in UAE

Let’s look at some of the market statistics.

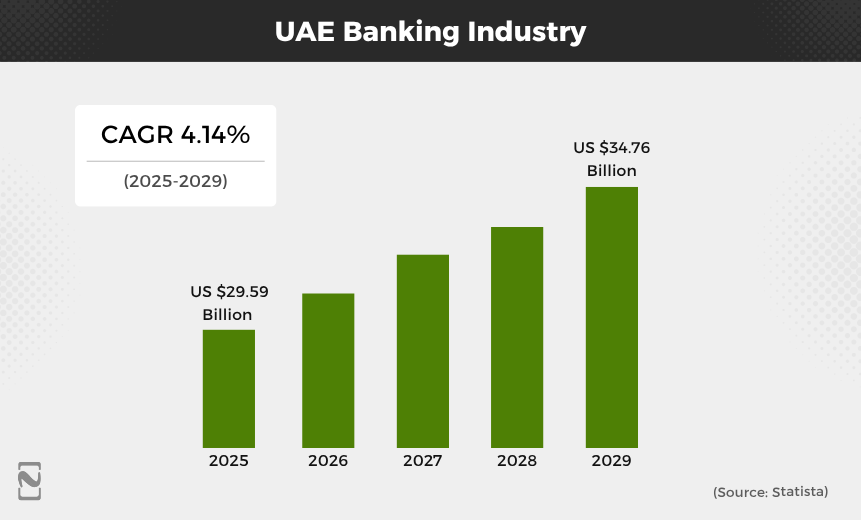

Banking in the UAE is one of the fastest-growing fields to invest in. The market is looking at continuous growth as the market is expected to grow with a CAGR of 4.14%, taking the market from an expected value of $29.56 billion to a whopping $34.76 billion between the years 2025-2029.

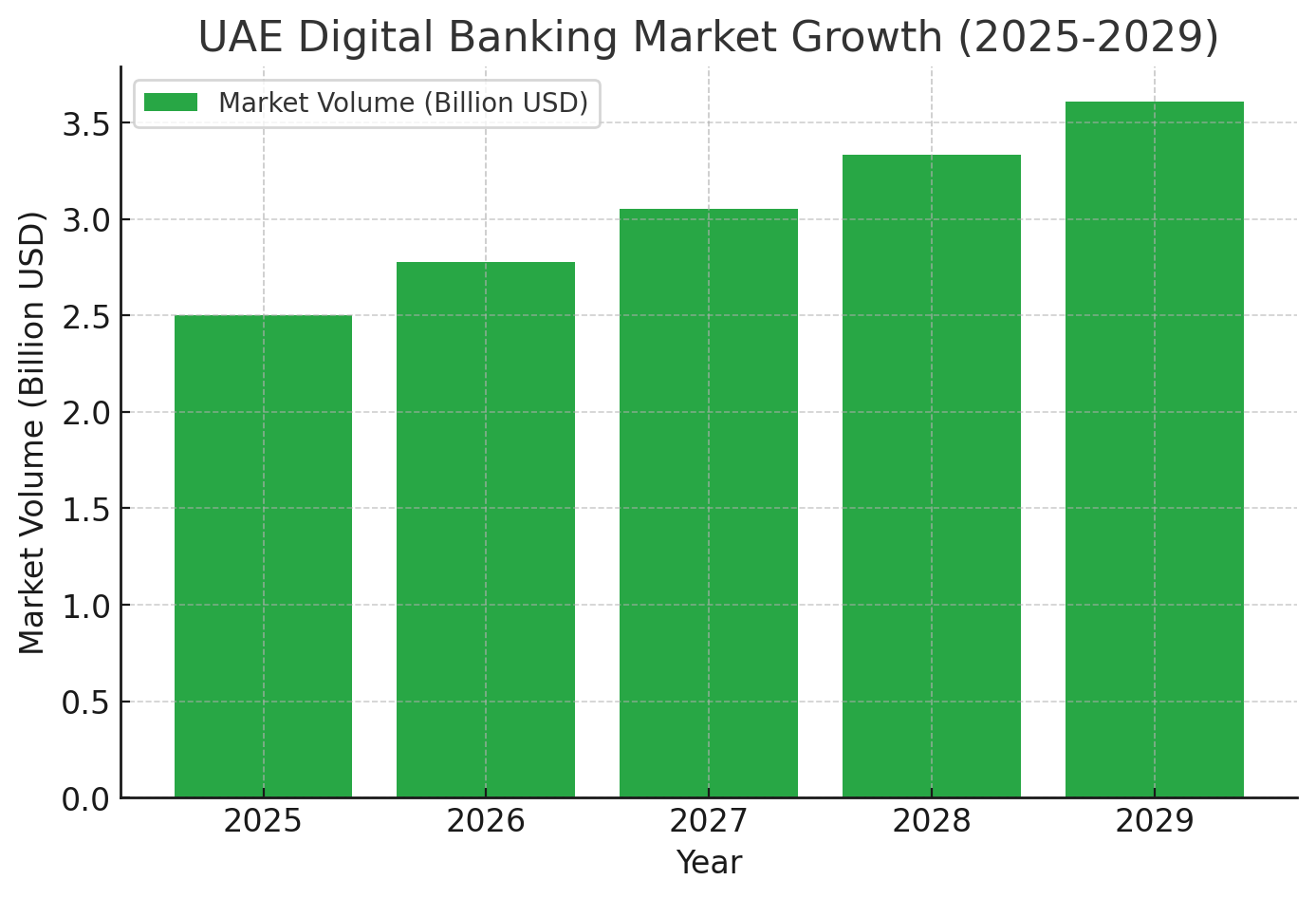

If we talk specifically about the digital spectrum of banking, the numbers are highly motivating. The market is already on the path to growth as it is expected to touch $3.61 billion market volume by 2029.

The banking industry in the UAE is certainly undergoing a digital transformation, taking the majority of the banking services like account management, fund transfers, etc., online.

The convenience that these applications offer has made it easy for users to access the services. At the same time, these apps have made it simpler for a bank to reach new customers and users, making the investment worthwhile for their mobile app startup.

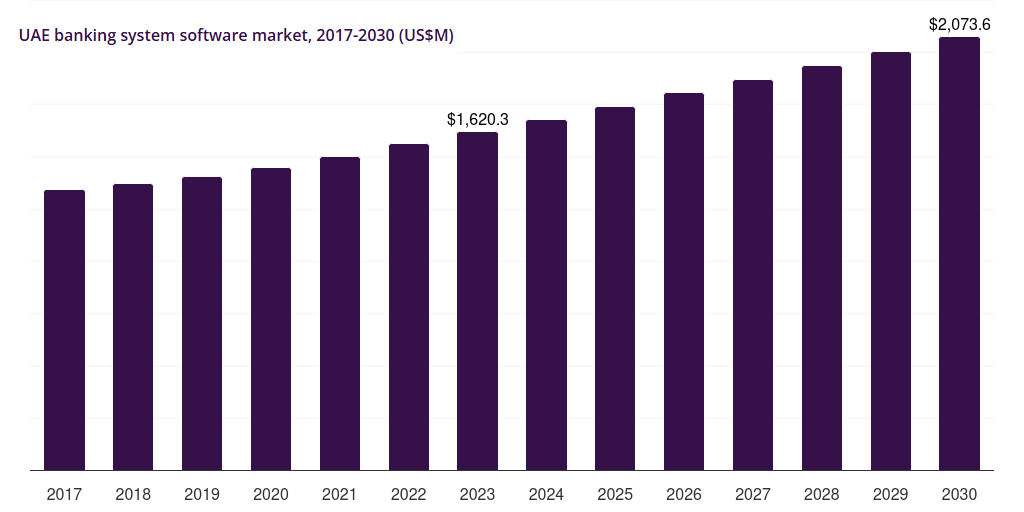

The banking system software market in the UAE is expected to reach a projected revenue of US$2,073.6 million by 2030. A compound annual growth rate of 3.6% is expected of the UAE banking system software market from 2024 to 2030.

These stats and several other factors make it worthwhile for a financial institution to build a banking app. Check out the next section to learn more about the same.

Why Build a Banking App Like Al Rajhi Bank?

Building a banking app like Al Rajhi Bank can be a great choice if you plan to break the financial market in the UAE, as it has laid the roadmap to success. The application offers some of the finest features and contributes to the extended reach of banking services.

Some of the core reasons that make building a banking app like Al Rajhi Bank a good decision for your banking app:

♦ Improved Reach

One of the core issues with traditional banking is that they are unable to expand its services to a wider audience.

Since they have a physical location to manage, they are unable to cater to users outside their reach. However, with an app, the services are easily accessible to each and every customer, allowing banks to target a wider user base.

♦ Better User Experience

Banking services are always considered daunting as a person has to spare time, physically go to a branch, and get things done.

Building an app like Al Rajhi Bank makes it easy for customers to utilize your services faster, and that too with a user experience especially designed for convenience.

This improved service experience yields better customer satisfaction, resulting in unmatched loyalty.

♦ Fewer Investments, More Returns

Opening newer branches in every convenient location will take more investment than simply building a fully functional banking app.

The investment depends on the approach. However, if you have an application for your bank, you can easily reach the masses and offer all the services that you might have required from an individual in the branch.

The digitization can help you reduce the resource cost by miles.

♦ Additional Revenue Opportunities

With a banking app like Al Rajhi Bank, you not only open doors to new customers, but you can even create new revenue streams.

Digital banking in the Middle East has a lot of potential earnings that you can enjoy in the form of transaction charges, service charges, ad revenue, subscriptions, etc.

You can even cross-sell a few products of your own, converting existing users into long-term users.

♦ Competitive Edge Over Others

Not every bank today offers the convenience of a digital application that does it all.

One of the core reasons why the Al Rajhi Bank app is successful is that it is one of the only few apps that offer all these services, making it the choice of users and giving it an edge over the existing options.

Having an application that simplifies the experience of a user, especially when we talk about complicated banking services, is a game-changer in the industry.

With all these benefits, the growth of your banking business will skyrocket. This is why banks and financial institutions build banking apps like Al Rajhi Bank.

Features to Include While Developing an App Like Al Rajhi Bank

Now that you are aware of the reasons why investing in an app like Al Rajhi Bank is a good option, let’s talk about the features that you must integrate with your application.

The features of a banking app play a crucial role in its success. That is because, while services are the backbone of any banking institution, it is the convenience that the application offers that makes all the difference.

Some of the most important and popular features that can help you develop an app like AL Rajhi Bank in Dubai and replicate its success are:

1] Account Management

The ability to manage your bank account, be it changing a few details, requesting resources like cards and a cheque book, etc., falls under this feature.

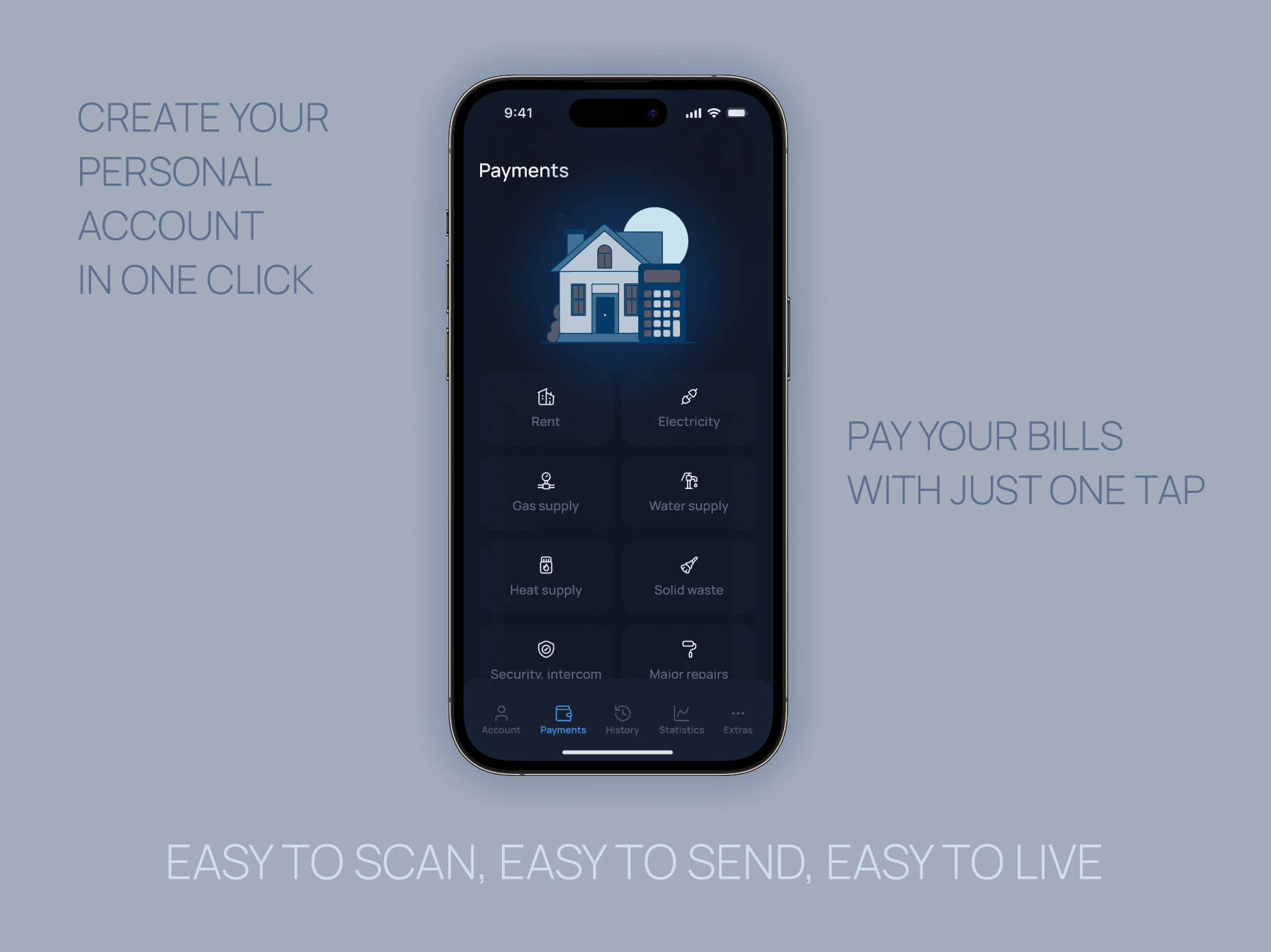

2] Bill Payments

The app should allow a user to use the account funds to pay bills, be it an electricity bill, a telephone bill, or any other. This way, the app becomes more useful in everyday business.

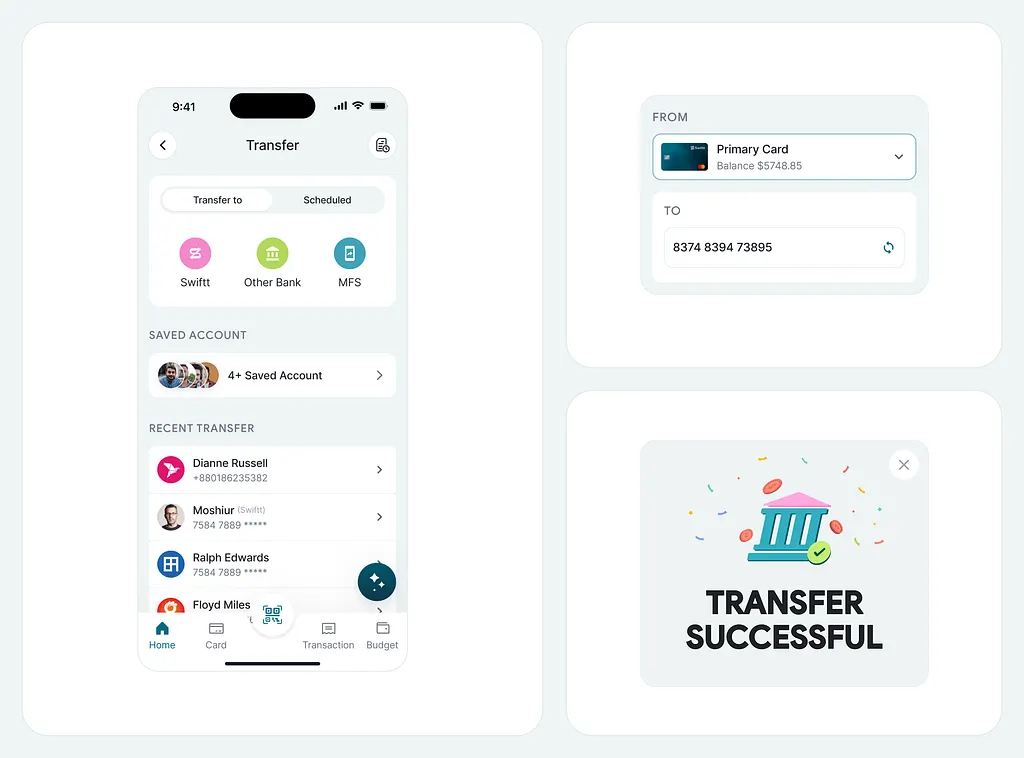

3] Fund Transfer

The ability to receive and send money through digital transfer adds value to your banking service, as businesses always look for easy ways to move funds

4] Credit Card Services

Offering tools to pay credit card dues or options to apply for a new one is a vital feature to include in your banking application. This way, you can build more customer relationships easily.

5] Customer Support

Offering the ability to chat with a customer relationship manager or integrating a dedicated section for support and grievance can surely help improve the customer experience.

6] Security Features

Features to protect your customer’s bank account and access features make the app robust. While a banking app offers convenience, it also leaves a user vulnerable to risks; hence, integrating security features is a must.

7] Additional Services

Integrating additional services such as entertainment booking, making reservations, etc., is also a good way to make your app more inclusive for the user.

Other than these basic features, such as checking bank balances at a glance, generating statements, digital banking assistants, etc., are also popular.

Keep in mind that all these features should be integrated in such a way that they can be easily accessed and do not make things complicated for the user.

Tech Stack Required for Creating an App Like Al Rajhi Bank

Knowing what type of features you want integrated into your banking app, you can identify the flow of functionalities in the app. Based on what type of things you want to get done, you can choose the technology that supports your vision.

Choosing the right tech stack for building an app like Al Rajhi Bank is one of the most important decisions that you need to make.

Just like any other application, the banking app has different components for which you need to choose a certain technology to support your application.

An ideal tech stack is required for creating an app like Al Rajhi Bank:

| Objective | Tech Used |

| Frontend | Swift, Kotlin, Java, Flutter, React Native, (depending on cross-platform/native approach) |

| Backend | Java, Python. Go. |

| Cloud | Amazon Web Services (AWS), Azure, Google Cloud Platform (GCP) |

| Database | PostgreSQL, MySQL, MongoDB, Cassandra. |

| Advanced Features | Artificial intelligence, Machine Learning, Blockchain, Encryption, SIEM |

Other than these, you will require API integration to enable payment gateways and fetch data for investment banking.

All of these technologies are required to build an application that is similar to Al Rajhi Bank. The idea is to develop an application that is scalable and sustainable.

Steps to Create an App Like Al Rajhi Bank

So you have the features, and you have the technology to design those features. What do you need next? Well, you need a solid strategy and a foolproof process. Fintech app development is highly dependent on the approach you take.

Here is a professional’s approach to developing an app like Al Rajhi Bank –

Step 1: Market Research & Analysis

Start your project by understanding the market and checking all the possible stats. These will give you insights into the market, making it easier for you to understand it.

Market research will help you find the gaps in the market that you can address in your app, making it a better option. Keep in mind that while Al Rajhi Bank is the reference point, there’s no harm if you can make an even better app.

Step 2: Define the Scope of Development

The scope of development refers to the approach you have decided to take for building the app. It also includes your final vision of what you expect the app to do.

This is the step where you decide if you want to go for a cross-platform app or a native application, what type of features you want, what technologies you want to use, and how you plan to achieve it all.

The development team you hire can help you define it better.

Step 3: Design Your App Experience

Once the scope is clear between you and the development team, it is time to design your app experience.

Going for a minimal UX.UI can help you target the masses, even those who are not fluent with technology. The app experience also gives you an idea of how your application will look and feel. The design step brings your app to life, helping you decide where your desired features will be placed and how the user experience will feel.

Step 4: Start Developing Functionalities

So, you have a design, you have the tools, you know what features to integrate, so what’s next? Well, it’s time to build the functionalities.

Design your features and start integrating them with the app design. This is the most important and time-consuming step of them all, as this is where you build your app.

There’s no way you can hurry this step; hence, you should plan the development phase accordingly. Deploying more resources is also an option if you are in a hurry.

Step 5: Test Your Final Product

The development stage brings your application to life. While that is more or less the end of building an app like Al Rajhi Bank, this is the step when you start testing the developed functionalities.

Every feature is put to the test, ensuring that it works in different use cases.

There are different ways people use their apps, and a quality assurance expert ensures that all of those scenarios are replicated while performance testing the app.

Step 6: Launch & Deploy

After you have tested the app and have gotten all the approvals, it is time to release the application for users.

The deployment stage refers to extracting the final release build that can be used by anyone with the respective device.

The application is then launched on respective platforms and made public for people to use.

As soon as the build is live, you need to monitor the application and ensure that it is behaving as expected.

There will be bugs in the app that you might discover when it is live; however, you have the option to release an update based on how users respond.

With all these steps, you can easily develop an app like Al Rajhi Bank. Keep in mind that it highly depends on the mobile app development company in Dubai that you hire. The development process is the backbone of app-building.

Cost to Build an App Like Al Rajhi Bank

All the steps involved in building an app like Al Rajhi Bank require multiple resources and professional assistance. And understandably, there is a specific cost associated with the same.

Well, on average, the cost to develop an app like Al Rajhi Bank in Dubai typically ranges between $30,000-$300,000. The range seems massive as several types of banking apps are built. If you are looking to build an MVP from scratch, it might be worth $35,000-$70,000.

An average app can be built for under $100,000, whereas things can even go above $300,000 if you plan to go all in and include the latest technologies.

Don’t forget that additional mobile app development costs also include maintenance and other support.

Factors Affecting the Cost of Building an App Like Al Rajhi Bank

The cost of building an app like Al Rajhi Bank depends on several factors that you have to consider.

Let’s take a look at them below:

-

Complexity of the App

The complexity of an app depends on the types of features you have chosen and how many functionalities are integrated into the app.

-

Choice of Platform

Choosing the right platform to launch your app on highly affects your app development cost. We can say that if you build an app for iOS, then it will cost more than the cost to develop an app for Android, then it will cost less than building a hybrid app that supports both platforms.

-

Application Framework

Whether you have gone for native app development or cross-platform app development directly impacts the cost of development.

-

Additional Features

Another factor that can impact the cost is the use of additional features and technologies that are not usually integrated into a banking app like Al Rajhi Bank.

-

Regulatory Compliance

Meeting all the compliance requirements based on the region you decide to operate in is often a crucial factor that decides the cost.

In the UAE, you have to ensure that there are strict provisions to restrict Money Laundering practices, which may cost more as it will need additional security features.

-

Development Team Location

The location of developers that you hire also plays a crucial role, as the cost of development is decided based on hours.

The number of hours required to develop an app like Al Rajhi Bank can vary depending on the resources. And the per-hour rate varies based on the location. Do you see the connection?

Other than these factors, some user choices along the course of development impact the final cost of development for an app like Al Rajhi Bank.

How to Make Money with An App Like Al Rajhi Bank?

Building the application is not that difficult if you have the right expertise guiding you. It can help you generate a lot of revenue over time.

A lot of banking institutions investing in the mobile application often think of it as an investment to expand their reach. What they do not realize is that it also offers an additional revenue stream.

There are different ways a banking app like Al Rajhi Bank can make money. Here are some top monetization strategies that you can follow:

► Cross-selling Services

Offering your existing customers new services that you have recently announced to convert them into loyal customers.

► Additional Features

Allowing users to check their credit score, access more detailed insights on investment banking, etc., can be monetized.

► Subscriptions

Making all those features into a subscription is a good way to get recurring revenue from the customers.

► In-App Purchases

You can offer in-app purchases related to banking services. It can be a feature to unlock for once and for all or a report for better insights.

► Transaction Fees

With fund transfers and regular transactions, you can easily make money by charging a minimal fee for facilitating the transaction.

Other than these, user-data marketing and other ways are also available to enhance your revenue stream; however, that depends on the limitations of regulations and compliance.

To get more insights on these, you can check out our post on top mobile banking app monetization strategies.

You must have a clear understanding of how you plan to earn money through your app, and accordingly, get the app designed.

How Nimble AppGenie Can Help You Create an App Like Al Rajhi Bank?

Understanding all of these factors and aligning them with your vision is not an easy task. More than understanding what it takes to develop an app like Al Rajhi Bank, you need to identify exactly who can help you achieve the best results.

Choosing the right partner simplifies the job for you, and if you plan to do the same, Nimble AppGenie is the best option.

With years of experience and a trusted team of developers, we are the best fintech app development company in Dubai that can easily help you not only build an app like Al Rajhi Bank, but also take you to the next level with an even optimized solution.

Reach out to our experts, as they can help you replicate the success of the top banking apps like Al Rajhi Bank in no time.

Conclusion

Identifying how things work when you want to make an app like Al Rajhi Bank opens a lot of opportunities for you.

Knowing the reasons why you should enter the market and understanding the features, technologies, and steps involved can give immense clarity on whether you want to pursue the vision of building an app like Al Rajhi Bank or not.

Hopefully, you might have got answers to all your questions and a deeper insight into ways to develop an app like Al Rajhi Bank. That is all for this post. Thanks for reading, and good luck!

FAQs

How Much Does it Cost to Build an App Like Al Rajhi Bank in Dubai?

The cost to build an app like Al Rajhi Bank in Dubai can vary between $30,000-$300,000 respectively.

What are the Ways a Banking App Like Al Rajhi Makes Money?

Additional services, in-app purchases, cross-selling products, and charging a minimal fee on transactions are a few ways the banking app makes money.

What Makes Al Rajhi Bank App Popular Among Users?

The sheer convenience that the AL Rajhi Banki app offers to its users, be it related to banking services or account management makes the app a widely popular choice among users.

Not to mention, the app offers Islamic Banking services which is another reason why it is popular in UAE, Saudi Arab, and other regions.